Business

Intel Corporation Faces Challenges Amidst Security Concerns and Weak PC Demand

Intel Corporation (INTC) is currently navigating through several challenges that have impacted its stock performance and operational stability. On October 31, 2024, Intel’s China unit responded to accusations from a Chinese cybersecurity association, which alleged that Intel’s CPU chips contain vulnerabilities and security risks, potentially threatening national security and consumer interests.

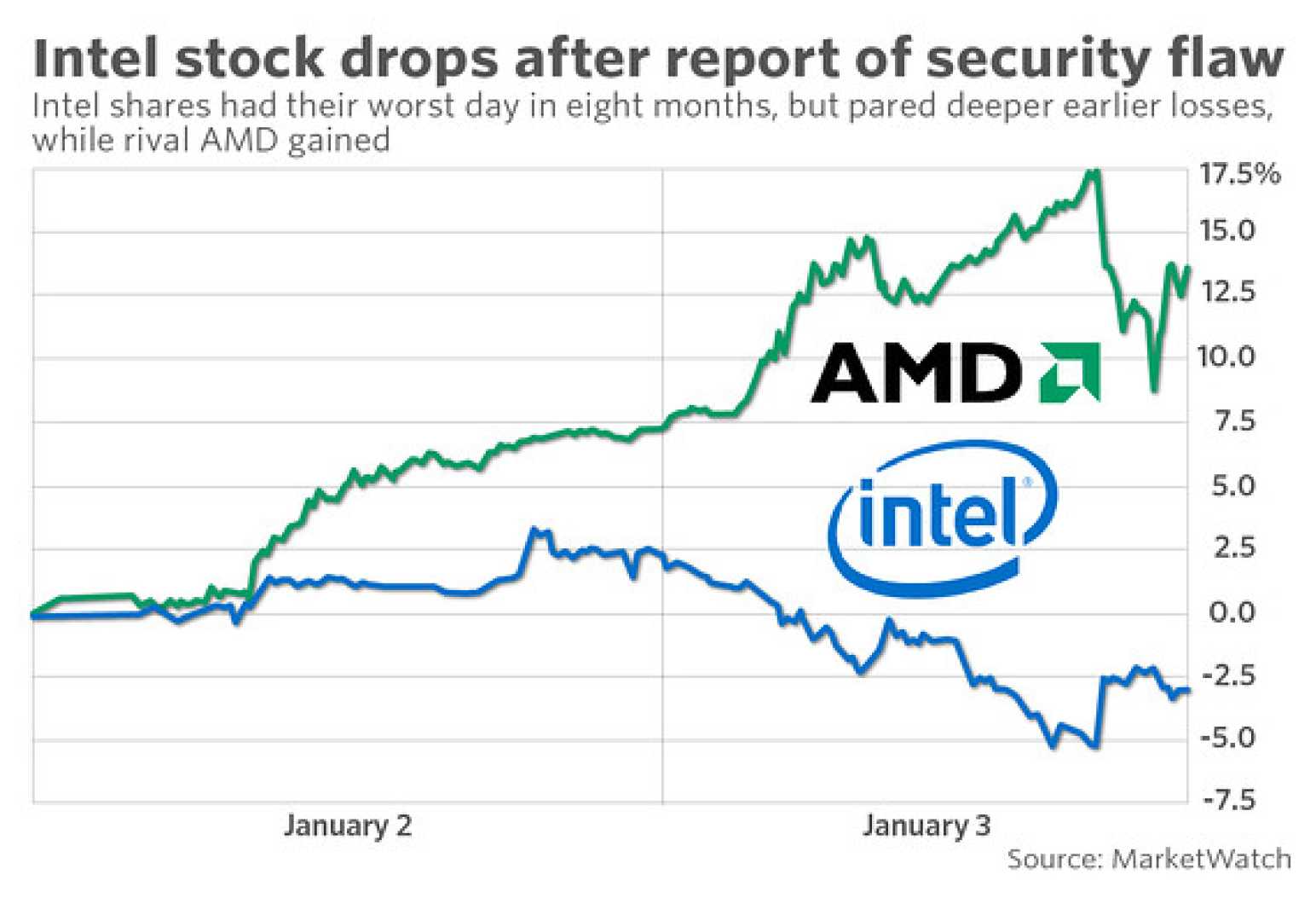

The company has reiterated its commitment to product safety and quality, but these allegations have contributed to a decline in Intel’s stock price. Intel shares fell on Wednesday following the report, adding to the company’s existing struggles in the Chinese market.

In addition to the security concerns, Intel is also facing headwinds in the global PC market. According to recent reports, worldwide shipments of traditional PCs dipped 2.4% year-over-year in the third quarter of 2024, which is not favorable for Intel and other chipmakers like AMD.

Financially, Intel is expected to report earnings on October 31, 2024, with analysts predicting a significant decline in earnings per share and revenue compared to the previous year. The forecast includes a 105% year-over-year decrease in earnings per share and an 8.1% decrease in revenue.

The company’s financial performance in 2023 was also weak, with revenue decreasing by 14% and earnings dropping by 78.92% compared to the previous year. These financial metrics have led analysts to assign a general “Hold” rating to Intel stock, with some even suggesting a “Sell” rating due to the high price-to-earnings ratio and other factors.