Business

US Nonfarm Payrolls Report for October: Expectations, Impact, and Market Reactions

The highly anticipated US Nonfarm Payrolls (NFP) report for October is set to be released on Friday, November 1, 2024, at 12:30 GMT. This report, issued by the United States Bureau of Labor Statistics (BLS), is a crucial indicator of the US labor market’s health and has significant implications for the US Dollar (USD) and broader economic policies.

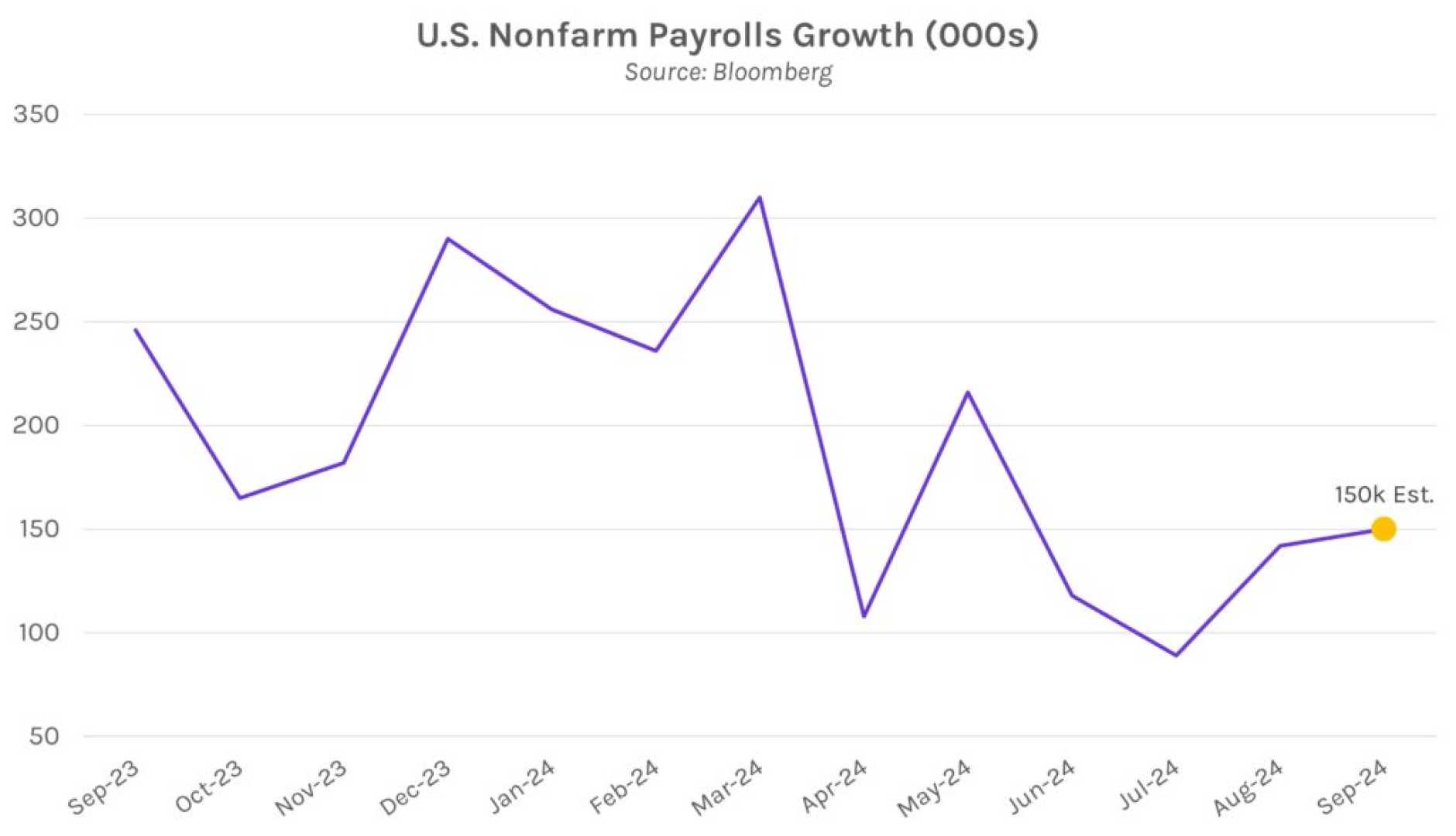

Following September’s robust job growth of 254,000, market expectations for October are more modest, with forecasts suggesting an addition of 113,000 jobs. This figure is seen as a key metric in assessing the ongoing strength of the US labor market and its potential impact on the Federal Reserve’s future interest rate decisions.

The NFP report is closely watched by investors and policymakers alike, as it influences the value of the USD against other major currencies, such as the Euro. A stronger-than-expected jobs report could lend support to the USD, potentially pressuring the EUR/USD pair below key support levels. Conversely, a disappointing report below 100,000 jobs could exacerbate USD weakness, allowing the EUR/USD to climb past 1.0900.

In addition to the headline job numbers, other components of the report, such as the unemployment rate, labor force participation rate, and average hourly earnings, will also be scrutinized. The unemployment rate fell to 4.1% in September, and any significant changes in these metrics could further influence market sentiment and economic forecasts.

The release of the NFP data coincides with a period of heightened market sensitivity, given the upcoming Federal Reserve policy meeting and the US presidential election. As a result, market participants are likely to react strongly to the NFP results, which could lead to substantial volatility in currencies, equities, and other financial markets.

The broader economic context, including mixed US economic data and steady Eurozone inflation, has set the stage for potential EUR/USD volatility ahead of the NFP report. Initial Jobless Claims dropped recently, while the Employment Cost Index showed a 0.8% rise in the third quarter, slightly below expectations. These indicators, along with the NFP data, will provide a comprehensive view of the US labor market’s trajectory.