Business

Bitcoin Approaches Key Resistance Amid Market Uncertainty

NEW YORK, NY — Bitcoin traded at a critical resistance level of $91,000 to $93,000 on Nov. 30, 2025, following a significant bounce from the $80,000 to $83,000 demand zone. Despite this recovery, the overall market trend remains bearish as the cryptocurrency struggles to break free from a descending channel.

The recent uptick is noted as the strongest recovery in the past month; however, it stalled against a vital supply block near the $90,000 to $93,000 range. The 100-day and 200-day moving averages continue to decline, indicating resistance above the current market price, which greatly influences the bearish macro trend.

Market analysts emphasize that Bitcoin must reclaim the $103,000 to $106,000 range to invalidate the current bearish flow. Without such a breakthrough, the price is expected to face headwinds. Notably, each attempt into the resistance area has shown decreased momentum, hinting that traders are hesitant for a sustained rally.

On the 4-hour chart, Bitcoin reached a pivotal resistance zone, coinciding with the $92,000 bearish order block and the extended downtrend line. Should resistance hold, a decline to $86,000 to $88,000 may occur, with further support at the strong macro demand zone of $80,000 to $83,000.

Conversely, a daily close above $93,000 could lead Bitcoin toward the $102,000 to $106,000 inefficiency zone. This critical price point is defined as the next area of notable market reaction.

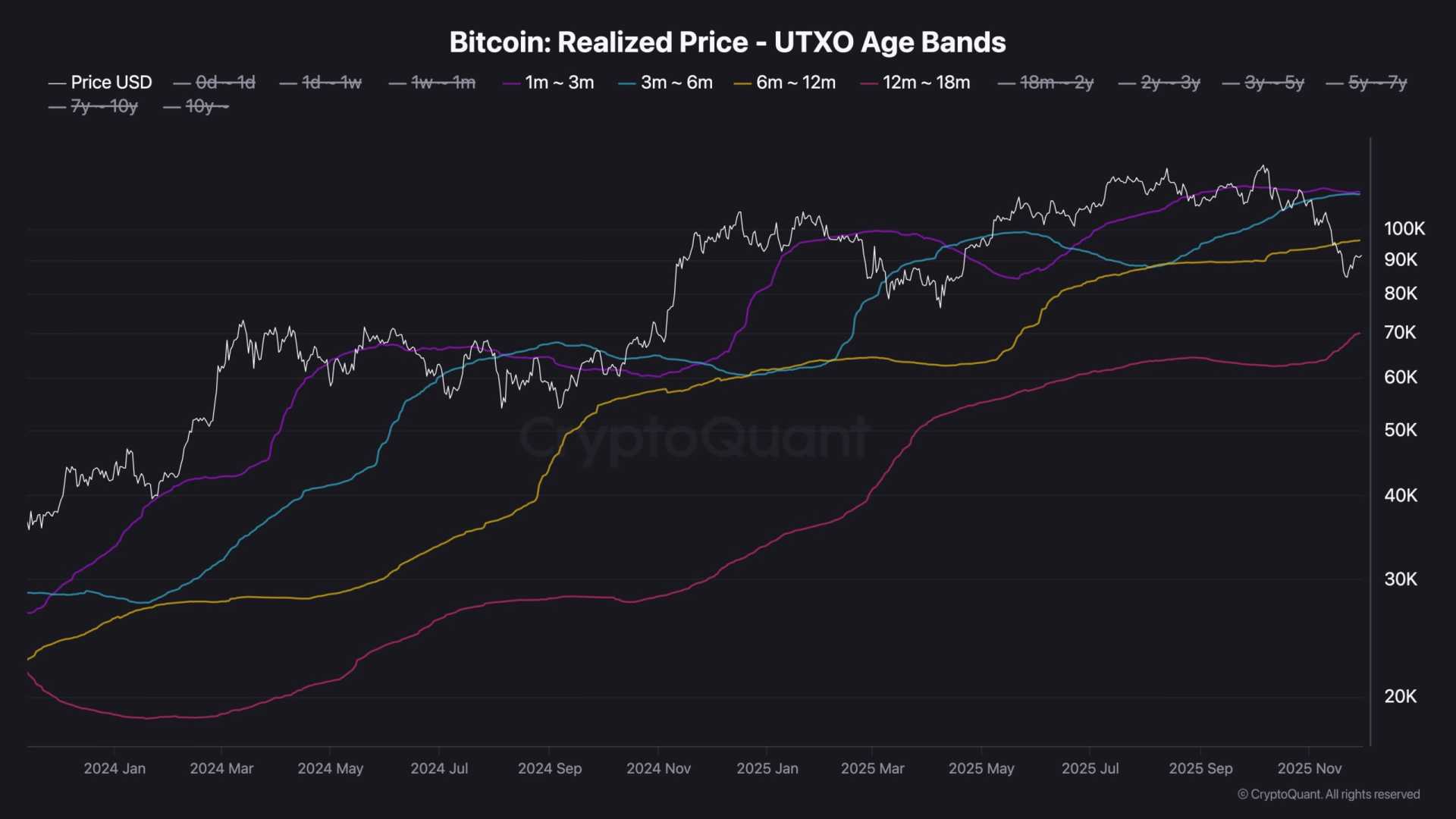

Current technical indicators suggest a significant hurdle at the $92,000 level. On-chain data indicates a second layer of resistance near $96,000 to $97,000, influenced by the average cost basis of various market participants. The Realized Price by UTXO Age Bands metric shows that this level serves as a psychological barrier for many investors.

Investors who bought Bitcoin recently may be seeking to exit at breakeven, generating increased sell-side pressure at higher prices. This situation is exacerbated by medium-term holders who entered earlier in the year, further complicating potential upward movement.

A decisive close above $97,000 is deemed necessary to confirm that the market has absorbed all sell pressure and is poised for higher valuations.