Business

Analysts Split on DTE Energy’s Stock Performance Amid Growth

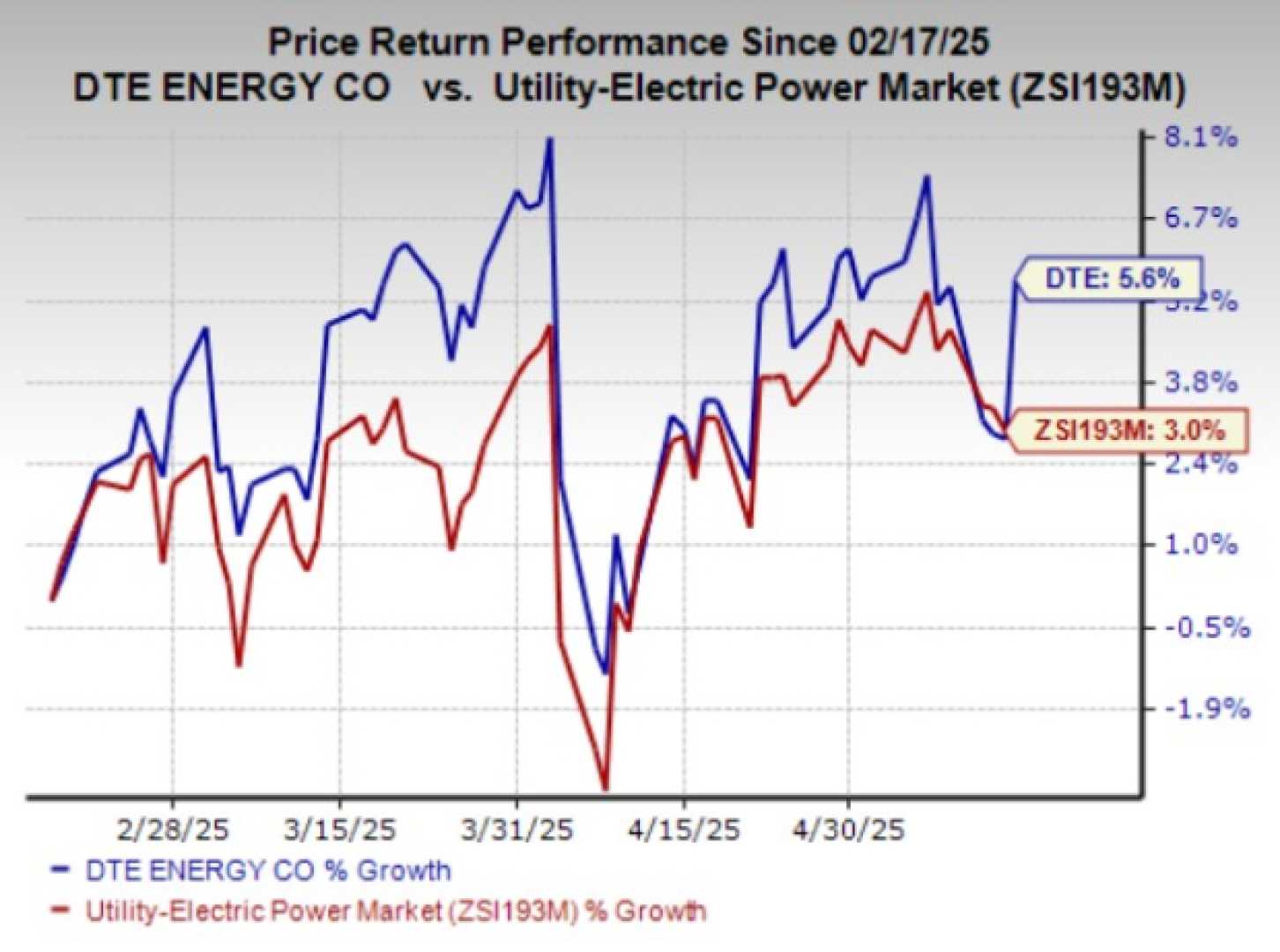

DETROIT, Mich. — DTE Energy has received mixed reviews from analysts over the past three months, reflecting a balance of bullish and bearish sentiments. As of May 22, 2025, six analysts provided ratings amid fluctuating market conditions, giving the company an average 12-month price target of $143.00.

The price targets range from a low of $134.00 to a high of $154.00, suggesting an overall positive outlook. The latest average shows a 4.38% increase compared to the previous target of $137.00.

Despite these encouraging signs, DTE Energy faces challenges. The company’s net margin stands at 10.0%, which is below industry standards. This indicates potential difficulties in achieving robust profitability. However, its return on equity (ROE) is at 3.76%, showcasing effective management and shareholder equity usage.

On the other hand, DTE’s return on assets (ROA), at 0.9%, lags behind its competitors, indicating challenges in maximizing returns from its assets. Furthermore, DTE maintains a lower debt-to-equity ratio of 1.97, reflecting a conservative approach to financing.

With approximately 3.6 million customers, divided between DTE Electric and DTE Gas, the company generates 90% of its earnings from utilities in Michigan. DTE also engages in nonutility businesses, including energy marketing, renewable natural gas facilities, and industrial energy projects.

As the company’s market capitalization continues to surpass industry averages, analysts emphasize the importance of monitoring these evaluations for future investment decisions. DTE is expected to navigate its current challenges while leveraging its strong market position for ongoing growth.

Analyst insights play a significant role in stock performance assessments, and potential investors can use this information to make informed choices.