Business

Gold Prices Climb Ahead of Fed Meeting and Jackson Hole Economic Symposium

NEW YORK, NY — Gold prices rose nearly 1% on Wednesday as the U.S. dollar weakened, with investors anticipating the release of minutes from the Federal Reserve‘s last policy meeting and the upcoming Jackson Hole economic symposium for hints on future interest rate changes.

As of 10:06 a.m. EDT, spot gold increased by 0.9%, reaching $3,343.42 per ounce after hitting a low not seen since August 1. U.S. gold futures also rose by 0.9%, reaching $3,387.10.

The decline in the U.S. dollar made gold, priced in dollars, more affordable for buyers using other currencies. The minutes from the Federal Reserve meeting are expected to be released at 2:00 p.m. EDT, just before Fed Chair Jerome Powell‘s speech at the Jackson Hole symposium on Friday.

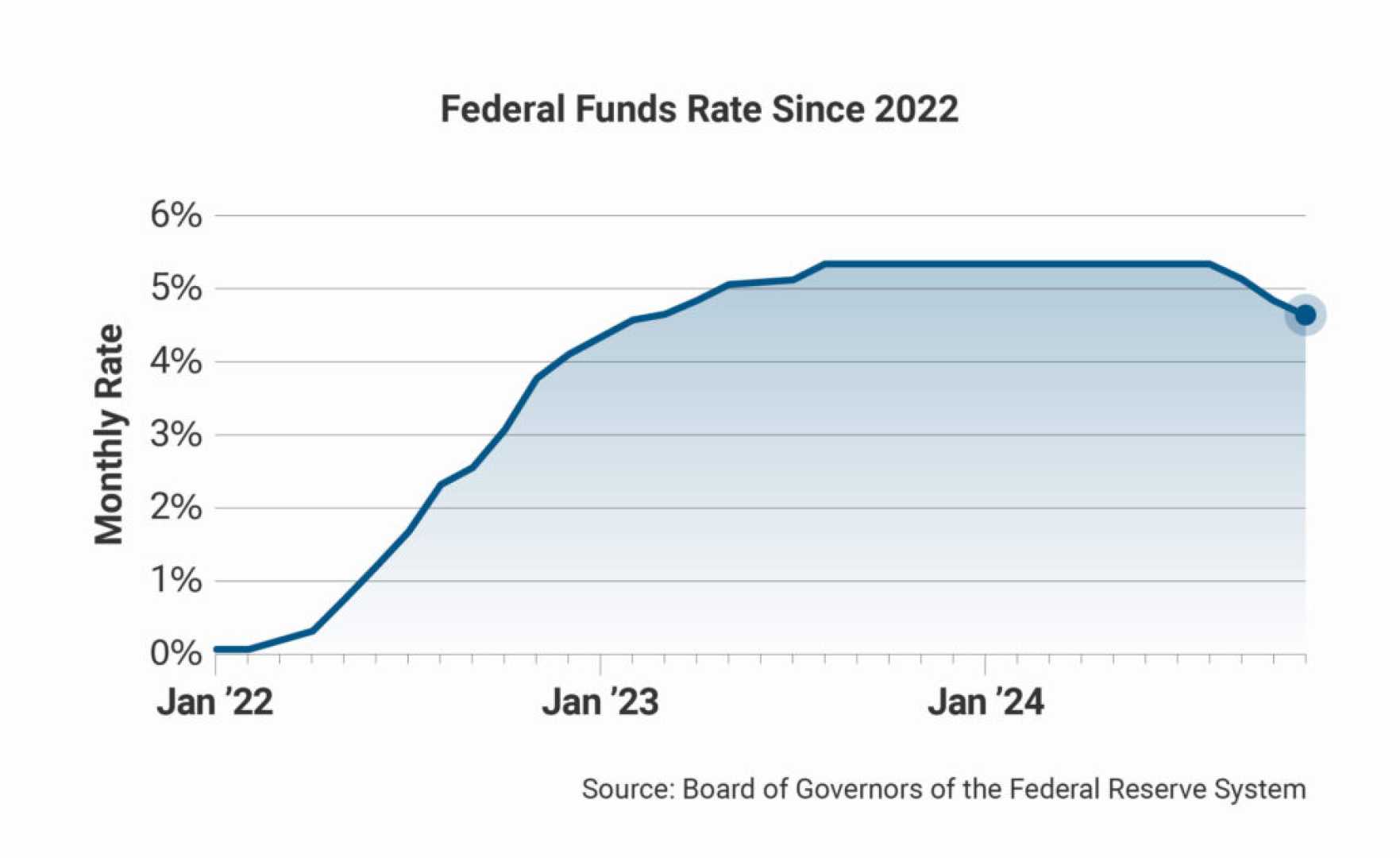

Last month, the Fed opted to keep interest rates unchanged, provoking dissent from two central bankers who advocated for a rate cut to support the weakening job market. RJO Futures market strategist Bob Haberkorn noted, “Gold prices fell yesterday, so now traders are looking at it as an opportunity to get into gold ahead of the Fed minutes.” He added that if Powell adopts a dovish tone, it would be bullish for gold as it does not earn interest.

Traders are currently predicting an 85% chance of a quarter-point rate cut in September, according to the CME FedWatch tool. Meanwhile, U.S. President Donald Trump called for Fed Governor to resign, following comments from the head of the U.S. Federal Housing Finance Agency urging the Department of Justice to investigate Cook over alleged mortgage fraud.

In the broader metals market, spot silver climbed 1% to $37.73 per ounce, while platinum rose by 2% to $1,331.70. Palladium prices remained stable at $1,115.92 after dropping to their lowest level since July 9 earlier in the session.