Business

CATL Aims for $4 Billion in Upcoming Hong Kong IPO

HONG KONG — Chinese EV battery manufacturer Contemporary Amperex Technology Co., Limited (CATL) plans to raise $4 billion in its initial public offering (IPO) scheduled for May 20. This IPO is expected to be the largest in Hong Kong for 2025.

Citing a filing to the Hong Kong bourse on Monday, CATL will offer approximately 117.9 million shares at a price of up to HK$263 per share (about $33.80). This could yield total proceeds of around HK$31.01 billion.

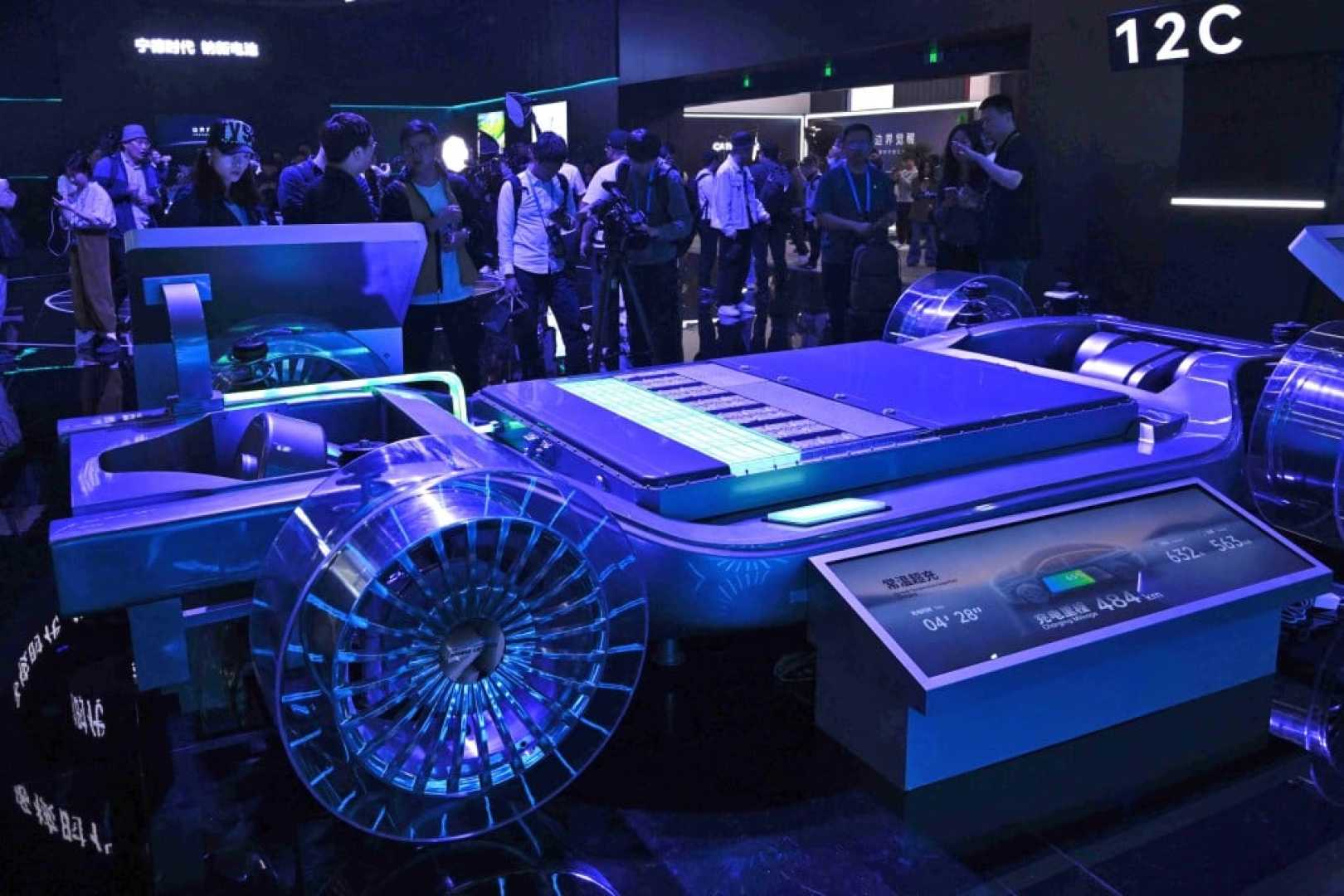

CATL is a global leader in the electric vehicle battery market, producing over a third of all EV batteries sold worldwide. The company partners with major automotive brands such as Tesla, Mercedes-Benz, BMW, and Volkswagen. CATL is already listed in Shenzhen, and this secondary listing in Hong Kong follows plans announced in a December filing.

Cornerstone investors, including Sinopec and the Kuwait Investment Authority, have already agreed to purchase shares worth HK$2.62 billion as part of the IPO.

CATL was founded in 2011 in Ningde, China, and initially gained success from robust growth in the domestic market. However, the EV market in China has recently begun to show signs of a slowdown, resulting in fierce competition among manufacturers.

Despite market pressures, CATL continues to report strong financial performance, with a 32.9% increase in net profit in the first quarter of this year. The proceeds from the IPO are expected to support CATL’s expansion efforts, particularly in Europe, where the company is building a second factory in Hungary after opening its first in Germany in January 2023.

In a move to further expand its manufacturing capabilities, CATL announced plans for a collaborative $4.3 billion factory with automotive giant Stellantis in Spain, with production scheduled to commence by the end of 2026.

The upcoming IPO is anticipated to revitalize Hong Kong as a competitive listing venue amidst a decline in new stock offerings since 2020.