Business

Trump Announces 25% Tariffs on Canada and Mexico Starting February 1

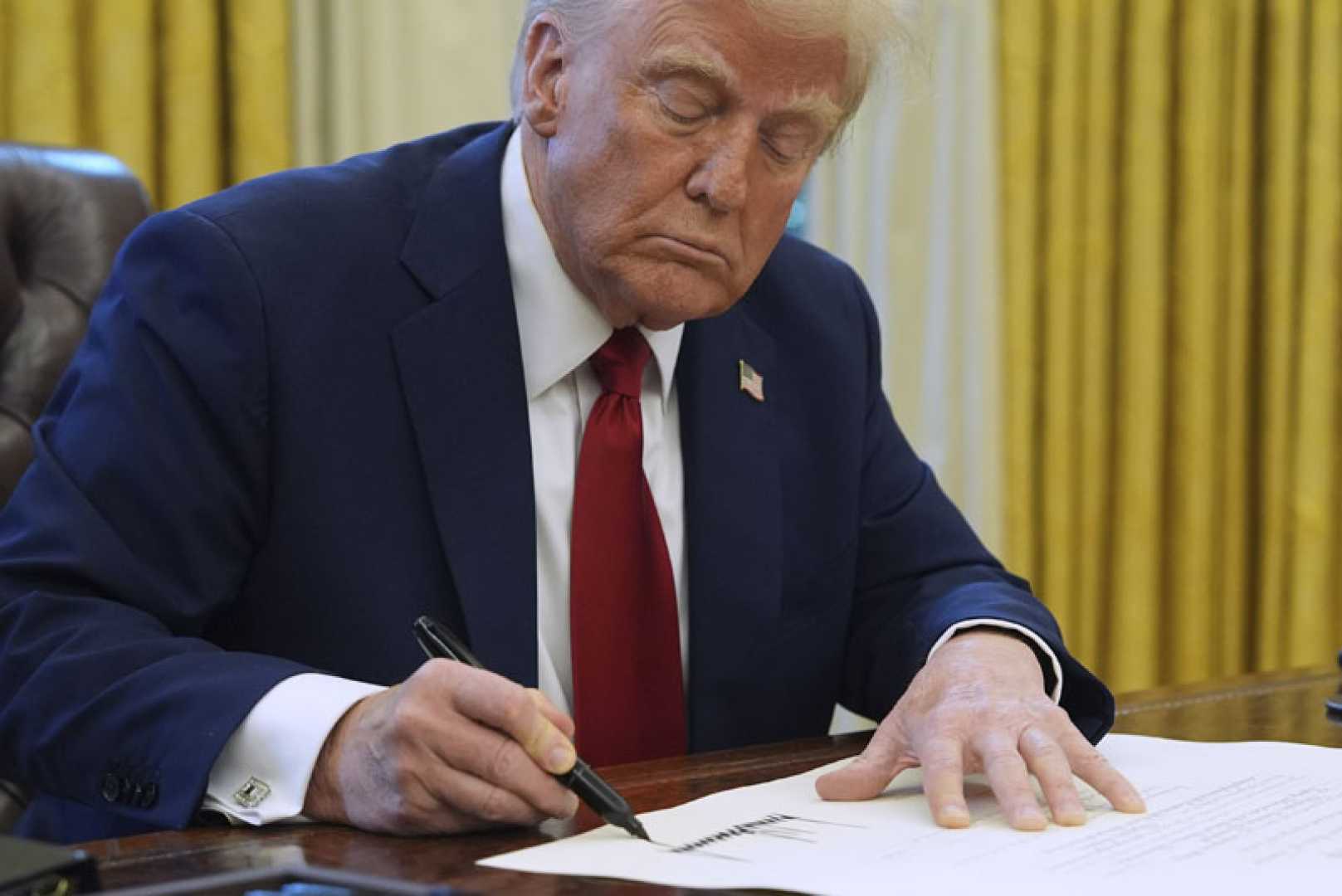

WASHINGTON, D.C. — U.S. President Donald Trump announced on Friday that he will impose 25% tariffs on imports from Canada and Mexico starting February 1, citing concerns over undocumented migrants, fentanyl trafficking, and trade deficits. The decision, made during a press briefing in the Oval Office, marks the first major trade policy move of his new administration.

Trump emphasized that the tariffs are aimed at addressing the flow of undocumented migrants and illegal drugs, particularly fentanyl, across U.S. borders. He also highlighted the trade deficits with both countries as a key factor in the decision. However, he noted that a final determination on whether to include oil imports from Canada and Mexico has not yet been made.

“We’ll be announcing the tariffs on Canada and Mexico for a number of reasons,” Trump said. “Number one is the people that have poured into our country so horribly and so much. Number two are the drugs, fentanyl and everything else that have come into the country. Number three are the massive subsidies that we’re giving to Canada and to Mexico in the form of deficits.”

The announcement has sparked concerns about potential retaliation from Canada and Mexico, both of which have indicated they will respond with their own measures. The two nations are key trading partners with the U.S., largely due to the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA).

Economists warn that tariffs on oil imports, in particular, could have significant repercussions. Approximately 40% of the crude oil processed in U.S. refineries is imported, with the majority coming from Canada. If tariffs are applied to oil, the costs could be passed on to businesses and consumers, potentially increasing prices for goods ranging from gasoline to groceries.

Bob Savage, head of markets strategy and insights at BNY Mellon, noted that the tariffs could disrupt financial markets. “The combination of earlier policy shifts and Trump’s tariff threats could puncture the buoyant mood on financial markets,” Savage said. “Investing requires greater clarity about the scope, size, and reach of Trump’s tariffs.”

Meanwhile, Trump also hinted at potential new tariffs on China, citing the country’s role in the fentanyl crisis. “With China, I’m also thinking about something because they’re sending fentanyl into our country, and because of that, they’re causing us hundreds of thousands of deaths,” he said. “So China is going to end up paying a tariff also for that, and we’re in the process of doing that.”

During his 2024 campaign, Trump had threatened to impose tariffs of up to 60% on Chinese-made goods, though no immediate action was taken upon his return to the White House. U.S. imports from China have remained flat since 2018, a trend partly attributed to the tariffs imposed during Trump’s first term.

In response to the escalating trade tensions, Chinese Vice Premier Ding Xuexiang urged for a “win-win” solution during his address at the World Economic Forum in Davos, Switzerland. He emphasized China’s commitment to expanding imports and resolving trade disputes through dialogue.

As the February 1 deadline approaches, markets are bracing for potential volatility. The Canadian dollar fell 0.4% during Asian trading on Friday, while the Mexican peso dropped 0.6% against the U.S. dollar. Oil prices also saw a slight increase, with West Texas Intermediate futures rising 0.6% to $73.17 per barrel.

Analysts remain divided on the long-term impact of the tariffs. Mohit Kumar, a global economics analyst at Jefferies, suggested that the tariffs could serve as a negotiating tool. “It is possible that Trump goes ahead with the 25% announcement for Mexico and Canada, which would be market negative,” Kumar said. “However, we still view tariffs as a negotiating tool, and even if Trump does go ahead with the tariffs, it will be followed by a period of intense negotiations.”