Business

Economic Calendar Impacts U.S. Stock Market Movements This Week

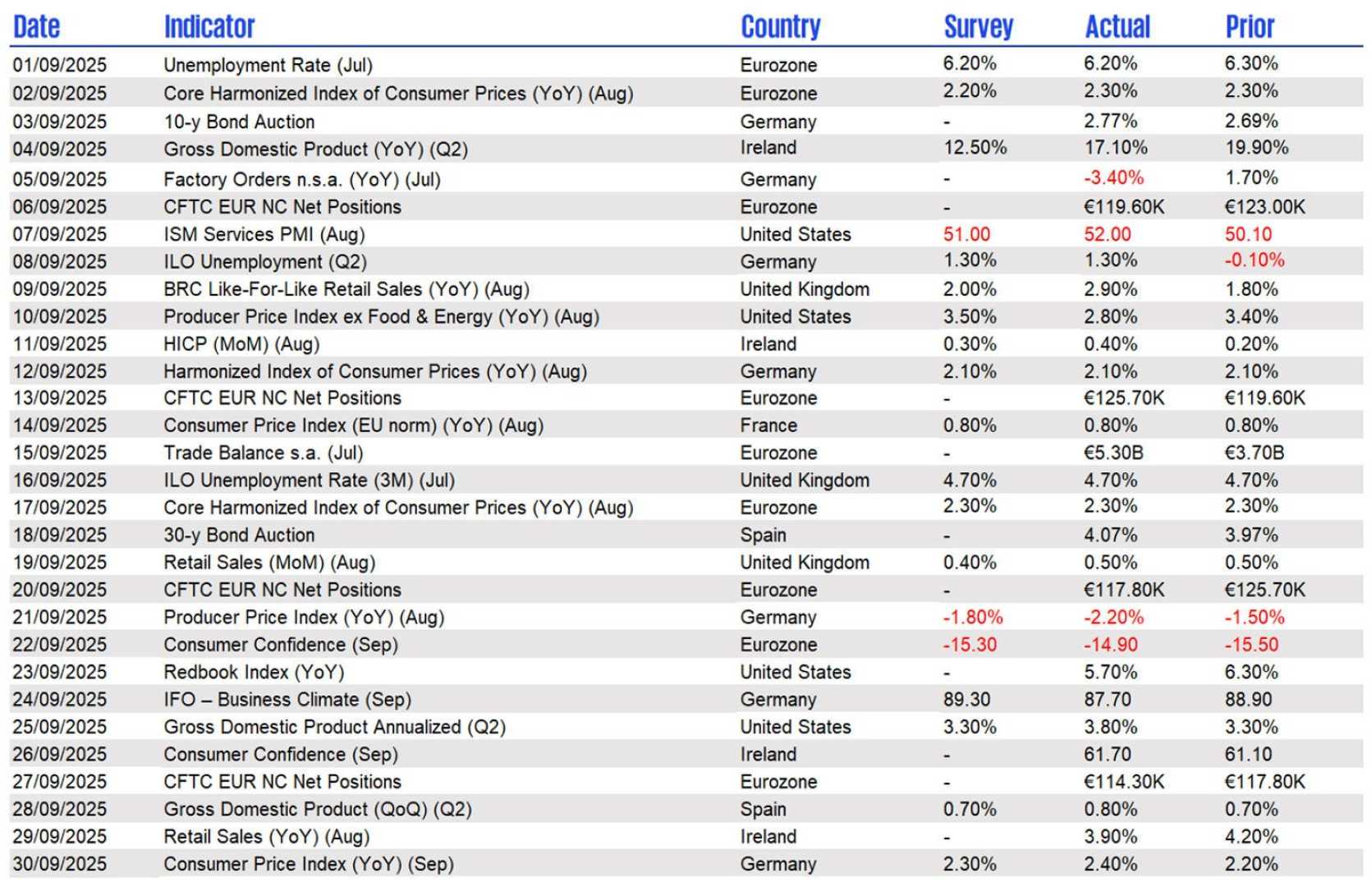

NEW YORK, NY — Investors are preparing for a busy week ahead as key economic data is set to shape U.S. stock market trends. Various reports including retail sales and the Producer Price Index (PPI) will be released this week, affecting investor strategies.

The economic calendar is essential for traders looking to navigate the stock market effectively. Data such as GDP reports, employment figures, and inflation statistics directly influence market movements. For instance, when unemployment rates are lower than expected, it often boosts investor confidence, potentially enhancing stock prices.

Analysts emphasize the importance of understanding economic indicators that signal the health of the economy. GDP growth suggests economic expansion, while a rising Consumer Price Index (CPI) can indicate inflation worries. These indicators directly affect market sectors; for example, strong non-farm payroll numbers could favor consumer-focused stocks.

Investors frequently rely on platforms like Meyka for real-time updates regarding economic conditions. Timely access to these insights can help them adjust their trading strategies. In particular, this week’s reports on initial jobless claims and retail sales will be closely monitored as they offer clues about consumer sentiment and spending patterns.

The upcoming Thanksgiving holiday impacts trading hours, adding urgency to these economic reports. Stock markets will close on Thursday and have early closings on Friday. Analysts suggest that reduced trading volumes this week could lead to higher volatility in stock prices.

Overall, staying informed about these economic releases is crucial for investors aiming to make smart decisions. The economic calendar remains a fundamental tool for understanding market dynamics and shaping trading strategies.