Business

Bitcoin Plummets 5% Amid Market Turbulence and Broader Economic Concerns

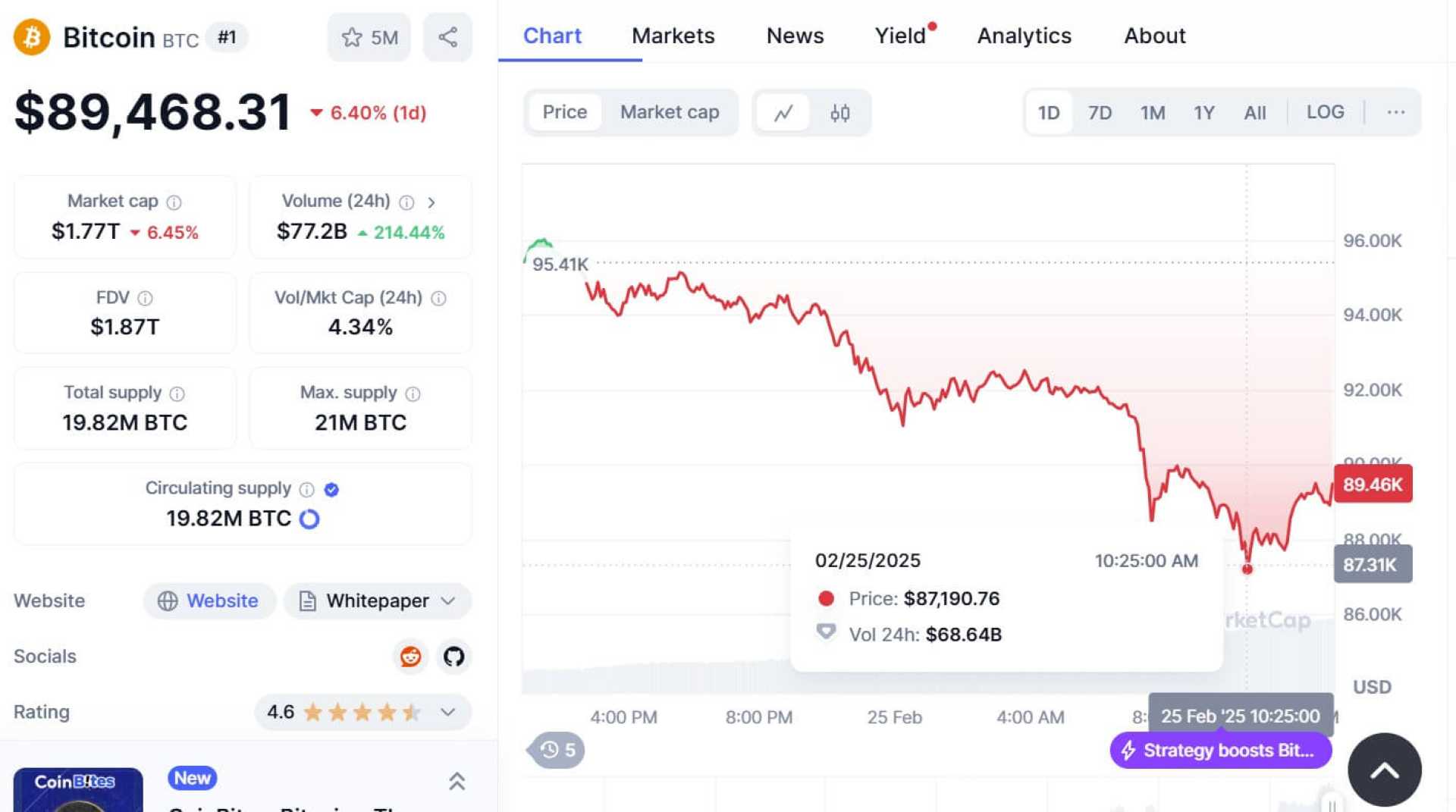

NEW YORK, NY – February 27, 2025 – Bitcoin, the world’s largest cryptocurrency by market value, fell by 5% during trading hours on Thursday, reaching an intraday low of $83,740. This decline reflects broader selling pressure across the cryptocurrency market, driven by geopolitical tensions and a record-breaking hack of the Bybit exchange.

As market conditions tightened, Bitcoin has now dropped nearly 20% from its all-time high of $109,350 recorded earlier this year. The sharp decline follows the inauguration of President Donald Trump, whose aggressive foreign policy has unsettled investors, contributing to a cautious risk-off sentiment.

Avinash Shekhar, Co-Founder and CEO of Pi42, noted, “The crypto market has entered a bear phase, having declined over 20% from its January peak to an intraday low of $83,740. Bitcoin’s retreat below $85K marks the largest sell-off of 2025, with approximately 79,300 BTC sold at a loss within 24 hours.”

Market sentiment was further dampened by ETF outflows and Trump’s threats of tariffs on European imports, which some analysts believe are exacerbating the bearish outlook. Following a four-day decline, Bitcoin has witnessed a drop of about 13%, marking its most significant downturn since August.

Ether and Solana, the second and third largest cryptocurrencies by market cap, have been affected even more significantly, with losses ranging from 7% to 10%. This widespread downturn has sparked concerns regarding institutional selling and macroeconomic instability.

“XRP’s open interest has reached its lowest level in 2025, indicating broader uncertainty within alternative coins,” Shekhar added. “While Bitcoin’s market dominance is rising, reflecting some long-term investor confidence, the recent surge in flash crashes and aggressive liquidation practices represent a volatile and fragile market.”

Market analysts are divided on whether this moment represents a temporary correction or the beginning of a more severe downturn. Investors face increasing pressure to navigate a landscape characterized by heightened risk and uncertainty.

As the situation evolves, industry stakeholders remain watchful. “The coming weeks will be critical in determining Bitcoin’s ability to withstand these emerging pressures and whether further price declines will materialize,” concluded Shekhar.