Business

Ariose Capital Invests $4.69M in iShares Bitcoin Trust

NEW YORK, NY — Ariose Capital Management Ltd has invested $4.69 million in the iShares Bitcoin Trust (NASDAQ: IBIT), according to a recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 88,400 shares of the trust, marking a significant move into the cryptocurrency market. This investment represents approximately 3.9% of Ariose Capital’s portfolio, making the iShares Bitcoin Trust its sixth-largest holding.

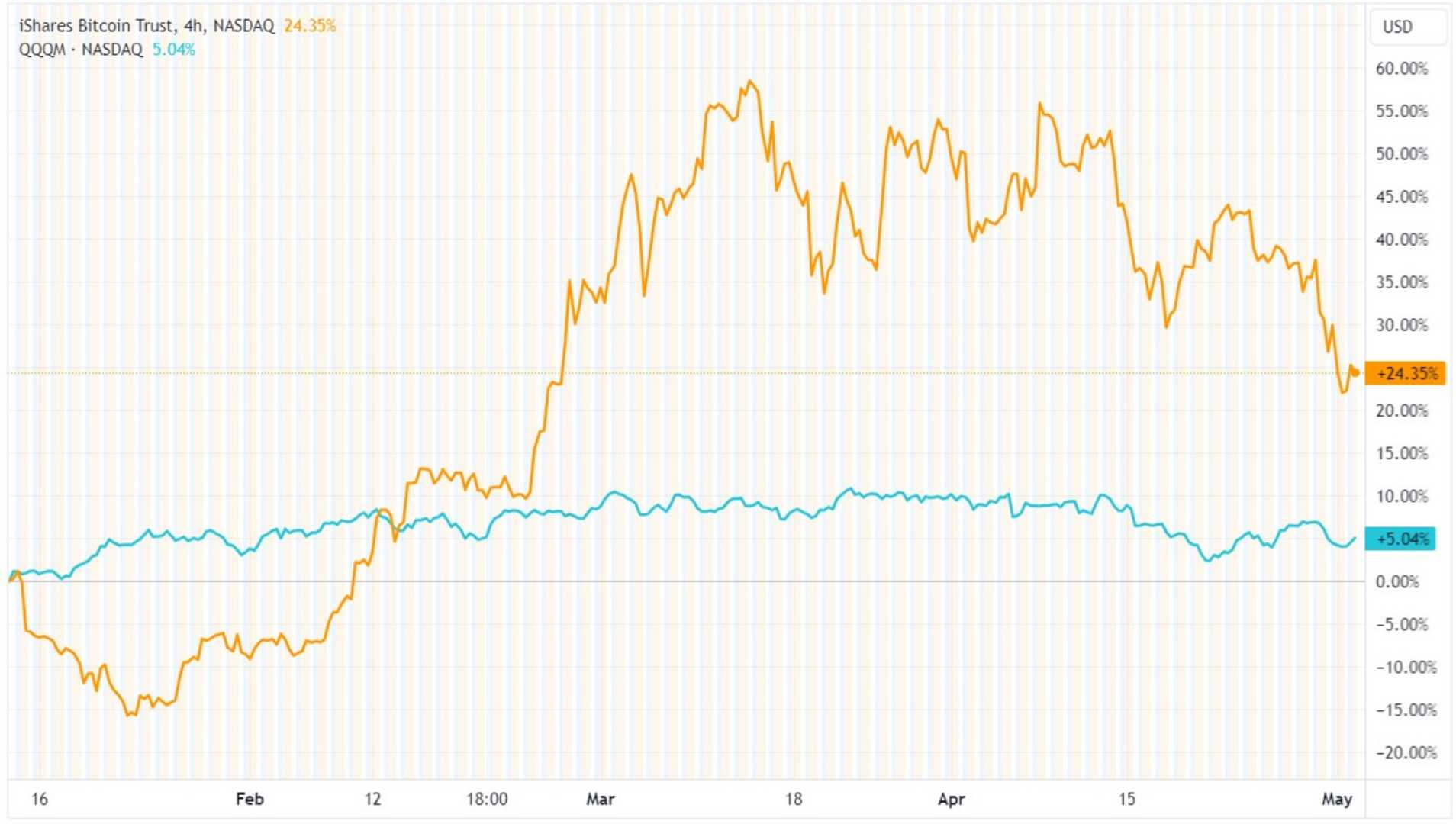

The iShares Bitcoin Trust, launched on January 5, 2024, by BlackRock, is an exchange-traded fund (ETF) designed to track Bitcoin’s spot price performance. It provides investors with a regulated and accessible way to gain exposure to Bitcoin without the complexities of direct ownership. The trust’s shares were recently trading at $59.62, with a 52-week range between $22.02 and $61.75.

Ariose Capital’s investment reflects a broader trend of institutional investors embracing cryptocurrency-linked assets. For instance, Aristeia Capital L.L.C. recently increased its stake in the iShares Bitcoin Trust by 47.2%, now holding 5,940,411 shares valued at approximately $202.8 million. This growing confidence in Bitcoin ETFs highlights the increasing mainstream adoption of digital assets.

“The iShares Bitcoin Trust offers a convenient and regulated avenue for institutional and retail investors to gain Bitcoin exposure,” said a spokesperson for Ariose Capital. The trust’s popularity is expected to fuel further growth in the cryptocurrency sector as more firms make substantial investments.

This move also signals a shift in the perception of Bitcoin as a legitimate asset class within diversified portfolios. As Ariose Capital deepens its commitment to cryptocurrency, it joins a growing number of institutional players acknowledging Bitcoin’s potential. The iShares Bitcoin Trust continues to serve as a gateway for traditional investors to participate in the digital asset revolution.