Business

SoFi Technologies Stock Rises Despite Recent Market Decline

ARLINGTON, Va. — September 29, 2025 — SoFi Technologies, Inc. (SOFI) ended the trading day down 1.54% at $27.55, underperforming the S&P 500, which managed a small gain of 0.26%.

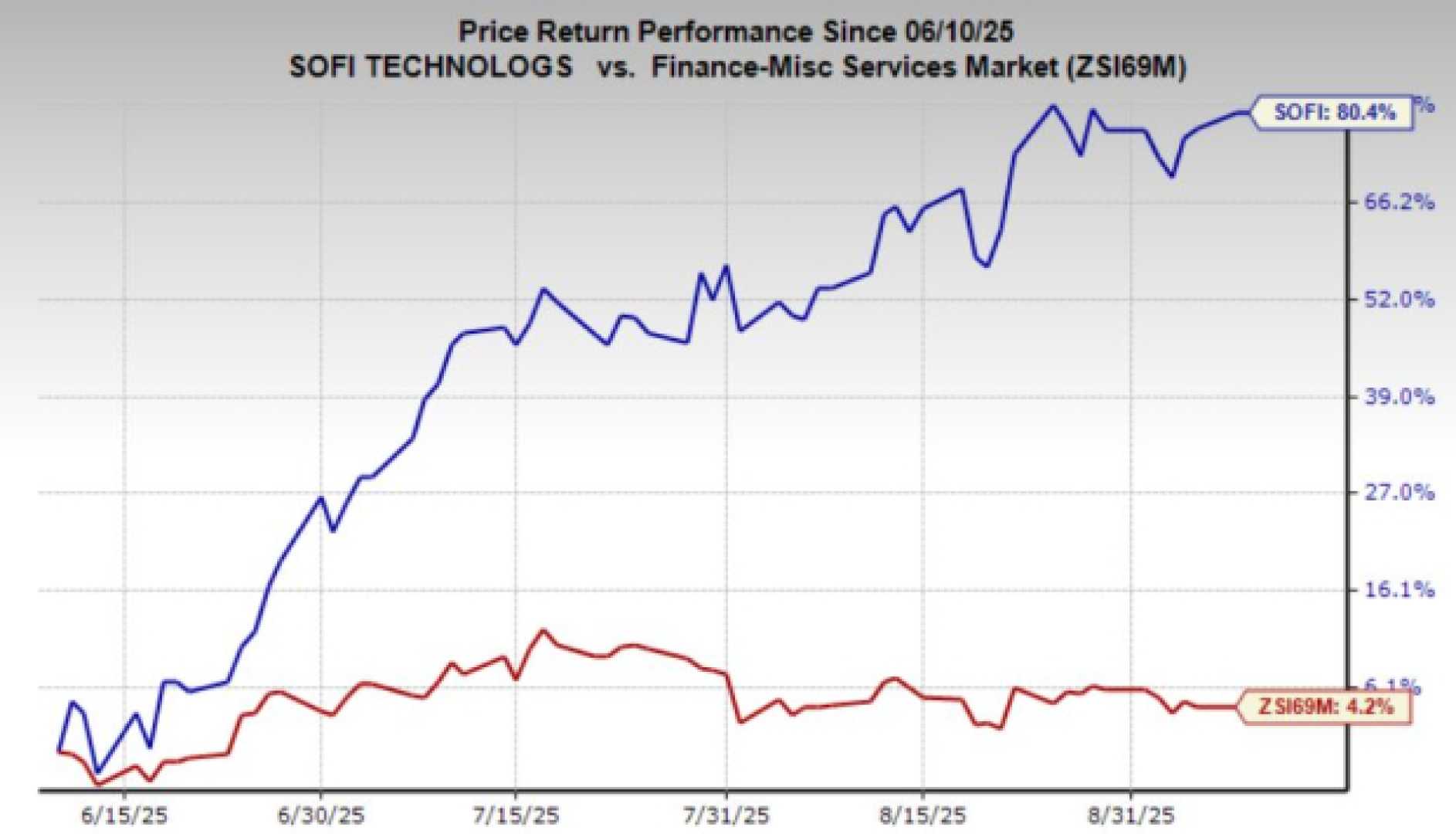

Despite the slight decline, SoFi has seen a strong performance over the past month with an increase of 9.55%. This growth surpasses the Finance sector’s 1.73% gain and the S&P 500’s increase of 2.87%. Investors are keenly awaiting SoFi’s upcoming earnings report, which is expected to reveal an earnings per share (EPS) of $0.08, a significant 60% rise from the previous year.

Analysts predict SoFi will report revenue of $883.14 million, representing a 28.09% increase compared to the same quarter last year. For the full year, projections indicate earnings of $0.32 per share and total revenue of $3.43 billion, reflecting increases of 113.33% and 31.73%, respectively.

Recent analyst estimate revisions indicate a generally positive outlook on SoFi’s operations, which may affect stock performance in the near term. The Zacks Rank system, which evaluates earnings revisions, currently rates SoFi as a #2 (Buy), suggesting strong potential according to historical data.

SoFi is trading at a Forward P/E ratio of 87.91, indicating a premium compared to the industry average of 12.97. Its PEG ratio stands at 3.32, highlighting its expected earnings growth amidst industry comparisons showing an average PEG ratio of 1 for the Financial – Miscellaneous Services sector.

As trading continues, investors are encouraged to visit Zacks.com to monitor these vital metrics along with additional stock insights. With current estimates showing promise, SoFi remains a noteworthy player in the financial services industry.