Business

Predictions on October Mortgage Rate Trends: Will They Decrease?

WASHINGON, D.C. — After four weeks of decline, mortgage rates in the United States ticked up slightly. As of September 25, the average 30-year fixed-rate mortgage rose to 6.30%, an increase from 6.26% a week earlier, according to Freddie Mac.

The recent uptick follows a 25 basis point cut in the federal funds rate announced by the Federal Reserve during its September meeting. Experts note that financial markets had anticipated more aggressive rate cuts than the Federal Reserve signaled it would implement. “Mortgage markets are forward-looking, pricing in Fed moves ahead of time,” said Kara Ng, a senior economist at Zillow Home Loans.

A recent report from the Mortgage Bankers Association showed a 0.6% increase in mortgage applications, with both refinance and purchase activities seeing gains. Bob Broeksmit, president of the MBA, emphasized the upward trend and its correlation with rates nearing the 6% mark.

Many experts believe October could bring further declines in mortgage rates. Predictions suggest stable to slightly lower rates due to a combination of economic factors, including slowing business activity and concerns about inflation. “Several factors will likely result in a stable to modest downward drift in interest rates,” said an executive from Cornerstone Capital.

On the other hand, there is uncertainty surrounding inflation and its impact on future rates. Economists from various institutions share divergent views on whether rates will climb, fall, or stabilize in the upcoming weeks. Charles Goodwin, head of lending at Kiavi, emphasized that inflation could put upward pressure on mortgage rates.

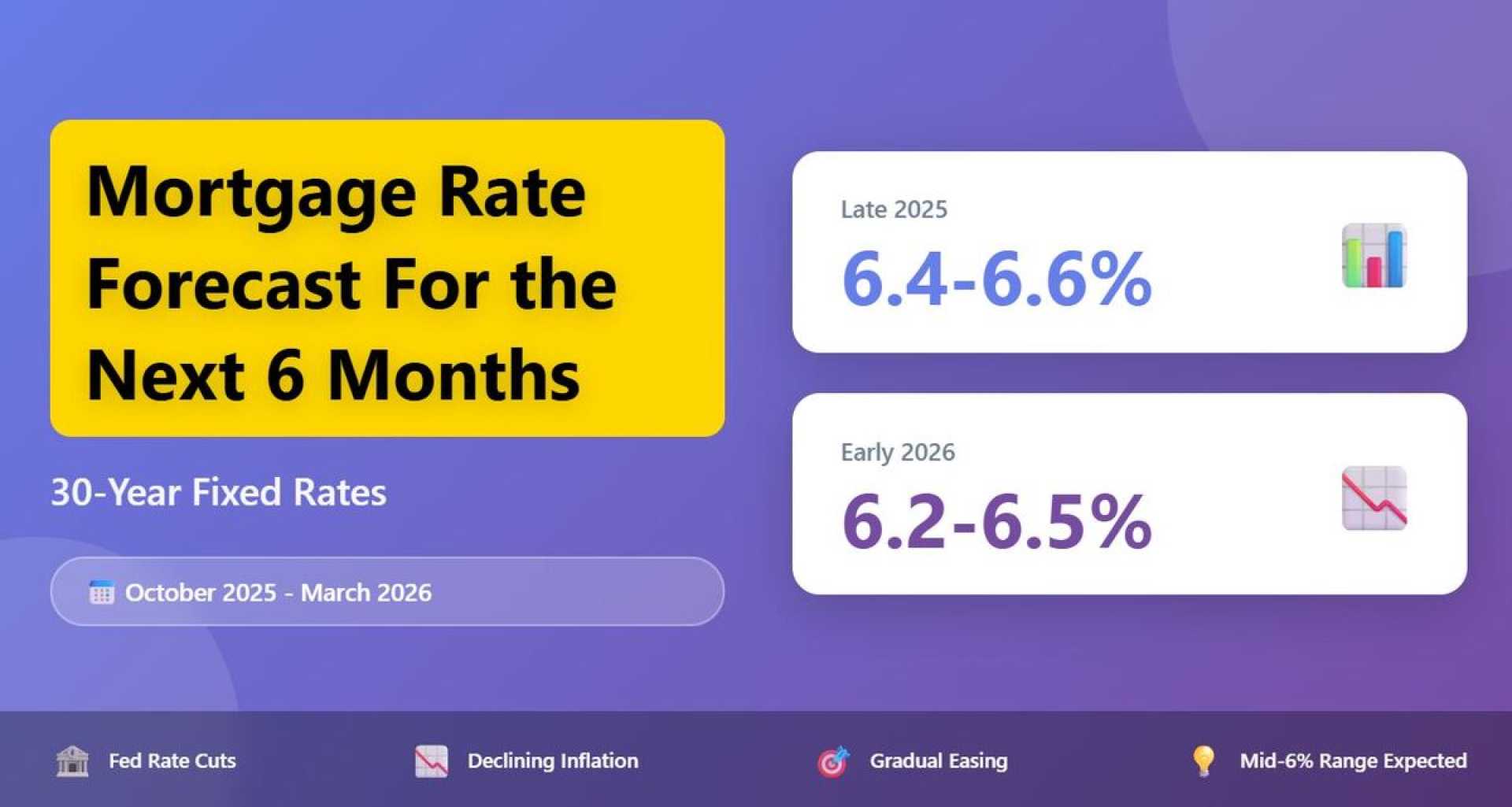

Despite recent fluctuations, the outlook remains cautious. “I expect mortgage rates to ease modestly into year-end,” said Tony Julianelle, CEO at Atlas Real Estate. He warned, however, that the situation is precarious, with both inflationary pressures and Fed policy at play.

Looking ahead, the personal consumption expenditures (PCE) index, which is the Fed’s preferred measure of inflation, will be released soon. Changes in this index could significantly affect mortgage rate movements. Experts suggest that borrowers should remain vigilant and consider various options as rates may fluctuate based on upcoming economic data.

As we approach October, potential homebuyers and investors are being urged to act. Financial markets are expected to continue reacting to economic data, and borrowers are advised to explore their refinancing options as rates remain historically low.