Business

Energy Transfer Plans Major Expansion Amid Cash Distribution Success

DALLAS, Texas — Energy Transfer, a leading midstream master limited partnership (MLP), reported strong growth expectations during its recent conference call. With a market cap of $62 billion, shares currently trade at $18.07, reflecting a slight decline of 0.67%.

The company is distinguished by its lucrative cash distribution, which stands at around 7.3%, significantly higher than the S&P 500’s average dividend yield. Co-CEO Tom Long expressed confidence in the company’s future growth, indicating plans for a $5 billion investment into organic growth capital projects this year.

Long highlighted the expected returns on these projects, saying, “Our projects are anticipated to achieve mid-teen returns, with several offering downstream benefits.” Most projects are targeted to go online by 2025 or 2026, including the Flexport NGL export expansion and new processing plants in the Permian Basin.

Energy Transfer has seen 5% earnings growth this year, with projections that forthcoming projects will substantially enhance this rate in 2026 and 2027. The backlog of projects currently under construction is set to enter commercial service by the end of next year.

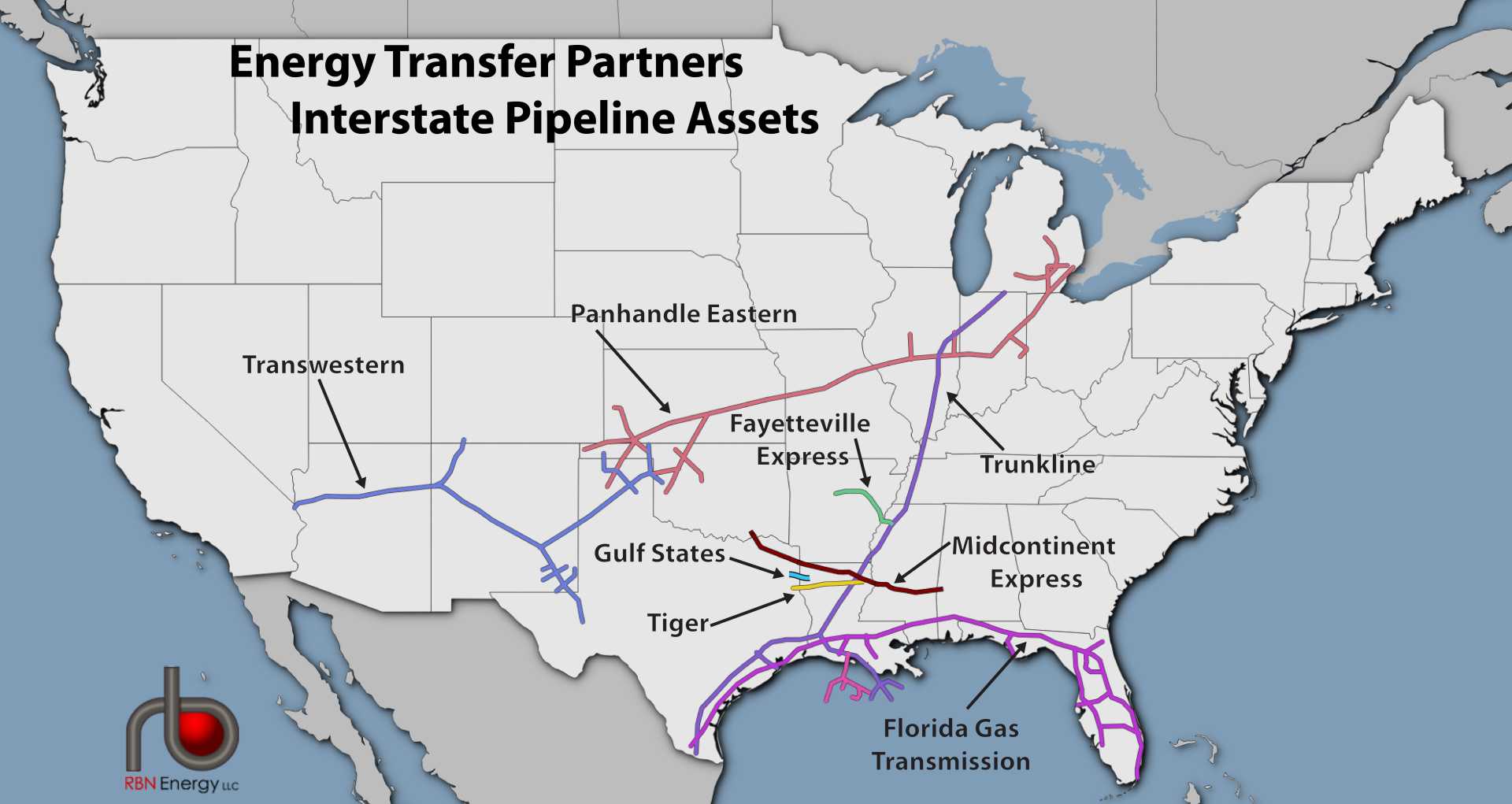

Long also discussed the company’s pipeline expansion efforts, particularly Phase 2 of the Hugh Brinson Pipeline. “Demand is currently outstripping our available capacity,” he noted, which underscores the potential for further growth.

Additionally, Energy Transfer is making progress on its long-awaited Lake Charles LNG project, where they recently enacted a deal with MidOcean to fund 30% of construction costs in exchange for an equivalent share of production. The project has secured LNG sales contracts with a Japanese utility and a German energy firm.

Long stated that discussions for the remaining uncommitted LNG offtake volume are ongoing, aiming for a final investment decision by year-end. He described Lake Charles LNG as a potential significant driver for future growth.

Energy Transfer continues to work on various natural gas supply projects, intending to meet robust demand amid increasing interest from power generation facilities. Long emphasizes that these initiatives are expected to require low capital and deliver quick revenue while solidifying the company’s growth outlook for years to come.