Business

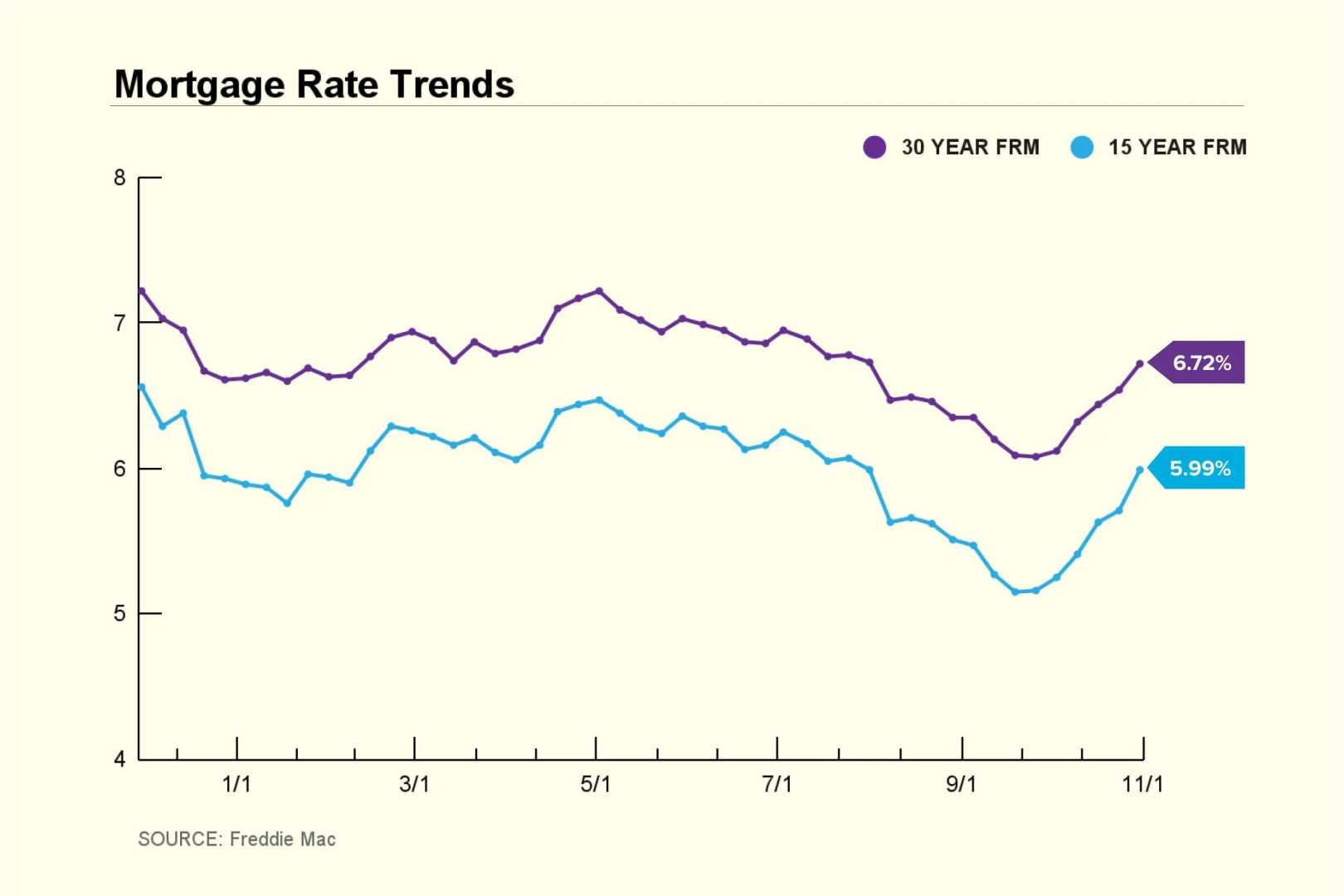

Current Mortgage Rates Continue to Rise Toward 7% as of November 6, 2024

As of November 6, 2024, mortgage rates in the United States have continued their upward trend, approaching the 7% mark. According to data from mortgage technology and data company Optimal Blue, the average interest rate for a 30-year fixed conforming mortgage loan has risen to 6.790%, up from 6.775% in the previous reporting period.

For other types of mortgages, the rates are also on the rise. The average rate for a 30-year jumbo mortgage has increased to 7.099%, up from 6.905% the previous day. The 30-year FHA mortgage rate is now at 6.447%, an increase from 6.415%. The 30-year VA mortgage rate stands at 6.351%, up from 6.301%, and the 30-year USDA mortgage rate is at 6.429%, down slightly from 6.522%.

Bankrate‘s latest data also reflects these increases. The national average 30-year fixed mortgage interest rate is 6.90%, rising 4 basis points over the last week. The 15-year fixed mortgage rate has seen a slight decrease to 6.16%, while the 5/1 adjustable-rate mortgage (ARM) has increased to 6.32%. Jumbo loans have also seen an increase, with the average rate now at 6.87%.

The rise in mortgage rates is attributed to various economic factors, including the Federal Reserve’s recent actions and the overall strength of the economy. Despite a half-point cut in the federal funds rate by the Fed in September, mortgage rates have generally been increasing due to the interconnected set of factors influencing them.

Homebuyers are advised to compare offers carefully, as rates can vary significantly between lenders. Additionally, the option of a mortgage rate lock is available to secure a rate for a specified period, although this comes with its own set of considerations and potential costs.