Business

Atmos Energy Stock Outlook: Analysts Raise Price Targets and Praise Dividend Growth

Atmos Energy Corporation (ATO), a leading natural gas utility company headquartered in Dallas, has been garnering significant attention from Wall Street analysts in recent days. As of November 27, 2024, the company’s stock outlook has been bolstered by positive analyst forecasts and dividend growth assessments.

Analysts from Mizuho have raised the price target for Atmos Energy to $165 from $148, maintaining an Outperform rating on the shares. This move aligns with the overall bullish sentiment among Wall Street analysts, who have set an average twelve-month price target of $143.94, with the highest target at $156.00.

The company’s dividend performance has also been a key focus. Atmos Energy is currently paying out a dividend of $0.81 per share, with a dividend yield of 2.32%. The annualized dividend has increased by 8.1% from last year, marking the fifth consecutive year-over-year increase, with an average annual increase of 8.44% over the last five years. This consistent dividend growth is seen as a strong attraction for income investors.

In terms of earnings, Atmos Energy is expected to see a year-over-year earnings growth rate of 4.98% for the fiscal year 2024, with the Zacks Consensus Estimate standing at $7.17 per share. The company’s payout ratio of 47% indicates that it pays out nearly half of its trailing 12-month EPS as dividends, suggesting a balanced approach to dividend distribution and earnings retention.

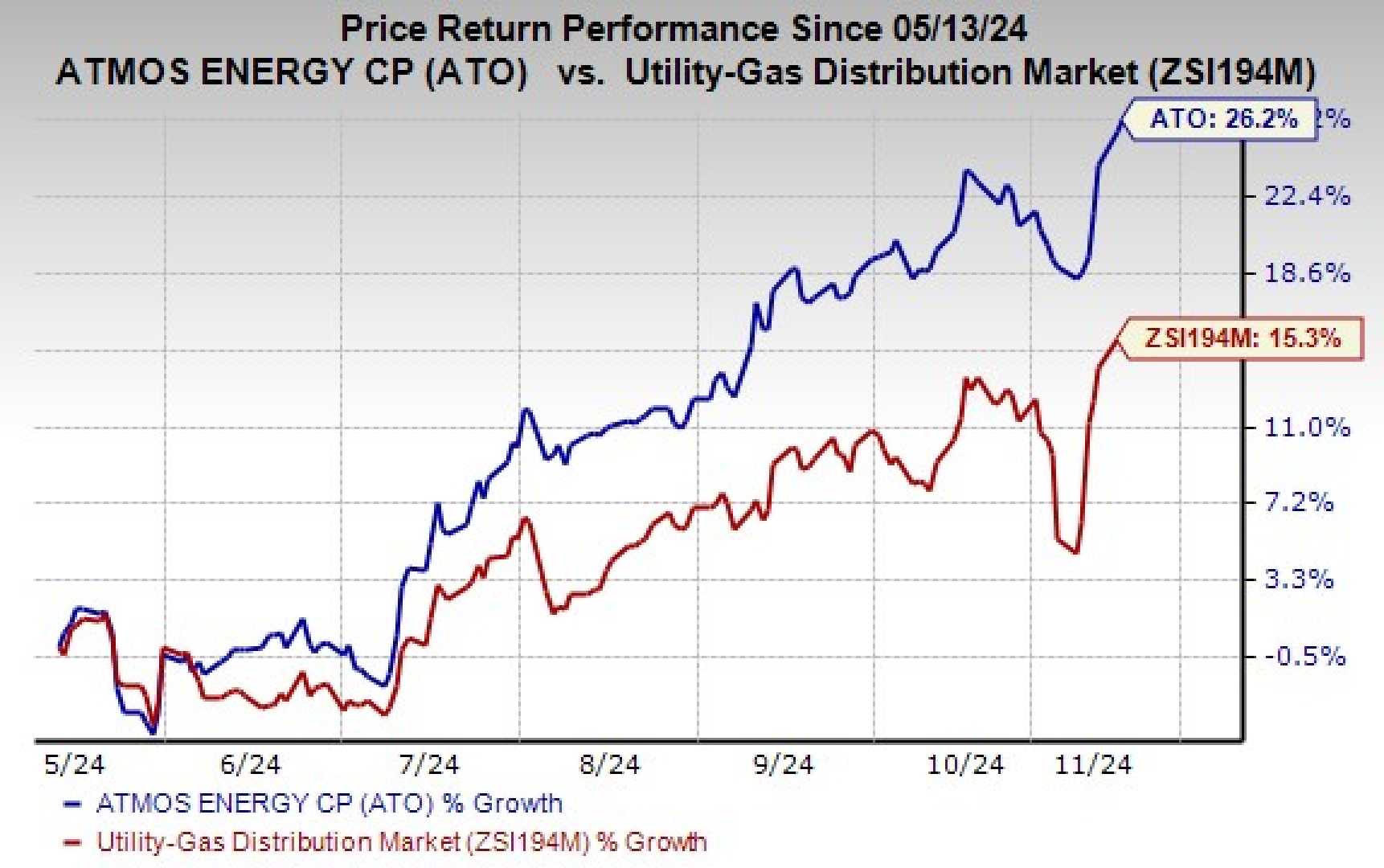

The stock has shown significant price appreciation, with a 29.58% increase since the start of the year. Despite some concerns about revenue meeting expectations, the overall consensus among analysts is that Atmos Energy represents a compelling investment opportunity, particularly for those seeking stable dividend income and moderate growth.