Business

Federal Reserve Officials Debate Future Interest Rate Cuts Amid Economic Uncertainty

Washington, D.C. — Federal Reserve officials showed strong support for lowering interest rates during their September meeting, with the main debate revolving around the number of cuts to implement, according to meeting minutes released Wednesday.

The Federal Open Market Committee (FOMC) minutes revealed that almost all participants agreed on the necessity of a cut due to ongoing weakness in the labor market. However, opinions differed on whether the committee should pursue two or three total cuts this year, which would include the recent quarter percentage point decrease approved during the September 16-17 meeting.

“In considering the outlook for monetary policy, almost all participants noted that… the Committee was well positioned to respond in a timely way to potential economic developments,” the minutes stated. The document highlighted varied opinions on the current restrictiveness of monetary policy and future policy directions, with most members believing further easing would be appropriate by year-end.

The minutes included projection materials displaying a tight split among the 19 FOMC officials. The “dot plot” indicated a 10-9 division, with a majority leaning toward two additional cuts before the year concludes. The full committee voted 11-1 in favor of reducing the federal funds rate to a target range of 4%-4.25%.

Newly appointed Governor Stephen Miran, attending his first meeting, was the sole dissenting vote, favoring a more aggressive half-point cut instead. Although the minutes did not name individual participants, subsequent public comments indicated that Miran’s views pointed toward a stronger easing strategy.

In public discussions, Miran raised concerns about how the current assessment of the economy could lead to missteps in policy-making. “The risk today is that the Fed misdiagnoses the fall in payroll employment growth as entirely a demand-side phenomenon,” he said, warning against cuts that may exacerbate wage pressures linked to decreasing labor availability.

The sentiment expressed during the meeting echoed a recent survey from the Federal Reserve, which found that nearly all primary dealers anticipated a 25 basis point cut at the September meeting. Roughly half expected another cut at the upcoming October meeting.

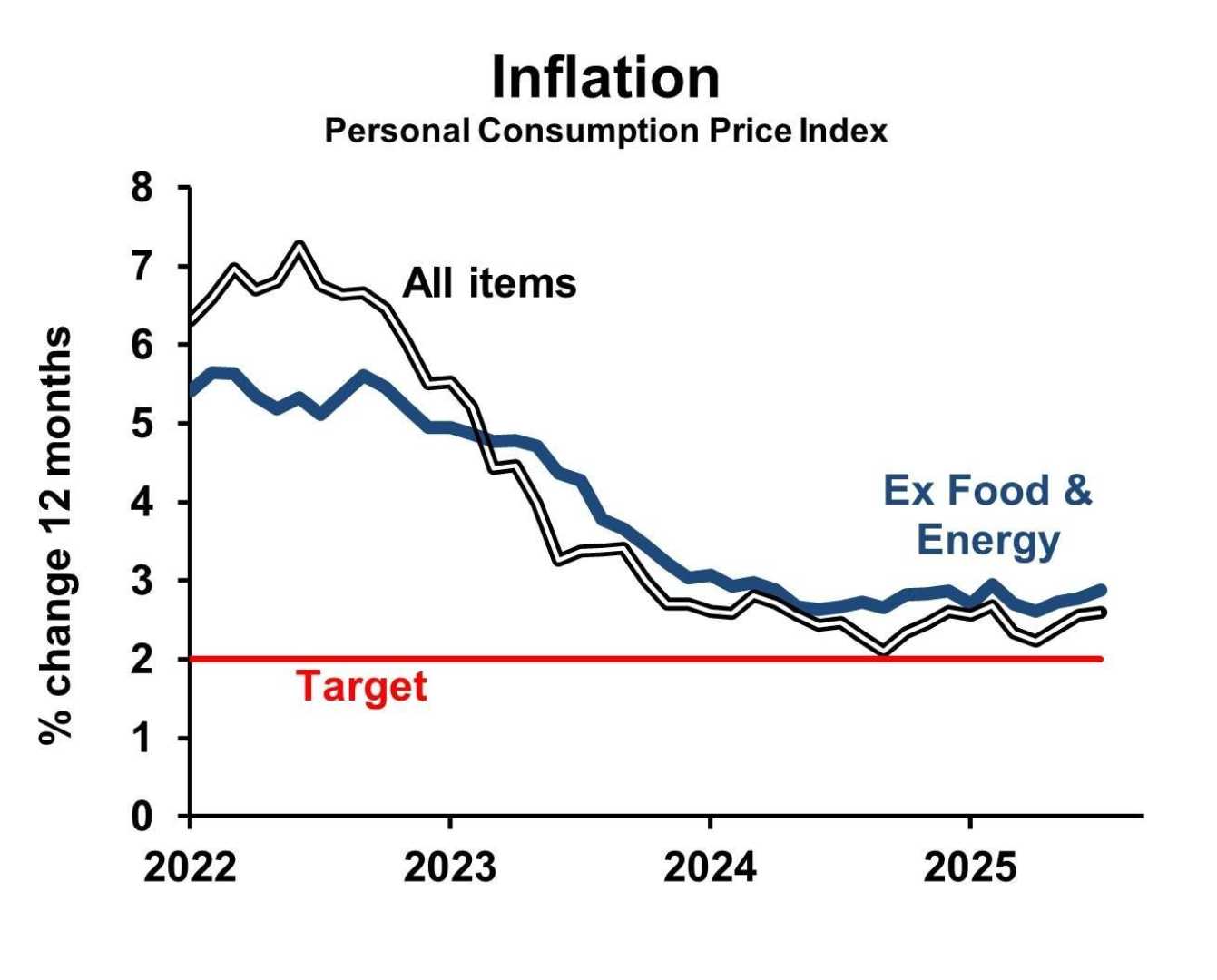

Concerns persist among officials regarding inflation, which remains above the Fed’s 2% target. Kansas City Federal Reserve Bank President Jeffrey Schmid noted the need for the Fed to maintain credibility on inflation, while some members are cautious about further cuts. Fed Chair Jerome Powell reiterated the need to keep the monetary policy “restrictive enough to apply downward pressure on inflation” but has not committed to pace of further reductions.

As the debate continues, the Fed faces a challenging path to navigate economic risks and labor market conditions as they consider adjustments to interest rates moving forward.