Business

Tesla Stock Volatility: Analysts Predict AI Future Amid EV Sales Drop

NEW YORK, NY — Tesla Inc. (TSLA) experienced significant volatility on Monday, with its stock jumping over 3% to touch an intraday high of $303.94 after Morgan Stanley analyst Adam Jonas named the electric vehicle manufacturer as a top pick for the auto sector. Jonas set a price target of $430, which is approximately 50% above Friday’s closing price of $292.98. However, the stock later retreated to reflect a 2.64% decline, signaling mixed investor sentiment.

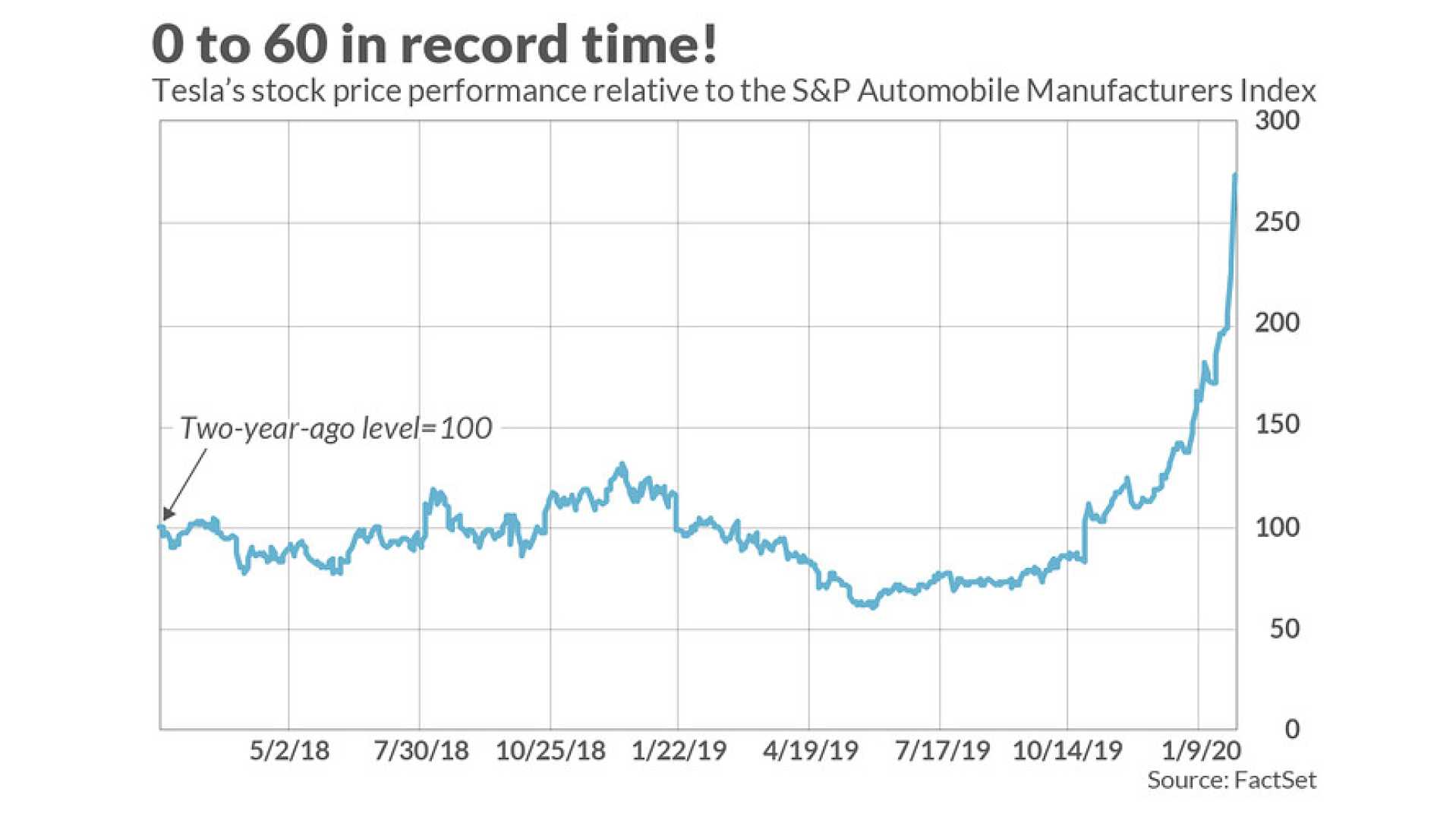

Jonas asserts that Tesla is transitioning from a purely electric vehicle company to a major player in the fields of artificial intelligence and robotics. He sees the potential for a bullish outcome with the stock reaching as high as $800. Despite projecting a year-over-year decline in delivery figures for 2025, he views this as an opportunity rather than a setback. This outlook comes against a backdrop of a nearly 26% decline in the stock over the past month, attributed to waning EV sales.

“The pivot toward AI and robotics has the potential to unlock larger and faster-growing markets than autonomous vehicles,” Jonas said. This shift is highlighted by Tesla’s pullback from a high of $479.86 that occurred after the election, indicating uncertainty within the market.

Elon Musk’s involvement in political matters has sparked discussions about the influence on Tesla’s brand perception. The drop in sales reported in February has led to speculation about consumer confidence, although Jonas characterizes the recent decline in deliveries as a strategic turning point rather than a critical issue for the company.

Tesla’s ambitions in AI and robotics, which include the development of humanoid robots and advanced neural networks, are expected to help the company expand into sectors beyond transportation. This diversification strategy may mitigate the impact of rising competition and market saturation in the electric vehicle space.

Even with a significant loss in post-election stock gains, the brief spike to $303.99 earlier in the day indicates retained investor confidence in Musk’s long-term vision. However, the midday downturn to 2.64% underscores the ongoing uncertainties surrounding how Tesla will navigate between its foundational automotive business and its futuristic endeavors in a fluctuating economic environment.