Business

Palo Alto Networks Earnings Report Set to Spark Stock Price Surge

PALO ALTO, Calif. – Palo Alto Networks (PANW) is scheduled to release its quarterly earnings report tomorrow after the market closes. The cybersecurity firm has demonstrated robust financial performance in the past, surpassing earnings estimates for three consecutive quarters leading up to this earnings call.

Currently, the stock price is trading at $197 per share, reflecting a significant recovery from recent lows and nearing all-time highs by just $10. Analysts forecast that the company will announce earnings per share (EPS) of $0.78 on revenue of $2.24 billion, both figures representing a slight increase from the previous quarter when Palo Alto Networks exceeded expectations.

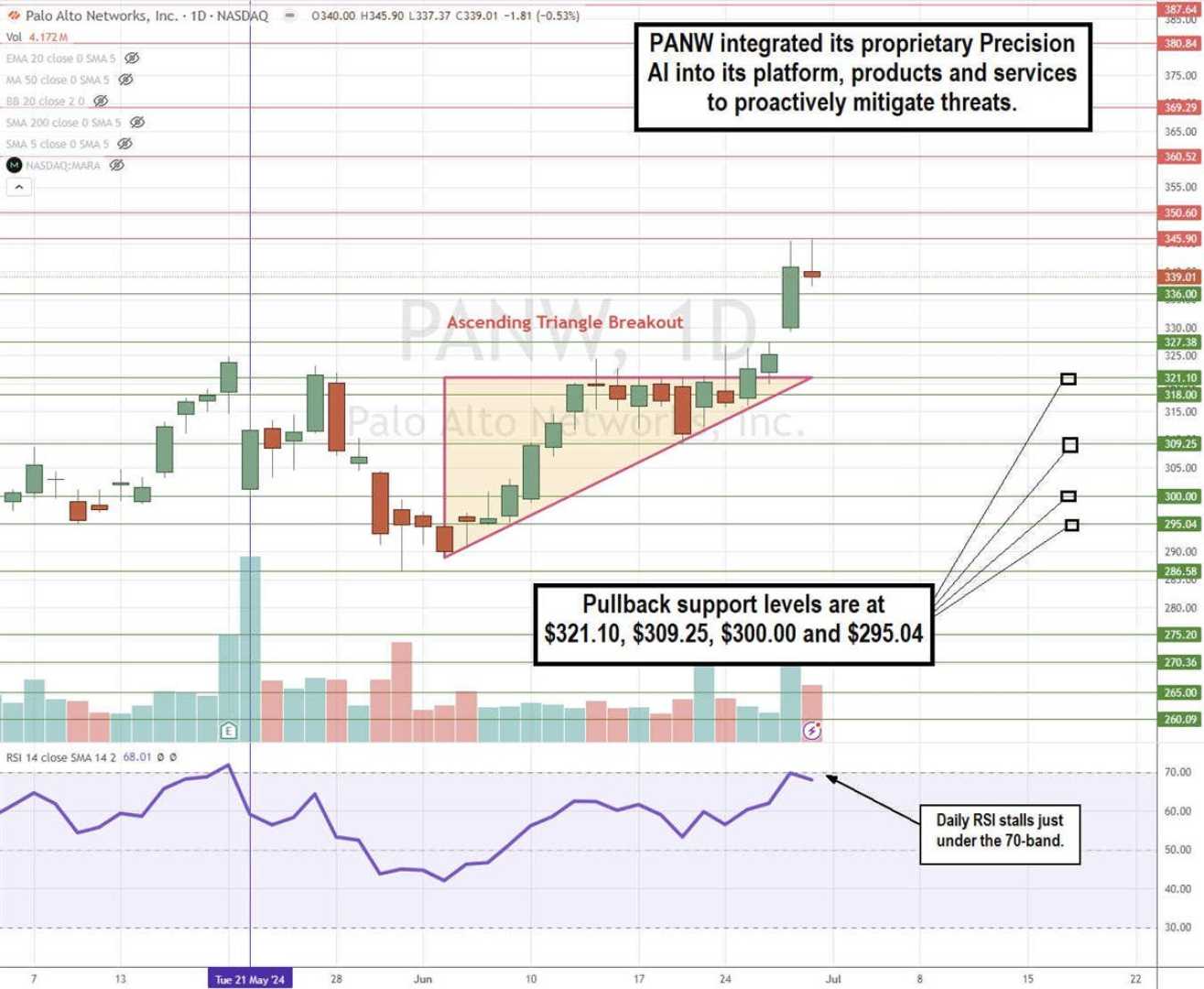

Market analysts have a generally optimistic outlook on PANW stock, particularly following the company’s strategic shift from individual product delivery to a more integrated ‘platformization’ approach. This strategy focuses on offering a comprehensive suite of cybersecurity products and services, rather than one-off solutions.

Nikesh Arora, CEO of Palo Alto Networks, expressed confidence in this shift during the last earnings call, stating, “Our Q1 results reinforced our conviction in our differentiated platformization strategy… We see a growing market realization that platformization is the game changer that will solve security and enable better AI outcomes. I expect this will be a multiyear trend for which we are best-positioned to deliver to our customers.”

Furthermore, Dipak Golechha, the firm’s Chief Financial Officer, reaffirmed this sentiment, noting, “Our platformization progress continued in Q1, driving strong financial results. As a result, we are raising our NGS ARR, revenue, and non-GAAP EPS guidance for the year.”

As investors anticipate the earnings announcement, options trading data suggests the market is expecting a stock price movement of approximately +/- $15.73 this week, which represents a projected 7% change given the current stock price. This range is wider than the typical 5%-10% fluctuations observed during earnings reports, indicating a potentially significant market reaction.

Looking ahead to May, the expected stock price movement narrows to +/- $28.51, pointing to heightened volatility surrounding this earnings announcement compared to future expectations. Investors are keen to see if Palo Alto Networks will continue its streak of strong EPS and revenue figures, hoping for sustained positive sentiment regarding the platformization strategy.

If the earnings report aligns with analysts’ expectations, the stock could reach or even surpass its all-time high by the end of this week. Conversely, any negative surprises, such as an EPS miss or lower-than-expected revenue, could lead to a decline in investor confidence and a fall in stock price.

Market watchers can tune in tomorrow at 11 a.m. CST for a live discussion ahead of the much-anticipated earnings announcement. Mike Butler, director of market intelligence at tastylive, has over a decade of experience in market trading and will provide insights during this session.