Business

PayPal Stock Ahead of Q3 Earnings: Analyst Expectations and Market Trends

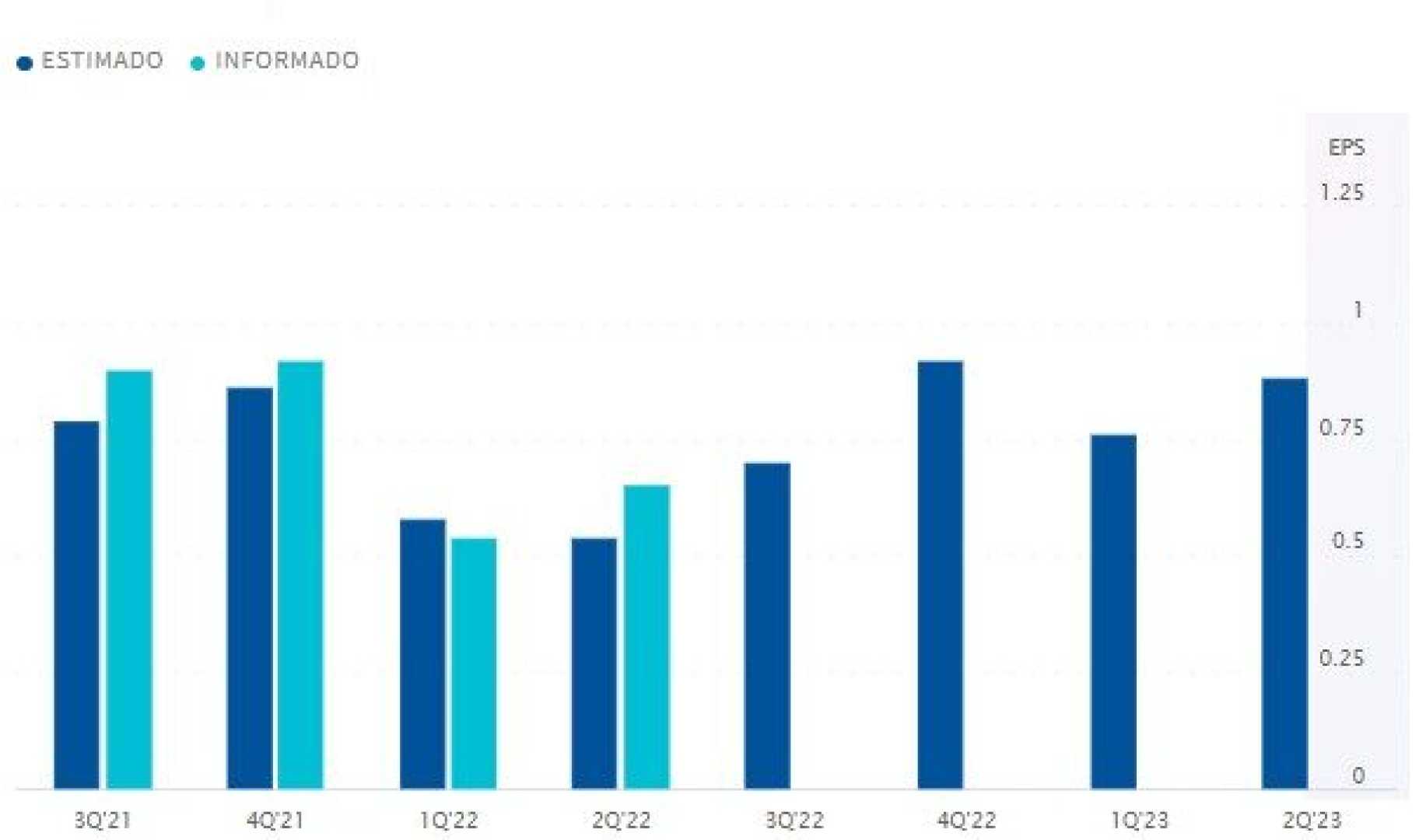

As PayPal Holdings Inc. (PYPL) prepares to release its third-quarter earnings on Tuesday, investors and analysts are closely watching the stock’s performance. Wall Street expects PayPal to report earnings per share (EPS) of $1.07, reflecting the company’s ongoing growth in the digital payments sector.

The stock has shown a strong bullish trend, trading above its five-day, 20-day, and 50-day exponential moving averages. As of the latest data, PayPal’s stock price is $83.59, up 63.13% over the past year and 35.50% year-to-date. Key short-term averages, such as the eight-day SMA at $81.17, the 20-day SMA at $80.23, and the 50-day SMA at $75.87, indicate consistent buying interest and potential upward momentum.

Technical indicators also support a bullish outlook. The Moving Average Convergence Divergence (MACD) reading of 1.82 reinforces the ongoing upward momentum. However, the Relative Strength Index (RSI) at 67.66 suggests that the stock is nearing overbought levels, which could indicate limited headroom for further gains and a potential pullback if buying interest wanes.

Analyst ratings remain positive, with a consensus rating of Buy and a price target of $78.24. Recent analyst ratings from firms like Monness, Crespi, Hardt; Stephens & Co.; and Wells Fargo have an average price target of $90, implying an 8.02% upside from current levels.

PayPal’s robust performance is attributed to its expansive technology platform that enables digital payments globally, connecting merchants and consumers through various services including PayPal, Venmo, Braintree, and more. The company’s ability to facilitate transactions through multiple funding sources, such as bank accounts, credit and debit cards, and cryptocurrencies, has been a key driver of its growth.