Business

RBI Holds Repo Rate Steady at 6.5% Amid Ongoing Inflation Concerns

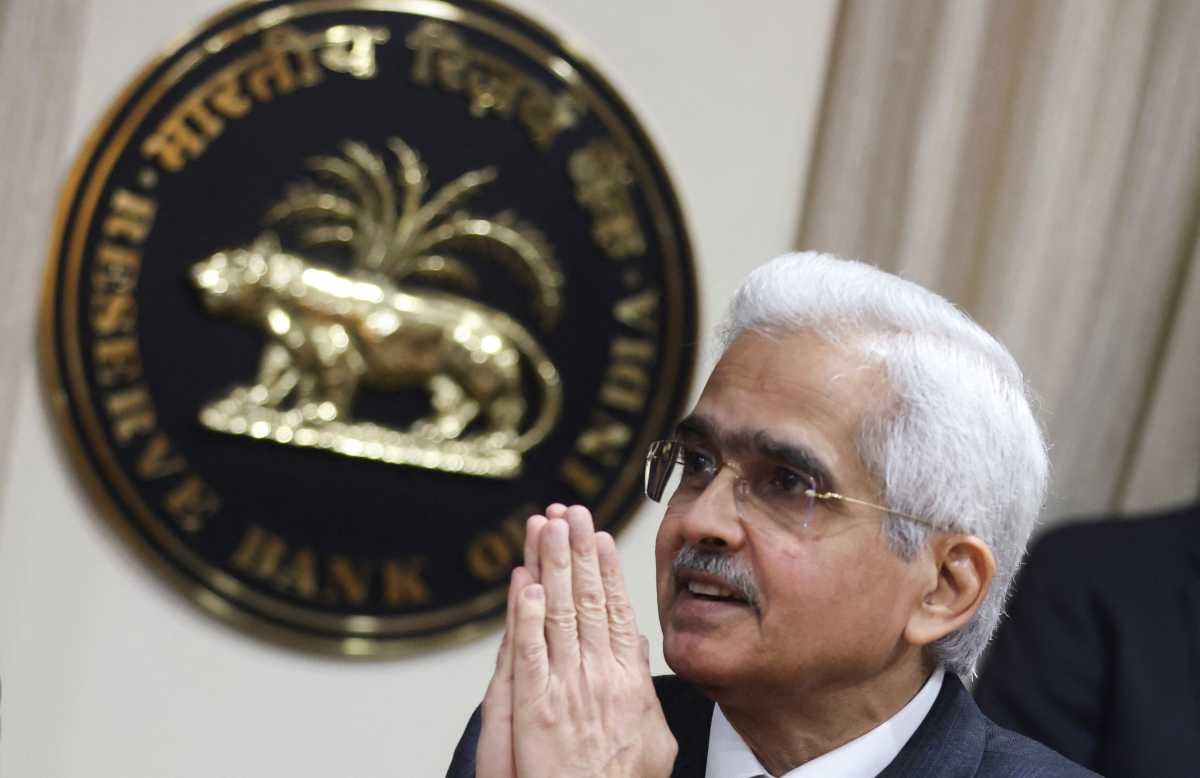

The Reserve Bank of India (RBI) Governor Shaktikanta Das announced on August 8 that the repo rate will remain unchanged at 6.5%. This decision comes as the central bank continues to navigate challenges linked to inflation and food prices.

During the bi-monthly monetary policy statement, Das mentioned that inflation and economic growth are progressing in a balanced manner, but he emphasized the need for vigilance regarding food prices.

The Monetary Policy Committee (MPC) met and after much deliberation, a majority voted to maintain the current rates. While four members supported this decision, two members expressed concerns that not cutting the rate could affect growth, especially given rising costs for businesses.

Das projected real GDP growth for the current financial year at 7.2%, showcasing optimism about India’s economic resilience. The RBI has adjusted its Consumer Price Index (CPI) inflation forecast for FY25 to 4.4%, expecting some relief due to favorable monsoon conditions.

He noted that retail inflation is projected at 4.5% for FY25, with improved agricultural activity potentially boosting rural consumption. However, continued high food prices have been a barrier to reducing inflation.

The Governor called for caution among banks regarding their liquidity, as a decline in deposits could pose structural challenges. He also highlighted the strength of India’s foreign exchange reserves, which stood at a record high of $675 billion as of August 2.

In a move aimed at enhancing the digital lending landscape, the RBI proposed creating a public repository for digital lending apps and announced an increase in the tax payment limit through UPI transactions.

Overall, the RBI’s decision to keep the repo rate steady is seen as a positive move for the housing market, as it maintains stability in borrowing costs and encourages potential homebuyers.