Business

Energy Transfer Faces Crucial Decisions Amid Market Volatility

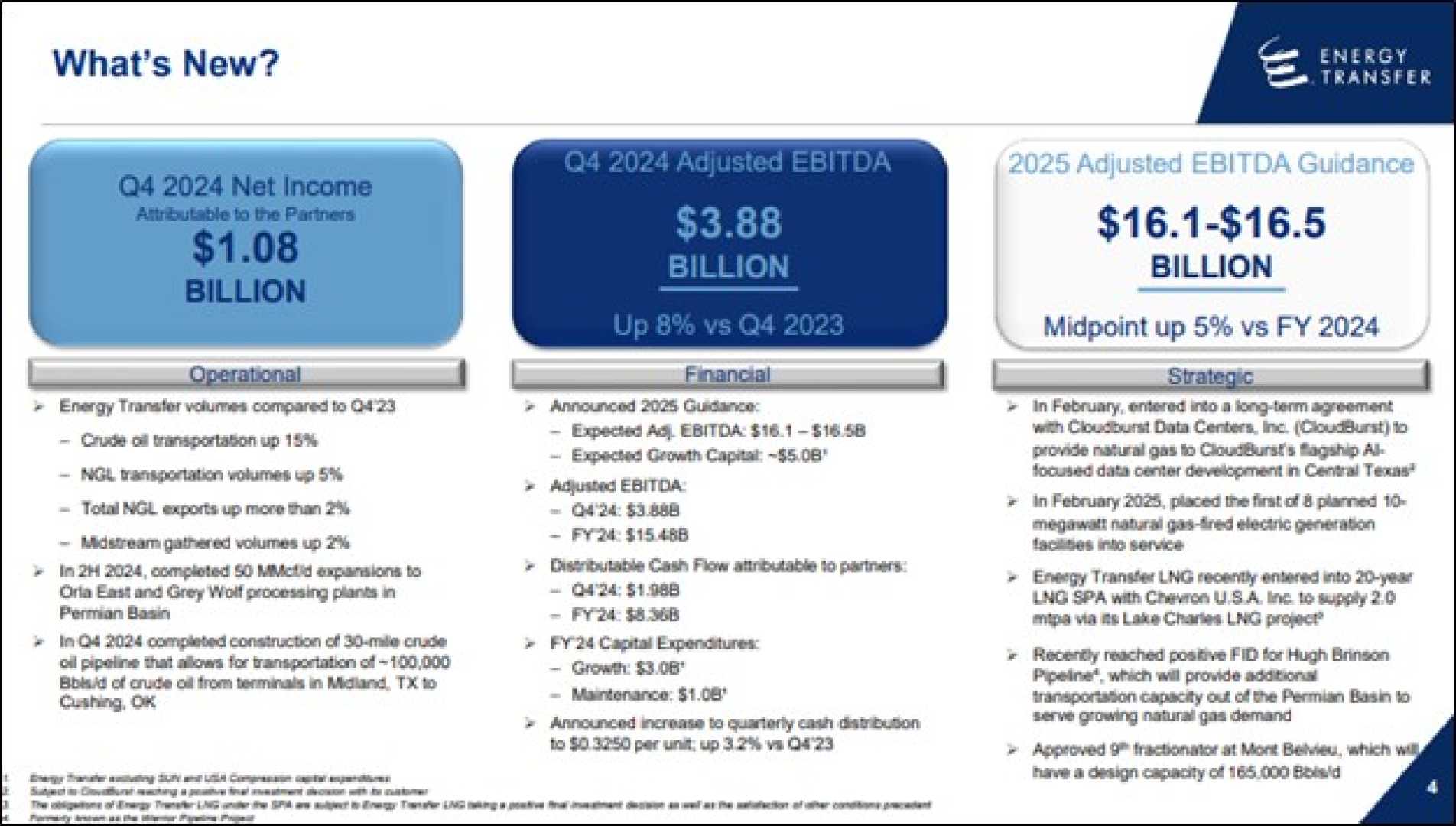

NEW YORK, NY — Energy Transfer, a major player in the midstream energy sector, has seen its stock drop 11.45% to $15.70, marking a notable change amid fluctuating market conditions. With a market capitalization of $61 billion, the company is navigating a complex landscape that offers both opportunities and risks for income-focused investors.

The primary attraction for investors is Energy Transfer’s robust dividend yield of approximately 6.8%, which is underpinned by rising cash distributions. However, the company’s past dividend cuts raise concerns for those considering adding it to their portfolio.

Energy Transfer operates a comprehensive network of pipelines and facilities that primarily serve to transport oil and natural gas. Unlike many peers in the industry, its operations are fee-driven, meaning the volume of oil and gas transported is more critical than the market prices of those commodities.

In addition to its core pipeline operations, Energy Transfer serves as the general partner for other publicly traded master limited partnerships (MLPs) and holds interests in partners such as Sunoco LP and USA Compression Partners. Recent expansions into liquefied natural gas (LNG) also diversify its asset base, although this complexity might deter some investors who prefer simpler business models.

“If you value stability and reliability in dividend stocks, Energy Transfer’s track record may give you pause,” noted an analyst with The Motley Fool. Historically, the firm cut its dividend in half during the pandemic’s oil price collapse, a move that still lingers in investor memory, contrasting sharply with peers like Enterprise Products Partners, which increased its distribution during the same period.

The price per barrel of West Texas Intermediate Crude, a vital regional benchmark, plunged below zero in April 2020, forcing many in the industry, including Energy Transfer, to make painful but necessary cutbacks to ensure liquidity. This past has left some investors wary, particularly in light of demographic shifts and increasingly stringent regulations in energy markets.

Energy Transfer attempted to avert deeper financial trouble by proposing to acquire Williams Companies back in 2016, a deal that faced substantial opposition. Concerns about the potential for higher debt loads and possible impact on dividends fueled skepticism among investors at the time.”

“These historical precedents raise questions about shareholder priorities,” the analyst added. Concerns about governance at Energy Transfer may overshadow its otherwise solid growth prospects, particularly in relation to the Permian Basin, where demand for midstream services is on the rise.

Currently, Energy Transfer is undertaking multiple projects to bolster its infrastructure and support future growth, including expansions of existing processing plants and new pipeline constructions. It aims to capitalize on sustained increases in natural gas and natural gas liquids (NGL) demand amidst burgeoning sectors such as AI data centers and onshore manufacturing.

The company maintains an extensive gas pipeline network already serving 185 power plants and has received numerous requests to connect gas to additional facilities including new power stations and data centers in multiple states.

Despite the these growth opportunities, analysts caution that the history of dividend reductions and governance concerns should lead investors to approach Energy Transfer with caution. “It’s essential to have a clear understanding of what you are buying into,” the analyst concludes.

While the dividend yield remains enticing, some financial advisors argue it might be safer to consider alternatives like Enterprise Products Partners, which offers a more straightforward investment profile.”