Business

Nio’s Stock Plummets While EV Growth Prospers Amid Competition

SHANGHAI, China — Nio Inc., an electric vehicle (EV) manufacturer, is facing challenges as its stock has fallen significantly from its peak. After reaching a high of $67 per share in early 2021, Nio’s stock price is now at $3.81, reflecting a 94% drop.

Despite this decline, Nio is making strides in China’s competitive EV market, projected to grow at 16% annually by 2030. In April, Nio reported a delivery growth of 53% year-over-year, with 23,900 vehicles delivered. This included 19,269 premium smart EVs and 4,400 family-oriented Onvo models. Additionally, Nio introduced its new brand, Firefly, which focuses on affordable compact smart EVs.

Looking ahead, Citi predicts Nio could deliver 63,000 units in the second quarter, marking a potential 50% growth from the previous quarter. This indicates Nio’s ongoing efforts to meet the increasing demand for EVs.

Nio also boasts a unique battery-swap technology that addresses charging time concerns. While traditional charging can take 30 minutes to an hour, Nio’s system allows drivers to replace depleted batteries in 3 to 5 minutes. Their battery-as-a-service model reduces vehicle purchase prices, and around 3,100 battery-swap stations are currently operational in China.

However, the company faces setbacks in its European expansion, where budget cuts have affected the rollout of new battery-swap stations, currently limited to three planned projects. Nio’s operating costs are high, and profitability remains a challenge; losses rose to RMB 22.4 billion ($3.1 billion) last year.

Regulatory risks also loom as discussions about trade and tariffs continue. Last year, Europe imposed tariffs impacting Chinese companies, including Nio, stemming from competitive practices. Ongoing negotiations could potentially reshape these tariffs into minimum prices.

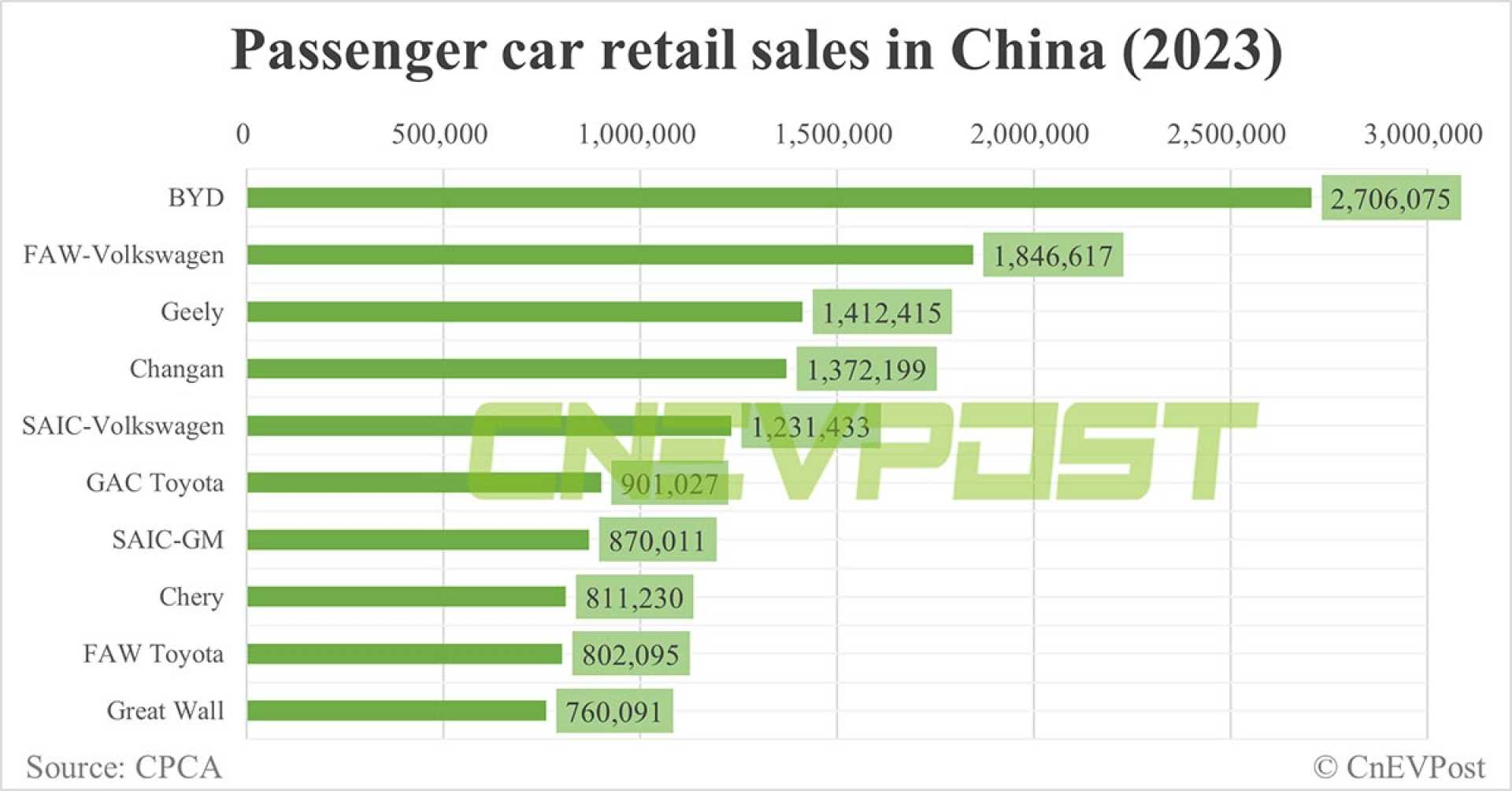

Nio’s growth highlights its potential, yet uncertainties about profitability and increased competition, particularly from rivals like BYD and Li Auto, remain significant concerns. Investors may need to approach Nio with caution, considering its market volatility.