Business

Amazon Shifts Focus to AI and Cloud Services Amid Earnings Season

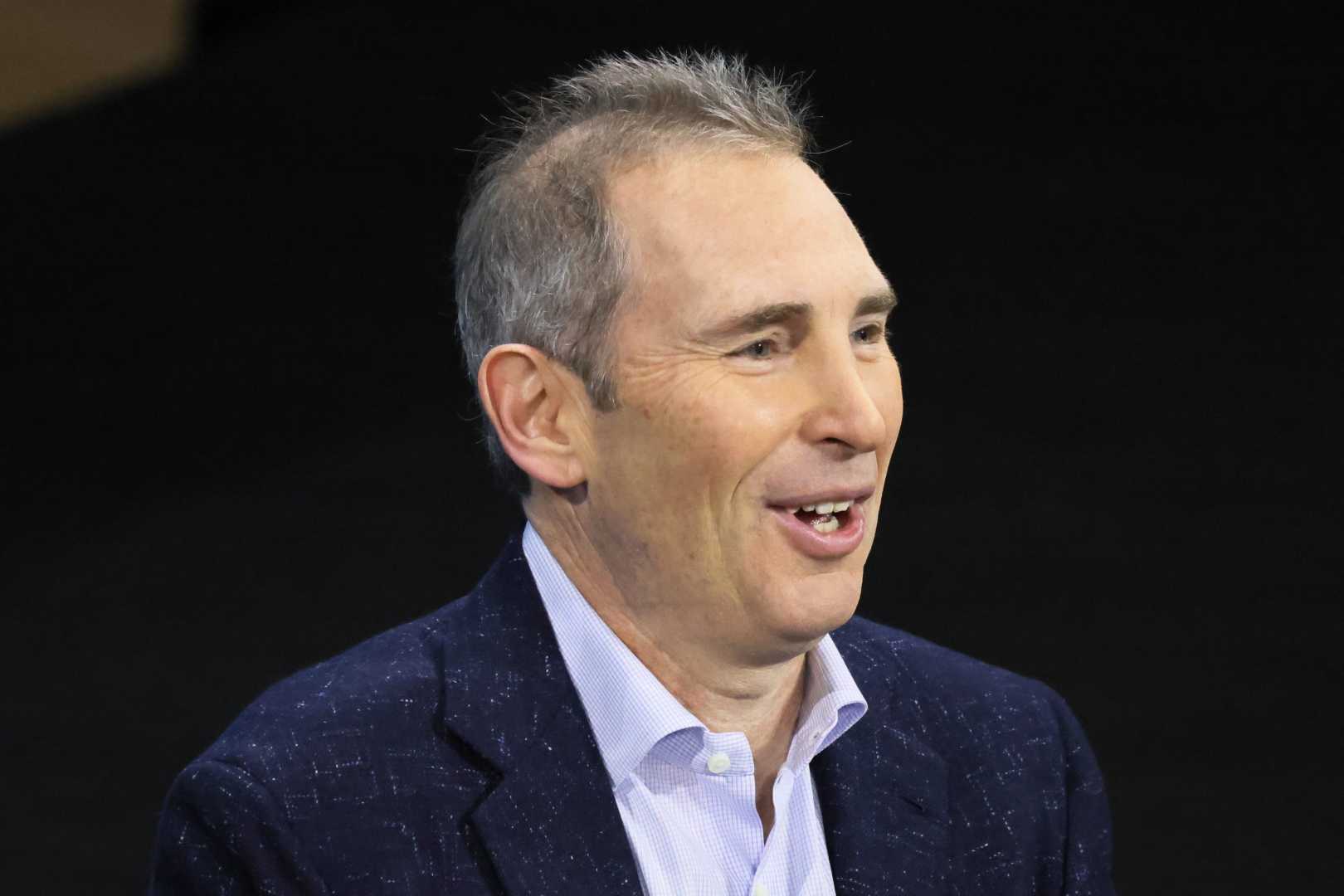

SEATTLE, Wash. — Wall Street analysts have reevaluated Amazon.com Inc. (AMZN) as the U.S. earnings season kicked off last week, highlighting the company’s strategic pivot toward artificial intelligence (AI) and cloud services under CEO Andy Jassy.

During the Needham Growth Conference, a panel of former Amazon employees, hosted by Needham analyst Martin, discussed the company’s evolving priorities. Panelists unanimously agreed that Jassy, the former founder and president of Amazon Web Services (AWS), is the right leader to steer Amazon toward its future. AWS, they noted, is central to Amazon’s current high-margin, high-growth revenue model and its future in large language models (LLMs) and generative AI tools.

Since taking the helm, Jassy has reallocated resources from long-term bets like the Fire Phone and grocery ventures to bolster AWS and improve near-term profitability. Amazon’s ‘debate and commit’ culture, where decisions are made after thorough discussion, ensures alignment but can lead to prolonged challenges in resolving complex issues. Panelists noted that only two projects in Amazon’s history have been shut down, reflecting a reluctance to abandon risky ventures.

Amazon’s rotational culture, where employees switch roles every 18-24 months, fosters fresh perspectives but risks talent burnout and high turnover. One panelist raised concerns about the sustainability of Amazon’s Delivery Service Partner (DSP) model, citing low control and high turnover among contractors as obstacles to operational excellence in last-mile delivery.

Despite thin retail margins, Amazon’s investments in automation and ‘hands-off-the-wheel’ technology are expected to improve profitability. The company’s Ad Business is also leading the industry in data collection and tying ad revenue to actual purchases, making it the top Retail Media Network today.

According to BofA Securities, Amazon outperformed the Nasdaq and e-commerce sector in 2024, with a 44% gain compared to the Nasdaq’s 25%. Analyst Post highlighted AWS’s growth and retail margin expansion as key drivers of Amazon’s success. He noted that AI-driven cloud growth and retail margin efficiencies will continue to fuel profit growth in 2025. Post slightly lowered his 2025 revenue and EPS estimates to $700 billion and $6.10, respectively, due to recent U.S. dollar appreciation but emphasized Amazon’s strong position in AI and robotics.

Amazon’s stock rose 2.35% to $231.25 at last check Tuesday, reflecting investor confidence in the company’s strategic direction.