Business

Mortgage Rates Rise Amid Economic Uncertainty

New York, NY—Mortgage rates for various loans have increased compared to last week, as per Bankrate data. The average rate for a 30-year fixed loan has risen to 6.90 percent, up five basis points from the previous week. Rates for other types of mortgages, including 15-year fixed and jumbo loans, also saw similar increases.

This rise in mortgage rates is influenced by multiple economic factors and is reflective of ongoing inflation concerns. The Federal Reserve‘s recent meeting on May 7 indicated that inflation is a priority for policymakers. While the Consumer Price Index released May 13 showed inflation slowing, experts suggest this may impact future Fed interest rate cuts.

“We are one step closer to a rate cut by the Federal Reserve as consumer price inflation continues to calm down,” said Lawrence Yun, chief economist for the National Association of Realtors. Yun emphasized that controlling shelter costs through increased housing supply is essential for overall inflation management.

The current marketplace average rates are as follows: 30-year fixed mortgage at 6.90%, 15-year fixed at 6.08%, and jumbo loans at 6.92%. Each rate represents a modest rise from the previous week, indicating a continued trend of increasing borrowing costs.

As for refinancing options, the average 30-year fixed refinance rate stands at 6.89%, while the 15-year refinance rate is at 6.16%. Financial analysts emphasize the importance of shopping around for the best rates amidst this volatility.

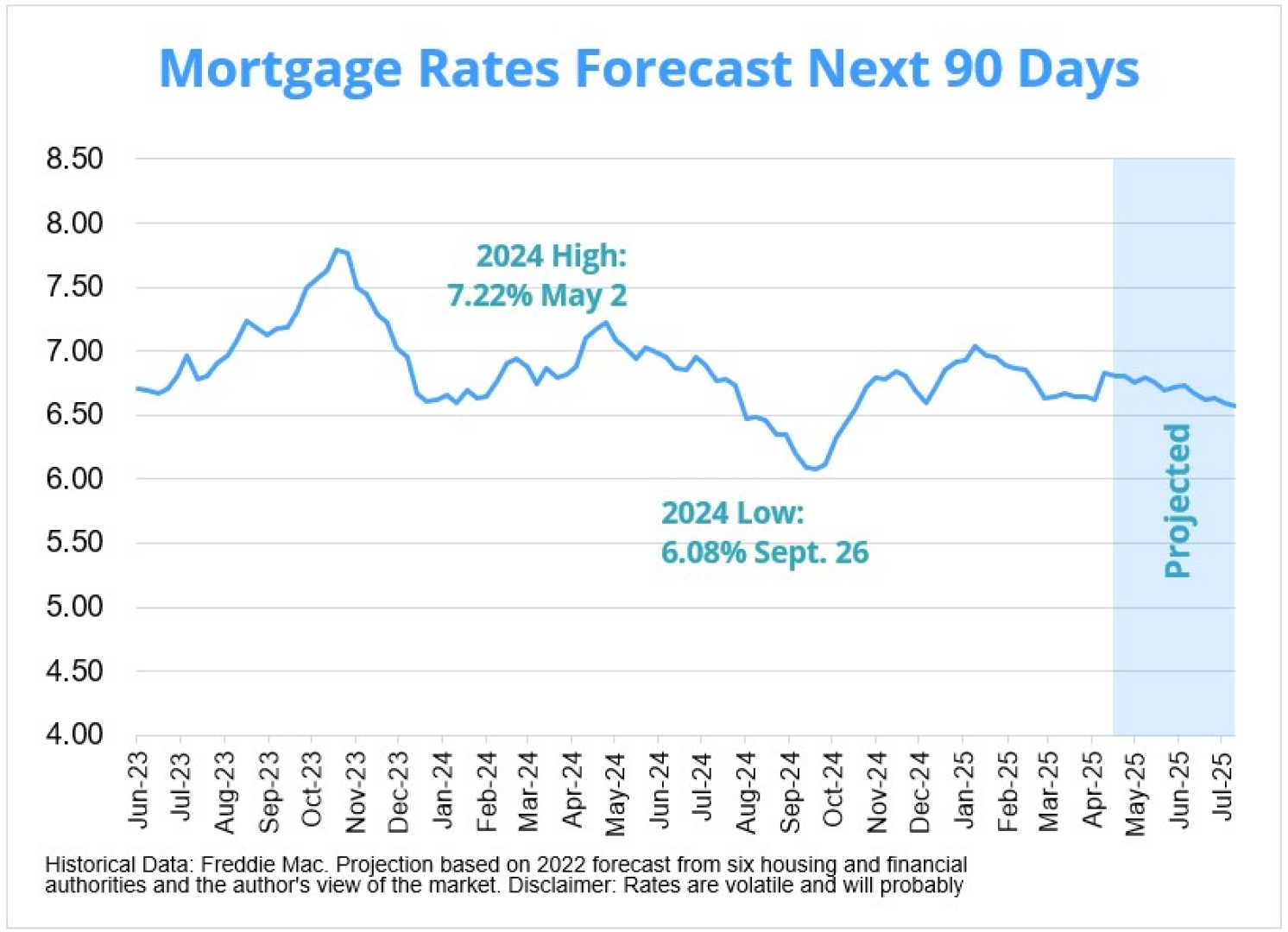

According to data from Freddie Mac, the average 30-year fixed mortgage rate was 6.81% as of May 15, climbing from 6.76% a week earlier. Experts predict that with inflation showing signs of moderation, rates may level off towards the lower end by mid-year, but uncertainty remains due to fluctuating economic conditions.

The latest figures show a significant shift in mortgage rates since they peaked last year, representing both opportunity and challenge for potential buyers. Those looking to secure favorable rates are encouraged to act swiftly, as market conditions can change rapidly.