Business

Dell Technologies Earnings Anticipated Amid AI Demand Surge

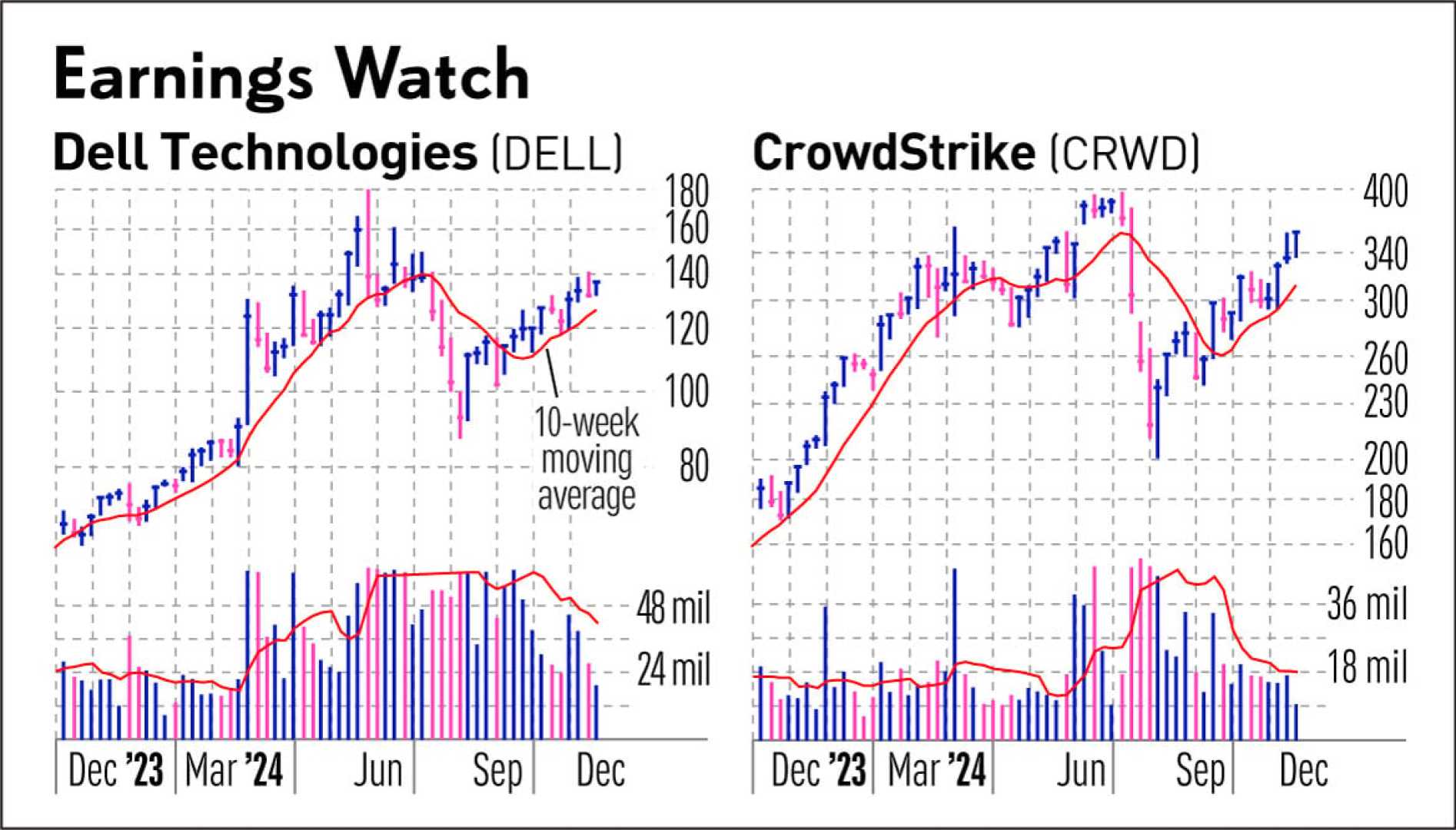

ROUND ROCK, Texas — Dell Technologies Inc. is set to release its fourth-quarter Fiscal 2025 results on February 27, following a year marked by significant growth driven by demand for its artificial intelligence servers. Investors are particularly keen to hear management’s insights on future growth prospects in the AI sector.

Analysts predict that Dell will report earnings of $2.52 per share, up from $2.20 per share in the same quarter last year. Revenue for the quarter is expected to increase by approximately 10% to $24.57 billion from $22.32 billion a year earlier, reflecting optimism surrounding AI technologies.

“Dell is uniquely positioned to capitalize on the increasing demand for AI-based solutions,” said Bank of America analyst Wamsi Mohan, who maintains a Buy rating on the stock. Mohan has adjusted his price target from $155 to $150, citing challenges in AI server revenue expectations but remaining optimistic about the company’s long-term growth potential, especially as the AI server backlog strengthens.

Investors are particularly interested in management’s commentary regarding the demand for AI servers and the timing of a potential PC refresh cycle. During a previous earnings report, Dell reported disappointing third-quarter results, which demonstrated the importance of guidance in maintaining investor confidence.

Despite some analysts lowering price targets, the general sentiment remains largely positive. Evercore analyst Amit Daryanani also reiterated a Buy rating, albeit reducing his target from $150 to $145, emphasizing potential for earnings per share to exceed $10 in Fiscal 2026. Daryanani anticipates a more tempered start to the year, aligning with historical industry trends.

The consensus rating for Dell’s stock is currently classified as a Strong Buy, with 14 analysts rating it as such and only two holds. The average stock price target of $146.24 suggests a 32% upside potential, which exudes confidence among traders ahead of the earnings announcement.

Using the TipRanks Options tool, analysts can gauge potential market movements post-earnings. Current indicators reflect a projected price range of movement in either direction after the earnings report is released—signifying the market’s expectation of volatility tied to Dell’s announcements.

As the earnings date approaches, the tech sector faces increased scrutiny amidst potential market fluctuations tied to other major tech earnings, particularly Nvidia’s performance amid AI market dynamics. The challenges faced by major players in the tech industry can significantly influence stock movements, making Dell’s performance on February 27 crucial for investor sentiment.

Market analysts will be closely watching the reaction to Dell’s earnings given the importance of AI in shaping future revenue prospects. Any significant deviation from expectations could unsettle traders and impact the broader tech sector, which is already navigating a period marked by volatility.