Business

Dividend Growth Stocks Outperform Market Over 50 Years, Study Shows

NEW YORK, NY – A recent study by Hartford Funds and Ned Davis Research reveals that dividend growth stocks have significantly outperformed non-dividend payers over the past 50 years. An investment of $100 in average dividend stocks in 1973 would have grown to over $8,700 by the end of 2023, compared to less than $850 for non-dividend payers.

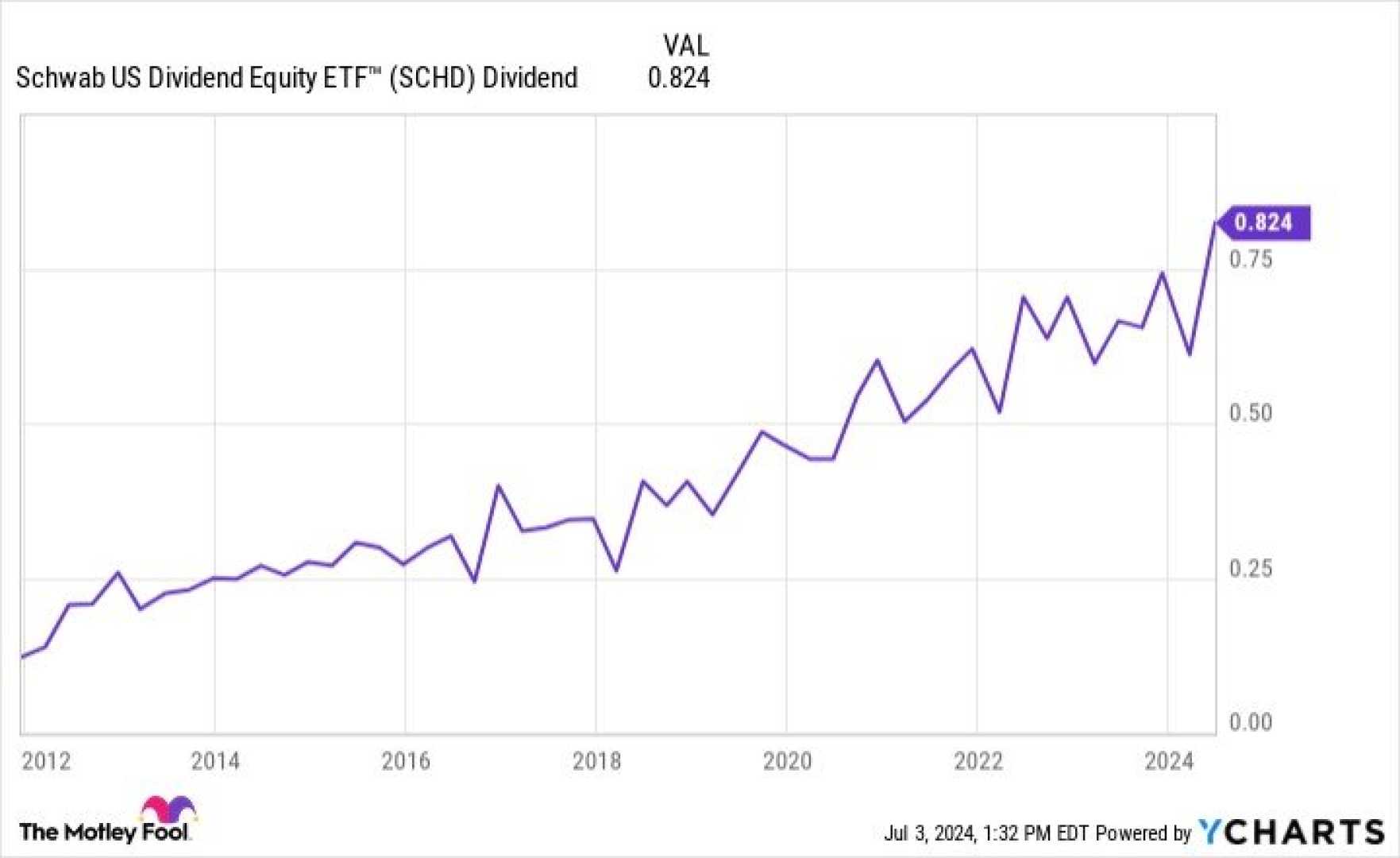

The Schwab U.S. Dividend Equity ETF (SCHD), which tracks the Dow Jones U.S. Dividend 100 Index, has become a popular vehicle for investors seeking exposure to high-quality dividend growth stocks. The ETF, which holds shares of 100 companies known for consistent dividend payments and strong financials, has delivered a 12.9% annualized total return since its inception in October 2011.

Pfizer (PFE), the ETF’s top holding, has paid dividends for 345 consecutive quarters and currently yields over 6.5%. Coca-Cola (KO), another notable holding, has increased its dividend for 62 consecutive years and offers a yield of 3.1%. The ETF itself provides a dividend yield of 3.6%, based on distributions over the past 12 months.

“The historical outperformance of dividend stocks, especially those that regularly increase their payouts, makes them a no-brainer pick for long-term investors,” said David Ksir, a private equity expert and contributor to Seeking Alpha. Ksir manages a family office focused on generating reliable dividend income through value investing.

The study also found that companies that consistently increased their dividends generated even higher returns, with a $100 investment in 1973 growing to over $14,100 by 2023. This performance significantly outpaced the S&P 500’s average dividend yield of 1.2%.

For investors seeking to maximize returns, experts recommend reinvesting dividends to accelerate income stream growth. The Schwab U.S. Dividend Equity ETF’s focus on dividend growth stocks positions it to potentially deliver above-average total returns over the long term, making it an attractive option for those with cash to invest.