Business

Apple Shares Surge Amid U.S.-China Tariff Concerns

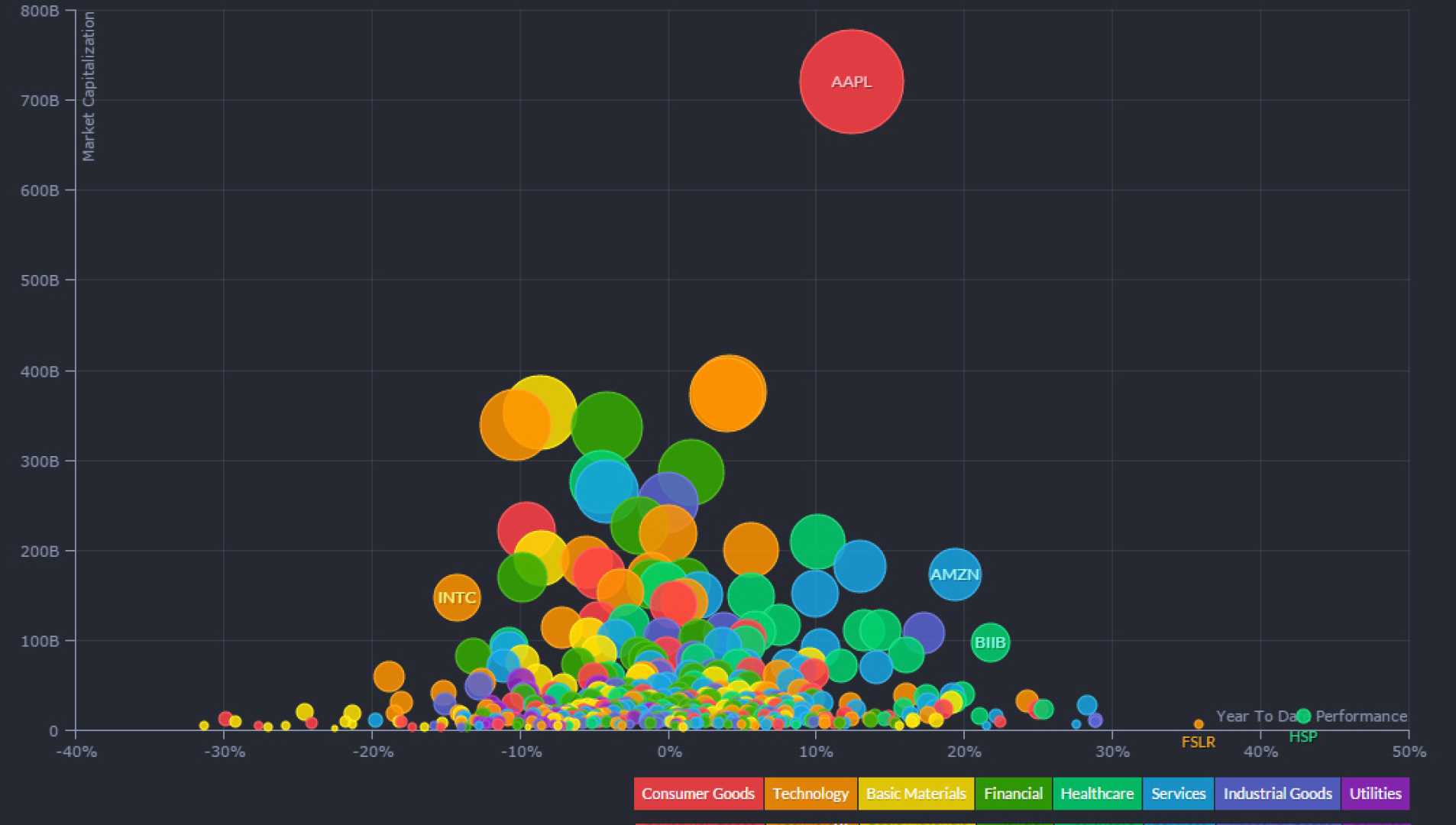

NEW YORK, April 3, 2025 — Apple Inc.’s shares surged more than 4% on Wednesday, reaching approximately $180 in midday trading, following a significant decline of over 20% in the previous four sessions. This recent volatility is attributed to increasing concerns regarding the escalating trade tensions between the U.S. and China, particularly in light of new tariffs announced by the Trump administration.

The precipitating decline began when the Trump administration indicated wide-ranging tariffs affecting nearly all trading partners, with specific implications for Apple, which assembles about 90% of its products in China. Apple’s stock had dropped markedly after breaking below the crucial 200-week moving average last month, which further intensified selling pressure among investors.

“While the technical indicators confirm a bearish momentum, they have also entered oversold territory,” said market analyst Jamie Reynolds. “This situation increases the likelihood that investors may seek short-term buying opportunities as they look for support levels.”

Investors are closely monitoring key price points in Apple’s chart. Analysts suggest potential buy interest could emerge near $166, where previous trading activity has shown support. Should the stock fail to maintain this level, it could further decline to around $155, an important support area connecting trading patterns from late 2021 through early 2023. A more substantial drop might bring the $138 level into focus, which historically has marked important trading activity for Apple.

On the other hand, during any recovery attempts, the $197 mark could pose significant resistance for the stock, given the peaks around that level observed in July and December 2023.

Meanwhile, broader market indices also showed fluctuations, driven by technology sector gains despite the ongoing trade tensions. Other technology stocks, including Tesla, Nvidia, and Microsoft, reported upticks, even as concerns about economic impacts from the tariffs loom large.

In a separate but related matter, the pharmaceutical sector faced a downturn as President Trump announced intentions to impose tariffs on pharmaceutical imports. Market giants like AstraZeneca, Pfizer, and Eli Lilly saw their shares slide following the announcement. Trump stated, “We’re going to tariff our pharmaceuticals, and once we do that they’re going to come rushing back into our country,” alluding to a potential reshoring of manufacturing.

The financial sector is bracing for an upcoming earnings season, worrying that economic repercussions from the tariffs may stifle lending and earnings reports, complicating the outlook for banks. Jamie Dimon, CEO of JPMorgan Chase, commented in an interview that a recession is “a likely outcome,” adding urgency to the need for strategic planning.

As the markets react to these developments, energy stocks also faced difficulties, with West Texas Intermediate crude oil trading below $57.50 per barrel, marking a 20% drop since the announcement of the tariffs. Major energy companies like Chevron, Exxon Mobil, and BP reported declines in stock prices, reflecting the uncertainty tied to global trade disruptions.