Business

Palantir Technologies vs. IonQ: A Battle for the Future of AI

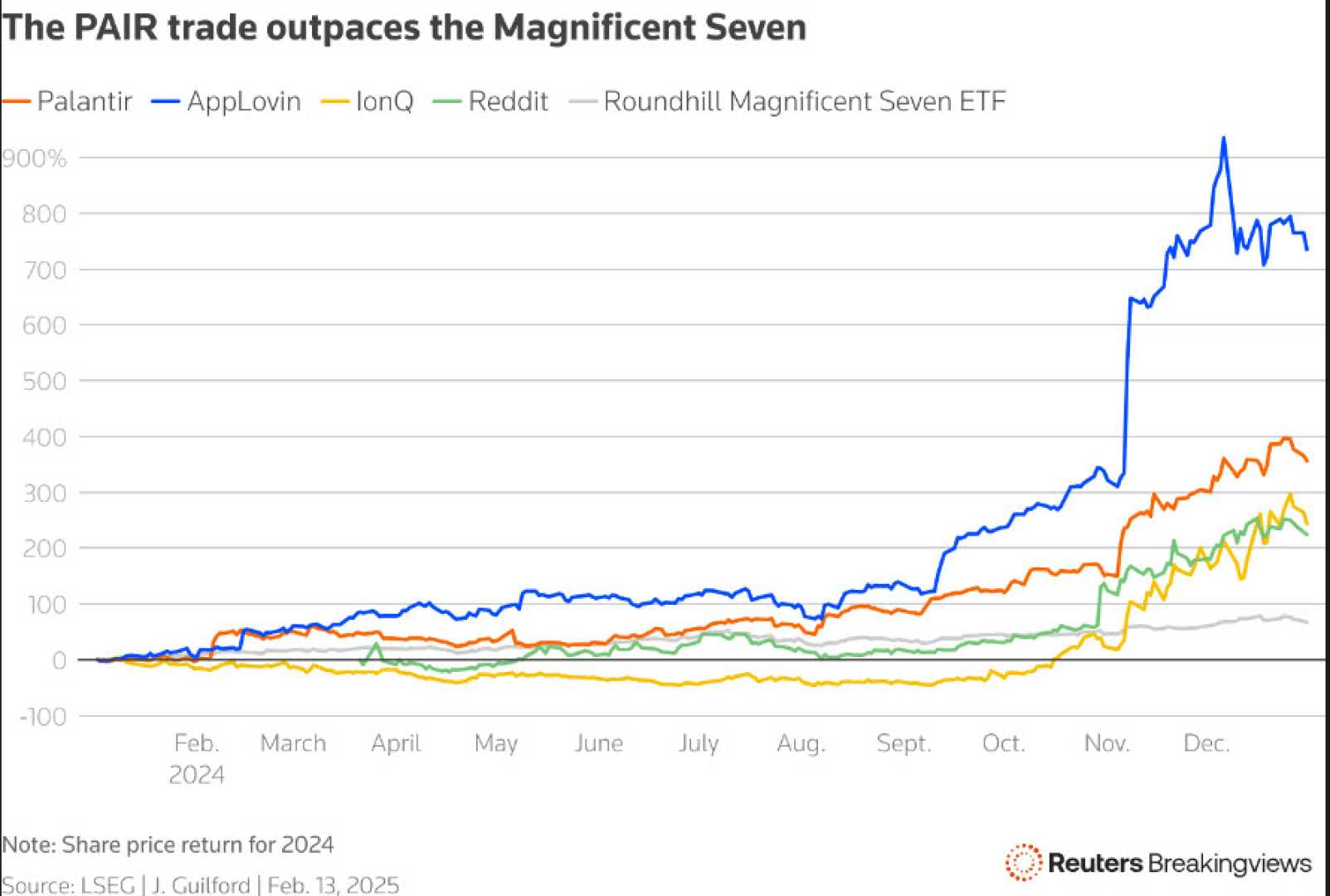

NEW YORK, NY — Palantir Technologies and IonQ are two of the hottest stocks in the tech industry as of June 2025, with Palantir’s shares soaring nearly 80% year to date. However, IonQ has recently outperformed Palantir over the last three months, raising questions about which company will dominate in the latter half of the year.

IonQ specializes in quantum computing, employing advanced physics principles such as quantum entanglement. This technology could dramatically transform various fields, including artificial intelligence, climate models, and drug development. Unlike its competitors, IonQ’s hardware is accessible on the three largest cloud platforms, positioning it favorably in a competitive market.

On the other hand, Palantir is a leader in artificial intelligence and data analytics. Its software platforms, Gotham and Foundry, allow organizations to convert large data sets into cohesive insights. Additionally, Palantir’s Artificial Intelligence Platform enhances its offerings, while Palantir Apollo manages software updates and configurations.

The efficiency gained through AI application has already provided significant benefits for commercial and government sectors. Long-term, these technologies might unlock new products and automate tasks traditionally performed by humans.

In terms of market capitalization, Palantir stands significantly larger at $319 billion, while IonQ’s market cap is around $10 billion. Both companies attract prestigious clients: IonQ collaborates with firms like Accenture and Goldman Sachs, while Palantir counts the U.S. government and major corporations like AIG and Citigroup among its clientele.

When examining financial metrics, Palantir clearly leads with $884 million in revenue for the first quarter of 2025, reflecting a year-over-year increase of 39%. In contrast, IonQ reported only $7.6 million, a decline from the previous year. Palantir’s profitability also outstrips IonQ’s, with earnings exceeding $214 million, compared to IonQ’s net loss of $32.3 million.

Yet, IonQ shows promise in growth projections, anticipating a 98% increase in revenue for 2025, while Palantir forecasts a growth rate of about 36%. Market valuations for both stocks remain high, with IonQ’s price-to-sales ratio at 201 and Palantir at 109, indicating investor confidence in both companies’ futures.

As both stocks continue to attract attention, they come with inherent risks tied to their high valuations. Analysts speculate whether the second half of 2025 could see IonQ or Palantir emerge as the superior investment. While potential legislative support for Palantir could enhance its standing, some analysts are cautiously optimistic about IonQ’s growth potential.

In the evolving landscape of technology investments, both companies could thrive, provided IonQ meets its revenue goals and Palantir secures significant contracts. With the future of artificial intelligence and quantum computing intertwined, the competition between these firms is only beginning.