Business

Circle Stock Drops Despite Higher Profits from Stablecoin Growth

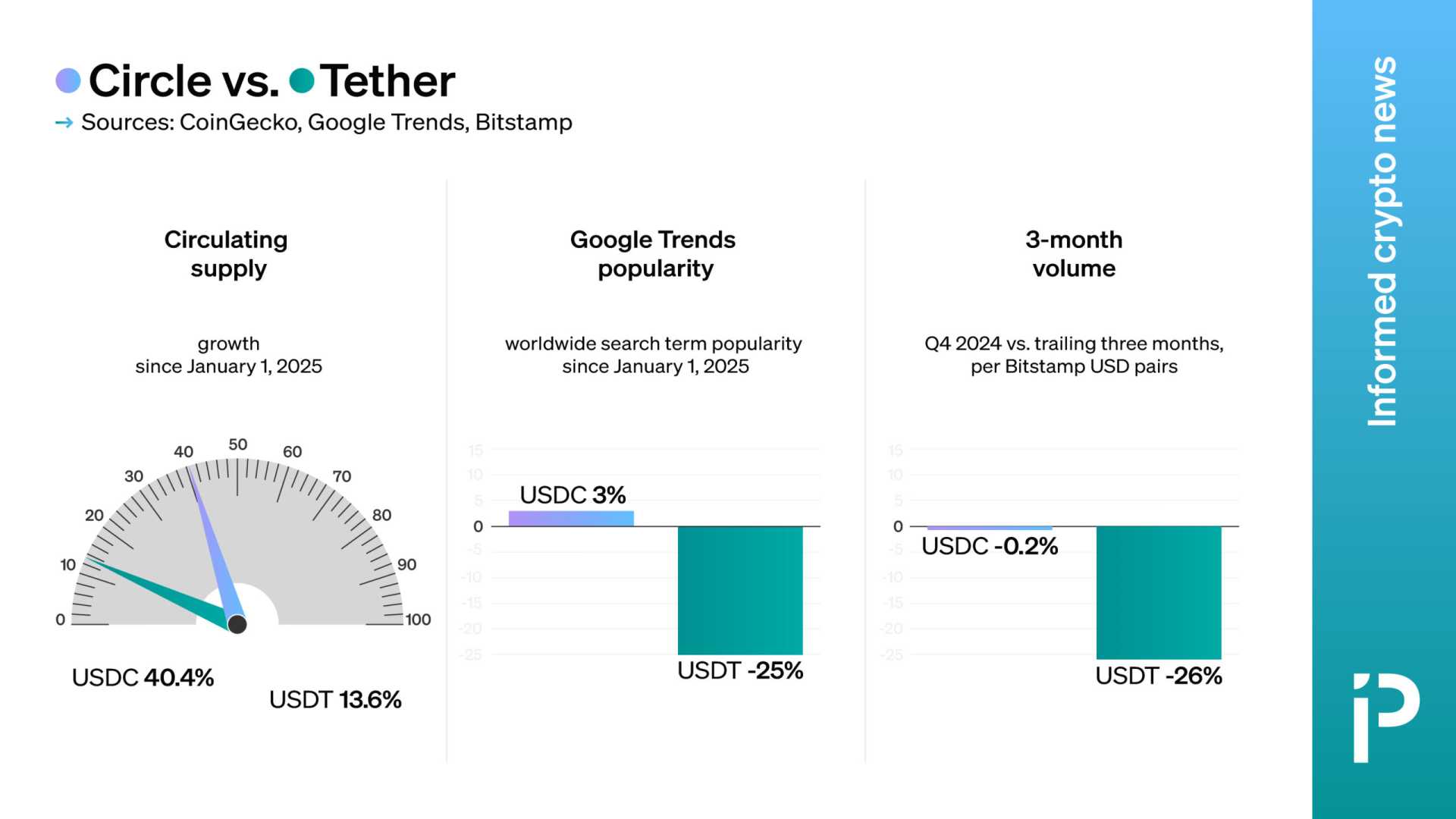

New York, NY — Circle (CRCL) saw its stock drop by 5% before the market opened on Wednesday, despite reporting a better-than-expected profit for the third quarter. The performance was fueled by a rise in stablecoin circulation, particularly for its USDC stablecoin.

During the earnings release, Circle highlighted that higher reserve income contributed significantly to its profit. Analysts had anticipated a profit per share of $0.39, but Circle exceeded this estimate, signaling strong business momentum.

According to Reuters, the decline in stock price may reflect investor caution about future performance amid a competitive landscape in the stablecoin market. Stablecoins like USDC play a critical role in the digital currency ecosystem and have been gaining traction with users seeking financial stability.

Last week, major technology firms including Uber, Spotify, and NFTs companies such as Constellation Energy also reported results during this earnings season, which has shown positively across various sectors. Investors are particularly focused on tech and AI developments as the market continues to rebound.

Despite the stock’s morning dip, some industry experts anticipate Circle’s growth trajectory might improve as stablecoins gain more acceptance among both users and regulatory bodies. Analysts suggest that increasing partnerships and deals, particularly related to digital finance, could help bolster Circle’s standing in the market going forward.

The broader market trend shows an overall profit increase, with 91% of S&P 500 companies reporting third quarter results, expecting a 13.1% rise in earnings per share compared to preceding quarters.