Business

BigBear.ai Struggles to Stabilize Amid AI Market Challenges

NEW YORK, NY – BigBear.ai, an artificial intelligence software company, continues to face significant challenges despite recent efforts to stabilize its business. Since its public debut in December 2021 through a merger with a special purpose acquisition company (SPAC), the company has struggled to meet growth targets and maintain investor confidence.

BigBear.ai’s stock opened at $9.84 per share in 2021, reaching a record high of $12.69 in April 2022. However, it plummeted to an all-time low of $0.63 by December 2022. Under CEO Mandy Long, who took over in October 2022, the stock has rebounded to around $3.40 as of January 2025, but it remains more than 70% below its peak.

The company develops AI-powered data-mining and analytics tools, offering modular solutions that integrate into existing software infrastructures. Despite its unique approach, BigBear.ai has struggled to compete in a crowded market. Its revenue grew only 6% in 2022 and flatlined at $155 million in 2023, far below its initial projections of $388 million for that year.

BigBear.ai attributed its sluggish growth to macroeconomic challenges, competition, and the bankruptcy of key customer Virgin Orbit in 2023. In contrast, competitors like Palantir and C3.ai managed to grow despite similar headwinds.

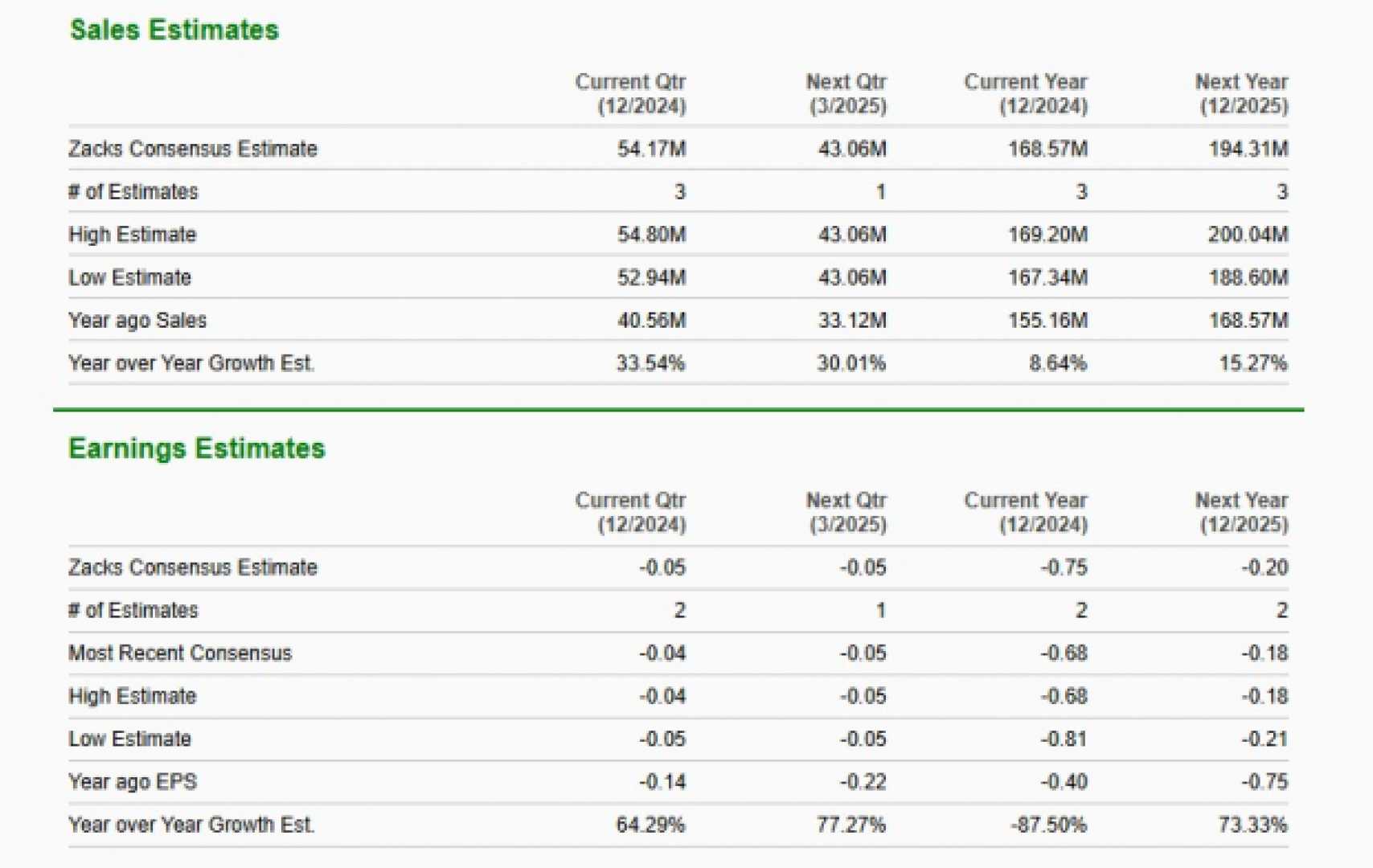

To address its challenges, BigBear.ai acquired AI vision-technology developer Pangiam in an all-stock deal and secured new government contracts. These efforts have improved its near-term revenue and brought its adjusted EBITDA closer to break-even levels. Analysts project an 8% revenue increase to $168 million in 2024, with a negative adjusted EBITDA of $1 million.

However, uncertainties remain. Kevin McAleenan, Pangiam’s founder, recently succeeded Long as CEO, raising questions about the company’s future direction. BigBear.ai also faces a high debt-to-equity ratio of 2.6, with $256 million in total liabilities as of its latest quarter.

While the company has stabilized its balance sheet by refinancing $182 million in convertible notes, its reliance on acquisitions and partnerships for growth raises concerns about sustainability. For now, BigBear.ai remains a speculative investment, with its long-term viability still in question.