Business

Celsius Holdings’ Shares Surge Ahead of Earnings Report and Conference

FORT LAUDERDALE, Fla. — Shares of Celsius Holdings Inc. rose approximately 5% on Wednesday morning ahead of the company’s upcoming earnings report and a scheduled presentation at a prominent conference. This increase comes as analysts continue to express confidence in the company’s future despite a challenging year.

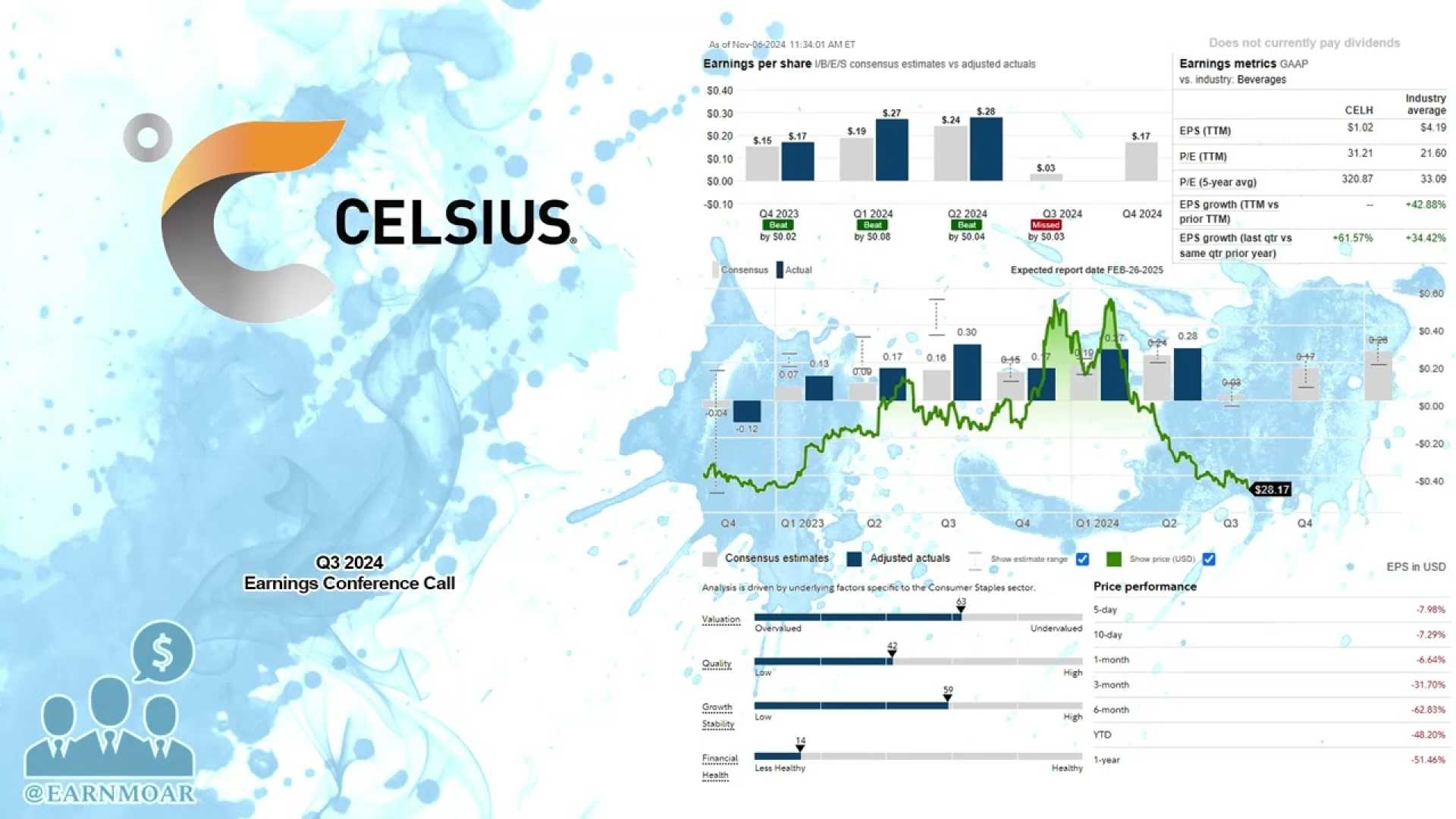

While no specific financial announcement triggered the premarket surge, the momentum aligns with analysts’ bullish outlook on the stock. Despite a significant 65% decline over the past year, brokers tracked by Visible Alpha maintain a favorable view. Currently, eight analysts recommend buying the stock, while four suggest holding it, with an average price target of $38.91—over 70% higher than Celsius’ closing price of $22.86 on Tuesday.

In a statement released after market hours on Tuesday, Celsius Holdings confirmed it will disclose its fourth-quarter earnings on Thursday afternoon. Additionally, three executives will present at the Consumer Analyst Group of New York conference on Friday morning, providing further insights into the company’s strategies and performance.

Analysts project that Celsius will report sales of $325.5 million for the fourth quarter, along with earnings of $0.15 per share, according to estimates compiled by Visible Alpha. The anticipated results are particularly notable as the company works to regain footing after experiencing a prolonged downturn.

Celsius shares, valued near their lowest point since July 2022, reflect investor caution, but analysts suggest that positive guidance could restore some confidence in the brand. “We believe there is significant upside potential for Celsius as the brand continues to capture market share in the growing energy sector,” said Rob Dominguez, senior analyst at Visible Alpha.

As the market anticipates the earnings release and executive presentations, the energy drink manufacturer is under scrutiny to deliver results that could influence both investor sentiment and stock performance in the coming months.