Business

Block Earnings Report Set to Reveal Stock’s Future

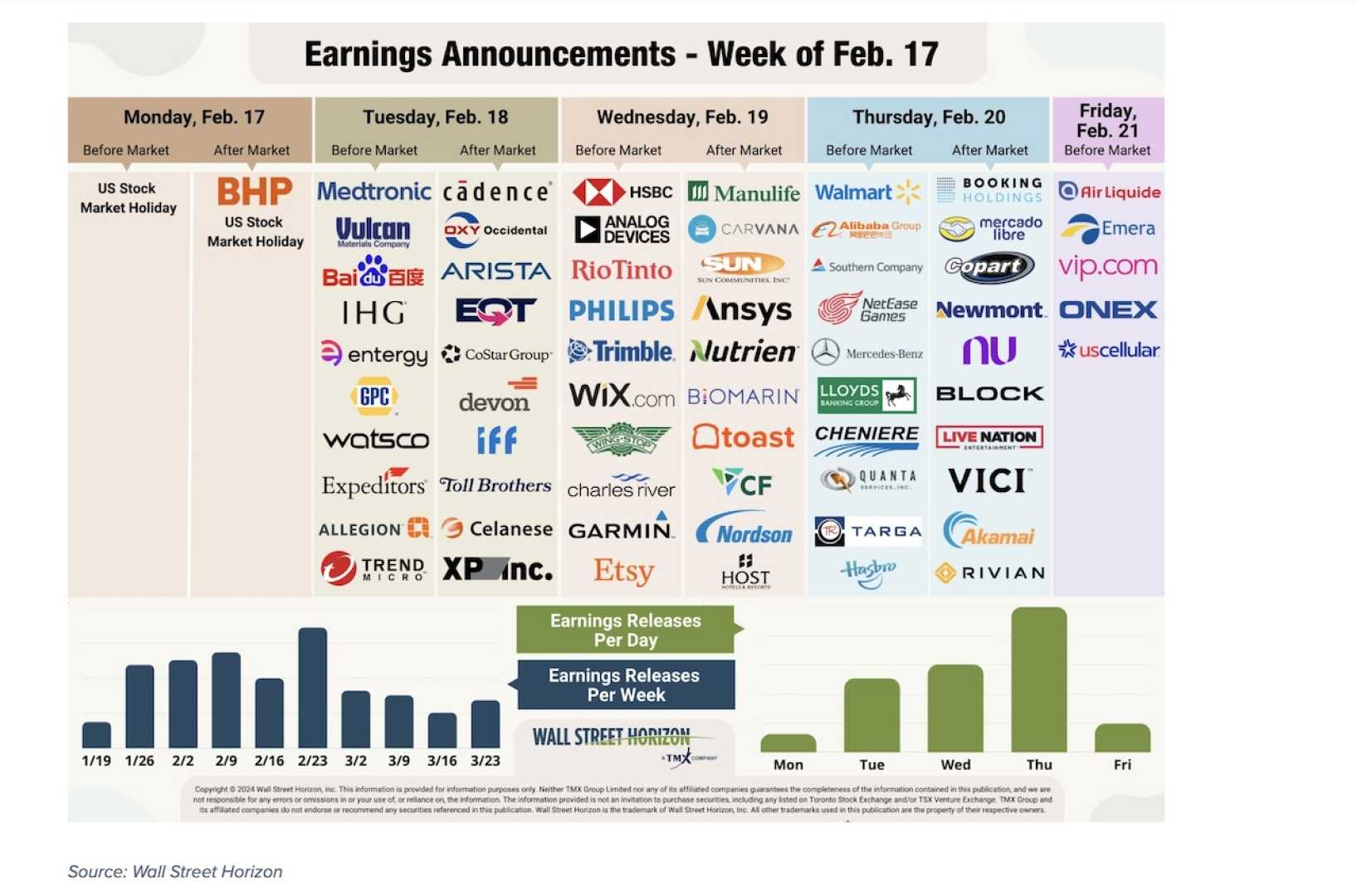

NEW YORK, New York — Payment company Block (XYZ) is poised to announce its fourth-quarter earnings on February 20, after market close, as analysts project a significant increase in performance metrics.

The anticipated earnings per share (EPS) of $0.88 and revenue of $6.29 billion signal year-over-year growth rates of 95.6% and 9%, respectively, according to data from TipRanks. Analysts believe the faster EPS growth relative to revenue growth reflects strong operating leverage, a critical indicator for investors.

However, Block has faced challenges in surpassing earnings estimates in previous quarters, successfully beating predictions only twice in the last four quarters. Despite this history, TD Cowen has taken a favorable stance on Block, revising its price target from $95 to $115 per share. The firm projects that prevailing strong economic indicators will support the company’s performance in 2025 and predicts a stable guidance outline for the upcoming fiscal year.

“We believe that the estimates for the fourth quarter are reasonable, and we do not anticipate unexpected changes in Block’s Fiscal Year 2025 guidance,” said a TD Cowen analyst.

Additionally, the Options tool available on TipRanks indicates that traders anticipate a potential 13.9% price movement, either upward or downward, following the earnings announcement. This illustrates an expectation of heightened volatility immediately after the report is released.

In the broader analyst landscape, Block has garnered a Strong Buy consensus rating, with a total of 18 Buy ratings, three Holds, and one Sell rating assigned over the past three months. The average price target of $106.48 suggests a notable 26.8% upside potential compared to current trading levels.

Investors will be closely monitoring Block’s performance as the earnings date approaches, with a keen eye on guidance for 2025 and its potential to navigate the market’s challenges.