Business

Ford’s Earnings Report Set to Show Decline Ahead of Market Close

DETROIT, Mich. — Ford Motor Company is anticipated to release its earnings report on May 5, 2025, after the market closes, amid expectations of significant declines in its financial performance.

The Zacks Consensus Estimate predicts the company’s earnings per share (EPS) for the upcoming quarter will break even, with automotive revenues projected at $35.5 billion. This represents an 11% decline compared to the same quarter last year when Ford reported EPS of 49 cents.

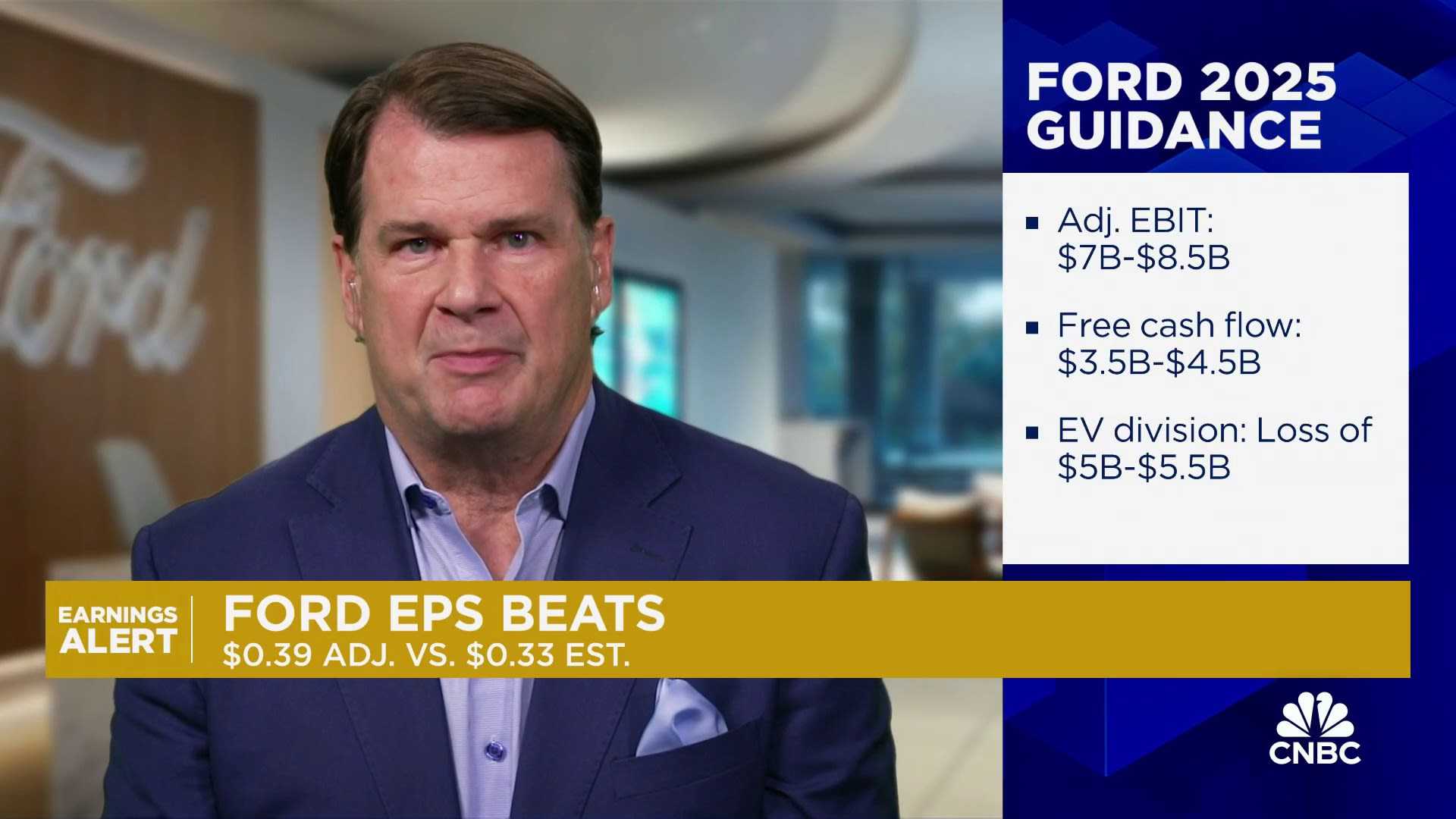

In the last week, the EPS estimate has seen a slight increase of 2 cents. However, analysts believe Ford’s upcoming quarterly revenues will reflect its ongoing challenges. For the entirety of 2025, the consensus estimate for Ford’s automotive revenues stands at $162.3 billion, indicating a year-over-year decline of 6%.

Ford’s recent sales figures show a 1.3% decline in unit sales, totaling 501,291 vehicles for the upcoming reporting period, attributed largely to the timing of rental fleet sales and the discontinuation of models like the Ford Edge and Transit Connect. In contrast, sales of electrified vehicles, which include EVs and hybrids, rose by 25.5% to 73,623 units.

While Ford faces stiff competition from companies such as Tesla and General Motors, which saw a 17% increase in sales year over year, analysts remain cautious about Ford’s future performance. Their expectations suggest the impact of a shift in product mix, along with given tariffs, remains a significant risk for profit margins.

Ford’s expectations for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) stand at break-even, significantly down from $2.7 billion in the first quarter of 2024. This drop stems from reduced volumes, a 20% production cut, and ongoing challenges with new plant launches.

Despite the negative outlook, Ford’s liquidity position remains robust, with $28 billion in cash and an overall liquidity of around $47 billion at the end of 2024. The company also maintains a high dividend yield, targeting a payout ratio of 40-50% of free cash flow, appealing to income-focused investors.

As investors await Ford’s performance results, the company asks for patience, emphasizing the need for clarity about its operational targets and strategies for overcoming challenges in an evolving automotive market.