Business

U.S. Jobless Claims Increase Amid Sluggish Hiring and Productivity Slowdown

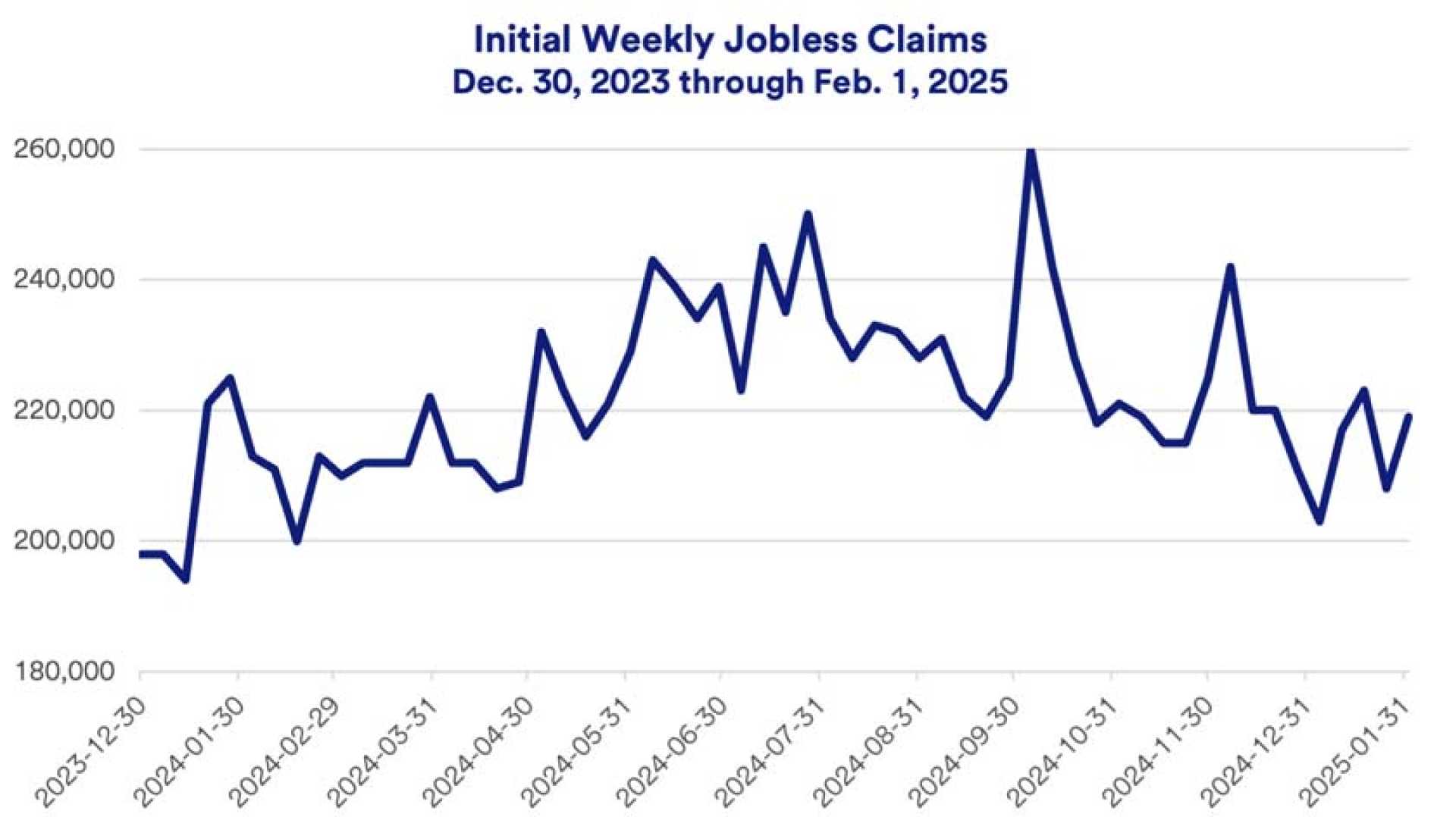

WASHINGTON, Feb. 6 (Reuters) – The number of Americans seeking unemployment benefits rose moderately last week, reflecting continuing shifts in an easing labor market. The Labor Department reported an increase of 11,000 initial claims, bringing the total seasonally adjusted applications to 219,000 for the week ending February 1.

Economists were predicting a lesser increase, forecasting 213,000 claims. Carl Weinberg, chief economist at High Frequency Economics, reassured that the rise is not cause for concern, stating, “There is nothing to worry about here.”n

The unadjusted claims also saw an increase, climbing by 11,370 to 239,690. Notably, applications surged in New York, up by 4,092, while California’s claims rose by 3,999, possibly due to lingering effects from recent wildfires in Los Angeles. In contrast, New Jersey reported a decrease of 1,343 claims.

Despite the steady increase in claims, low layoff rates continue to underpin a resilient labor market. However, job opportunities for the unemployed are diminishing. In December, there were only 1.1 job openings for every unemployed person, a decline from 1.15 in November.

The report also indicated that the number of people receiving benefits after their initial week of aid rose by 36,000 to a seasonally adjusted 1.886 million for the week ending January 25. Business hiring plans are currently subdued, with a report from Challenger, Gray & Christmas revealing that U.S. employers announced only 6,089 hiring plans in January, a 24% drop from December and the lowest January figure on record.

These claims data do not directly impact January’s employment report, which is expected to show a net increase of 170,000 nonfarm jobs. The unemployment rate is anticipated to hold steady at 4.1%. The labor market’s resilience has allowed the Federal Reserve to pause interest rate cuts as it weighs various economic factors, including the fiscal and trade policies of President Biden‘s administration, which many economists perceive as inflationary.

The Federal Reserve’s benchmark interest rate remains unchanged in the 4.25%-4.50% range, following significant cuts totaling 100 basis points since last September. Economists project the reduction in job growth may be a response to the upward shift in labor costs, which surged at a 3.0% rate in the fourth quarter, up from a 0.5% increase previously.

Labor productivity growth, a critical indicator of economic health, also slowed more than expected, increasing only 1.2% in the fourth quarter, significantly lower than the revised 2.3% growth rate from the previous quarter. This decline in productivity poses potential challenges for future job growth as firms navigate costs to maintain profitability.

Despite an upward trend in productivity since 2023, it lags behind the long-term growth rate of 2.1%, which has led economists like Ben Ayers from Nationwide to caution that increasing labor costs may weigh on job growth in 2025. Ayers noted that “the upward shift in labor costs has the potential to weigh on job growth as firms look for ways to reduce expenses and maintain profits.”