Business

EZCORP Survives Market Turbulence While Krispy Kreme Falls Behind

Chicago, IL – April 8, 2025 – Zacks Equity Research has named EZCORP (ticker: EZPW) as the Bull of the Day, highlighting its resilience amid recent market volatility. Conversely, Krispy Kreme (ticker: DNUT) has been designated the Bear of the Day, with significant shortcomings reported in its stock performance.

Following a week of extreme market fluctuations stemming from drastic tariff policy changes, investors have sought refuge in stocks showcasing robust fundamentals. EZCORP, the second largest operator of pawn shops in the U.S. with approximately 1,100 locations, has posted strong sales and earnings growth, compounding at an annual rate of 27% since 2020. According to Zacks, EZCORP offers a reasonable valuation alongside steady growth forecasts.

“EZCORP has demonstrated persistent relative strength during these turbulent market conditions,” said a representative from Zacks. “This resilience is reflected in its earnings momentum, with EPS growing from $0.38 per share in 2021 to $1.21 per share in the trailing twelve months.”

Analysts have increased profit estimates for EZCORP, with current quarter predictions rising by 10% over the last two months and yearly estimates climbing by approximately 5%. For the upcoming year, sales are projected to rise by 8.5% and earnings by 11.1%, affirming the stock’s positive trajectory.

From a technical standpoint, EZCORP’s share price has shown significant upward momentum recently. The stock is currently trading within the range of $15.10 to $15.80, forming a bullish pattern indicative of a possible breakout. “If the stock can close above the upper limit, it may advance even further,” added the Zacks source.

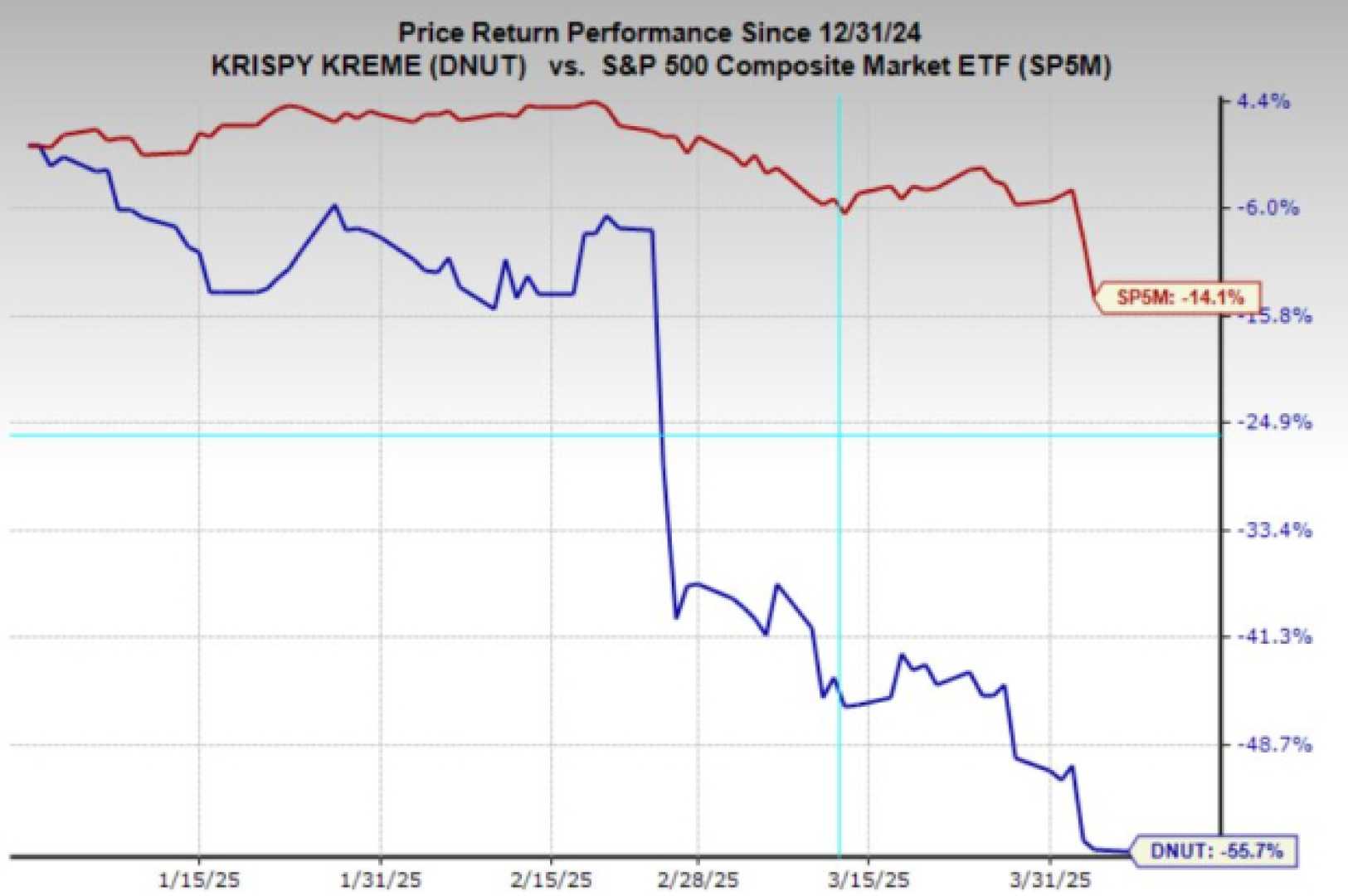

Conversely, Krispy Kreme has struggled dramatically on the stock market, declining 56% year-to-date and 79% over the last five years. Analysts have sharply lowered their earnings estimates, with the current quarter forecasts flipping negative and 2025 estimates plummeting by 86%.

<p“Krispy Kreme currently holds a Zacks Rank #5 (Strong Sell), reflecting the ongoing downward trend,” said Zacks analysts. “While the brand remains beloved, the fundamentals do not support investment in the stock.”

Challenges for Krispy Kreme include rising operational costs and flat revenue growth over the past year. The company faces significant margin compression and inefficiencies within its operational structure, further complicating its investment appeal.

According to Zacks, “Investors should be cautious regarding DNUT at this time. Until the earnings picture stabilizes and the stock shows signs of recovery, it is better to avoid this name,” highlighting the stark contrast with the performance of EZCORP.

In other news within the equity markets, Uber Technologies has announced a partnership with China’s WeRide to integrate self-driving technology into its rideshare platform in Dubai, aiming to support the city’s goal of making a quarter of all trips autonomous by 2030. While Uber has navigated recent market instability well, recording a 7.2% gain this year, its competitor Lyft continues to underperform.

As economic uncertainties loom, investors are urged to conduct thorough evaluations and consider defensive plays such as EZCORP while avoiding stocks like Krispy Kreme that currently lack positive growth trajectories.