Politics

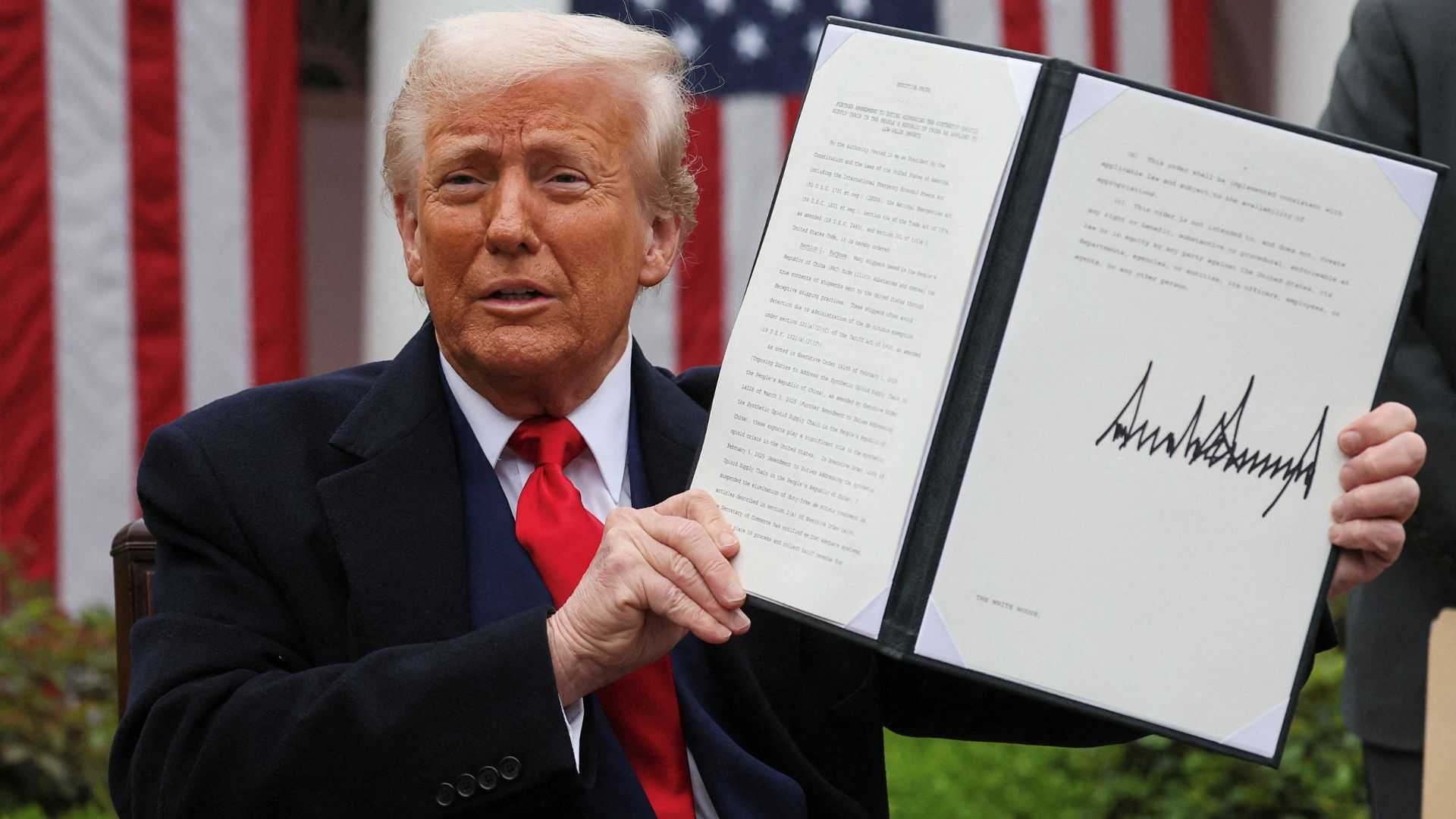

Trump Proposes $2,000 Tariff Dividends Amid Economic Claims

WASHINGTON, D.C. — President Donald Trump announced on Sunday that he plans to pay a dividend of at least $2,000 to Americans, excluding high-income individuals, derived from tariffs his administration has implemented. He claims these tariffs have made the U.S. the “richest, most respected country in the world.”n

In a post on Truth Social, Trump stated, “People that are against tariffs are FOOLS! We are now the richest, most respected country in the world, with almost no inflation and a record stock market price. 401(k)s are the highest ever.” He expanded on the dividend proposal without specifying the details of how it will be funded or when payments might occur.n

During an appearance on ABC News‘ “This Week,” Treasury Secretary Scott Bessent commented that he had not yet discussed the specifics of the dividend with Trump. Bessent stated the payment could take various forms, potentially including benefits from tax decreases proposed by the president.n

Current estimates suggest the implementation of these $2,000 dividends could substantially increase the national deficit. Analysts estimate each round of payments may cost around $600 billion. In contrast, the tariffs currently in place are projected to yield about $300 billion annually.n

The discussion around tariff revenues raises concerns regarding their actual utilization. Some experts believe additional tariff revenue should prioritize reducing the federal budget deficit over direct payments to citizens. The national debt is nearing $40 trillion, which has prompted calls for more prudent fiscal measures from lawmakers.n

Trump has made similar proposals in the past, suggesting that the tariff revenue could directly benefit American households, reminiscent of the economic impact payments distributed during the COVID-19 pandemic. Under those programs, previous stimulus checks provided up to $1,400 per individual, with phase-out thresholds based on income levels.n

Opposition may arise regarding the practicality and timing of any dividend. The nature of how rebates would be administered remains uncertain, particularly since legislation typically requires Congressional approval for such financial distributions. There are concerns about public perception as Americans currently face rising inflation and economic challenges, which could complicate support for any type of tariff rebate scheme.n

As of now, details remain scarce and the proposal appears more theoretical than actionable, but the administration maintains that a formal plan could be developed soon. This story will continue to evolve.