Business

Seagate Technology Set to Reveal Earnings Amid Strong Demand

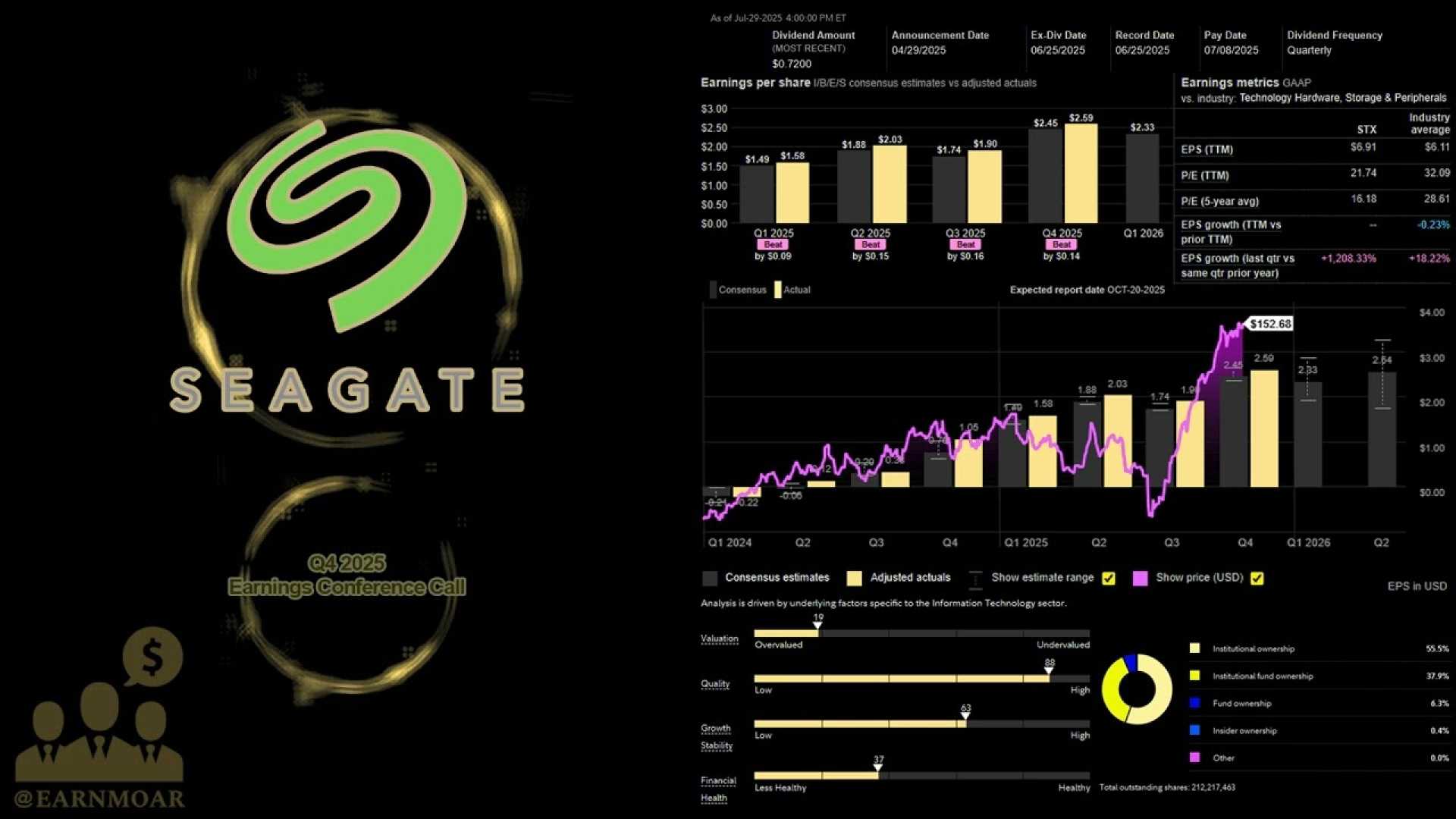

City, State – Seagate Technology Holdings plc (STX) is set to announce its first-quarter fiscal 2026 earnings on Oct. 28, following the closing bell. Analysts expect earnings of $2.36 per share, reflecting a 49.4% increase from the previous year. Revenue estimates are pegged at $2.53 billion, indicating a 16.7% rise compared to the same period last year.

Management projects first-quarter revenues will be around $2.5 billion, with a margin of +/- $150 million. This forecast suggests a 15% year-over-year growth. Non-GAAP earnings are anticipated to be approximately $2.3 per share, with a variability of 20 cents.

Seagate has consistently outperformed the Zacks Consensus Estimate in the last four quarters, with an average surprise of 7%. The current earnings model indicates a strong possibility of another earnings beat due to a positive Earnings ESP of +2.54% and a Zacks Rank of #2 (Buy).

Investors should note the increasing demand for mass capacity storage solutions, driven by a surge in nearline cloud storage requirements. Last quarter, revenues from mass capacity devices soared 40% year-over-year to $2 billion, bolstered by growing nearline enterprise sales.

Cloud service providers are focusing on developing AI applications and infrastructure. Seagate believes hard disk drives (HDDs) are crucial for supporting this growing sector and anticipates a corresponding rise in demand in the current quarter.

Additionally, evolving data sovereignty rules are fueling local storage needs as around 50% of global data centers are concentrated in just four countries. Seagate’s mass capacity hard drives are proving effective in meeting these requirements.

The upcoming Mozaic 3+ hard drive platform, set for launch in 2024, will integrate Heat-Assisted Magnetic Recording (HAMR) technology, which promises to enhance data storage density. This expected performance aligns with an anticipated revenue increase of 22.5% year-over-year to $2.1 billion from mass capacity solutions.

The earnings estimates for the HDD segment stand at $2.35 million, signifying a 17.4% increase, while the non-HDD segment, including enterprise data solutions and solid-state drives, is projected at $161.5 million, down 1.5% from last year.

Seagate’s gross margins continue to improve, estimated to reach 39.4% for the fiscal first quarter compared to 33.3% in the previous year. The company has also recorded impressive cash flow, which supports dividends and stock buybacks.

However, it’s essential to consider that Seagate’s revenues largely come from international markets, making it vulnerable to foreign exchange fluctuations and global macroeconomic challenges.

Despite a challenging environment, Seagate shares have skyrocketed by 185% in the last six months, outperforming not only the computer-integrated systems industry but also the broader technology sector.

Seagate currently trades at a forward price/earnings ratio of 20.21, which is below the industry average of 25.75, yet higher than its historical mean of 11.84. In comparison, competitors like Western Digital Corporation (WDC) and Pure Storage (PSTG) have also seen substantial price growth.

With a favorable outlook driven by increased demand for mass-capacity storage, along with anticipated improvements in technology and profitability, many investors are eyeing Seagate as a strong buy option at this juncture.