Business

S&P 500 Shows Resilience Amid Market Shifts and Policy Changes

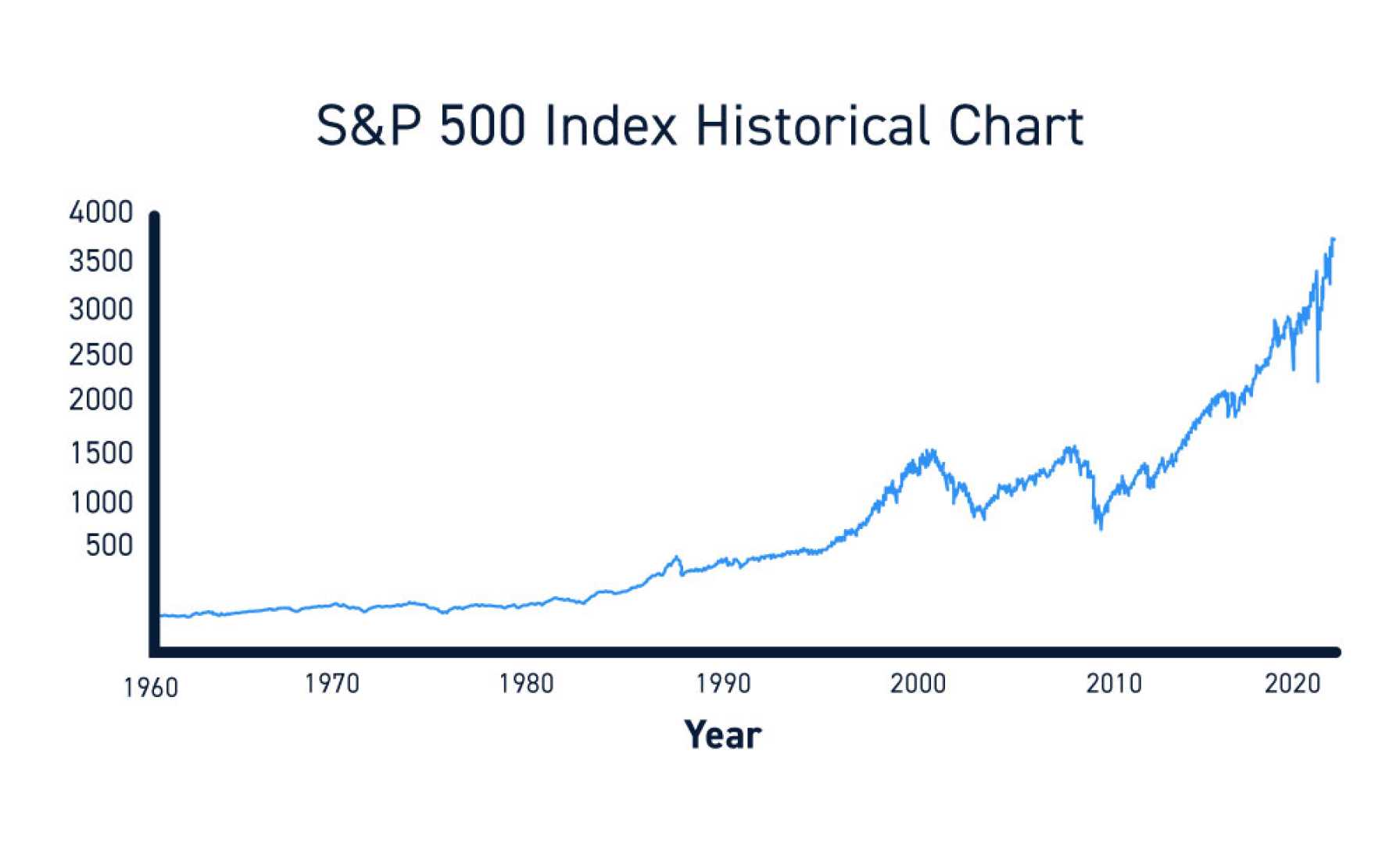

NEW YORK, NY — The S&P 500 has demonstrated remarkable recovery since its lows in late 2022, achieving a significant 26% growth in 2023 and another 23% in 2024. As of now, the index has seen a modest increase of 1.4% this year, despite recent market corrections.

Analysts attribute this resilient performance to various factors, including shifts in trading strategies and the effect of recent policy moves from former President Donald Trump. These developments have notably impacted investor sentiment and market dynamics.

Additionally, online brokerage Robinhood Markets Inc. has expanded its offerings to include zero-day-to-expire options (0DTE). This decision has made such contracts more accessible to a broader range of investors, influencing trading behaviors and market volatility.

According to market expert data, the surge in 0DTE options trading presents a striking shift in how investors engage with the S&P 500. “This new trading option has attracted a different demographic of traders who are looking to leverage short-term market movements,” said an industry analyst familiar with the trends.

Despite the favorable returns in recent years, experts caution investors: “Past performance is no guarantee of future results,” emphasizing the importance of prudent risk management amidst market fluctuations.

In light of these developments, the overall sentiment remains cautiously optimistic. Investors continue to monitor economic indicators, policy changes, and innovative trading products as they navigate potential opportunities and challenges in the evolving market landscape. “Staying informed and adaptable is key in today’s fast-paced trading environment,” the analyst added.