Business

Fed Repo Facility Sees Record Usage Amid Market Volatility

Washington, D.C. — The Federal Reserve’s Standing Repo Facility set a record for cash loans on Friday, October 31, as month-end pressures surged. The facility lent a total of $50.35 billion to eligible financial institutions in two transactions, marking its highest usage since it was established in 2021.

The spike in borrowing coincided with significant inflows into the Fed’s reverse repo facility, totaling $51.8 billion. Financial analysts noted that month-end dealings typically introduce volatility into markets, as firms adjust cash flows for various reasons, including reducing lending activities.

“Ironically, the number of securities given to the Fed about equals the amount of cash received,” said Scott Skyrm from Curvature Securities. “This was the first time the SRF functioned as designed.” Some analysts, including those at Wrightson ICAP, predict that funding pressures will ease next week.

Earlier in the week, the Federal Reserve announced plans to cease liquidity withdrawals by December 1 as it prepares for changes to its balance sheet strategy. During a press conference, Federal Reserve Chair Jerome Powell emphasized their goal to address ample reserve conditions in money markets.

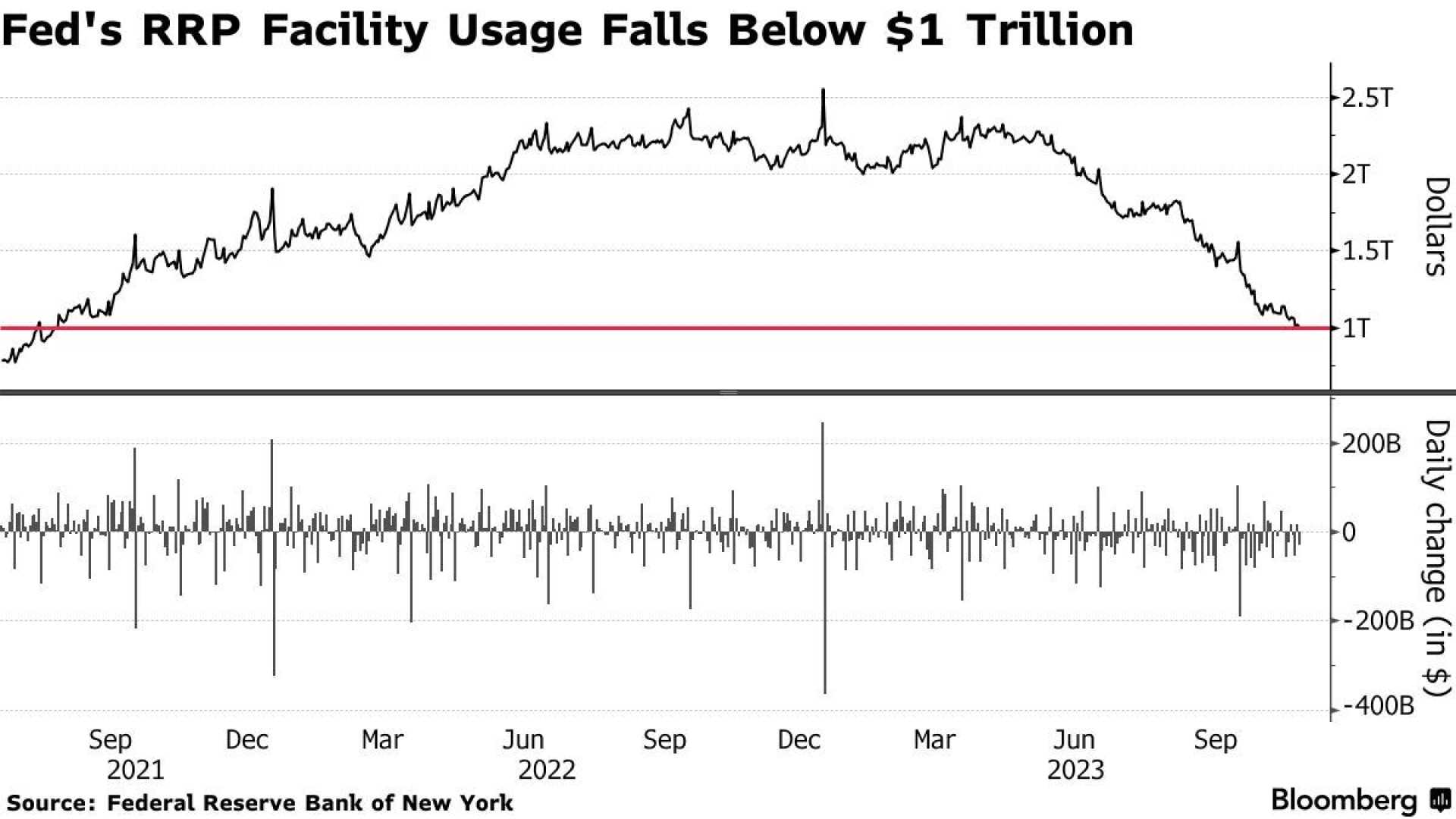

The Fed’s balance sheet has decreased from $9 trillion in the summer of 2022 to $6.6 trillion now, achieved by allowing previously acquired Treasury and mortgage bonds from pandemic stimulus to mature without replacement. “Money market conditions indicate the Fed’s balance sheet is now much closer to a normal size,” Dallas Fed President Lorie Logan noted.

Logan expressed disappointment with the usage of the SRF, noting its intended role as a liquidity buffer hasn’t been fully realized in high-rate periods. “With rates averaging higher than they were just a few months ago, the likelihood of the SRF rate becoming economical on some days is higher,” she added.

The Fed’s leadership changes and operational adjustments are under scrutiny, especially as usage of the SRF tool remains uneven. Cleveland Fed Chief Beth Hammack echoed these concerns over the SRF’s utilization, stating it’s disappointing to see such tools underused by banks that requested them.

As the market adjusts coming out of a volatile month-end, the Fed appears poised to monitor and respond to evolving liquidity needs in the financial sector.