Business

Trump Softens Stance on Fed Chair and Tariffs, Boosting Stock Futures

NEW YORK, NY — Stock futures surged on Wednesday after President Donald Trump confirmed he does not plan to remove Federal Reserve Chairman Jerome Powell. His statement came amid signals that tariffs on Chinese imports may be reduced.

On Tuesday evening, Trump revealed that he has “no intention” of firing Powell, whose term as Fed chair will last until May 2026. This shift in tone directly followed previous criticisms, where Trump had described Powell as a “major loser” for his monetary policy decisions. On Truth Social, he had expressed a desire for Powell’s termination, indicating a potential power struggle over interest rates.

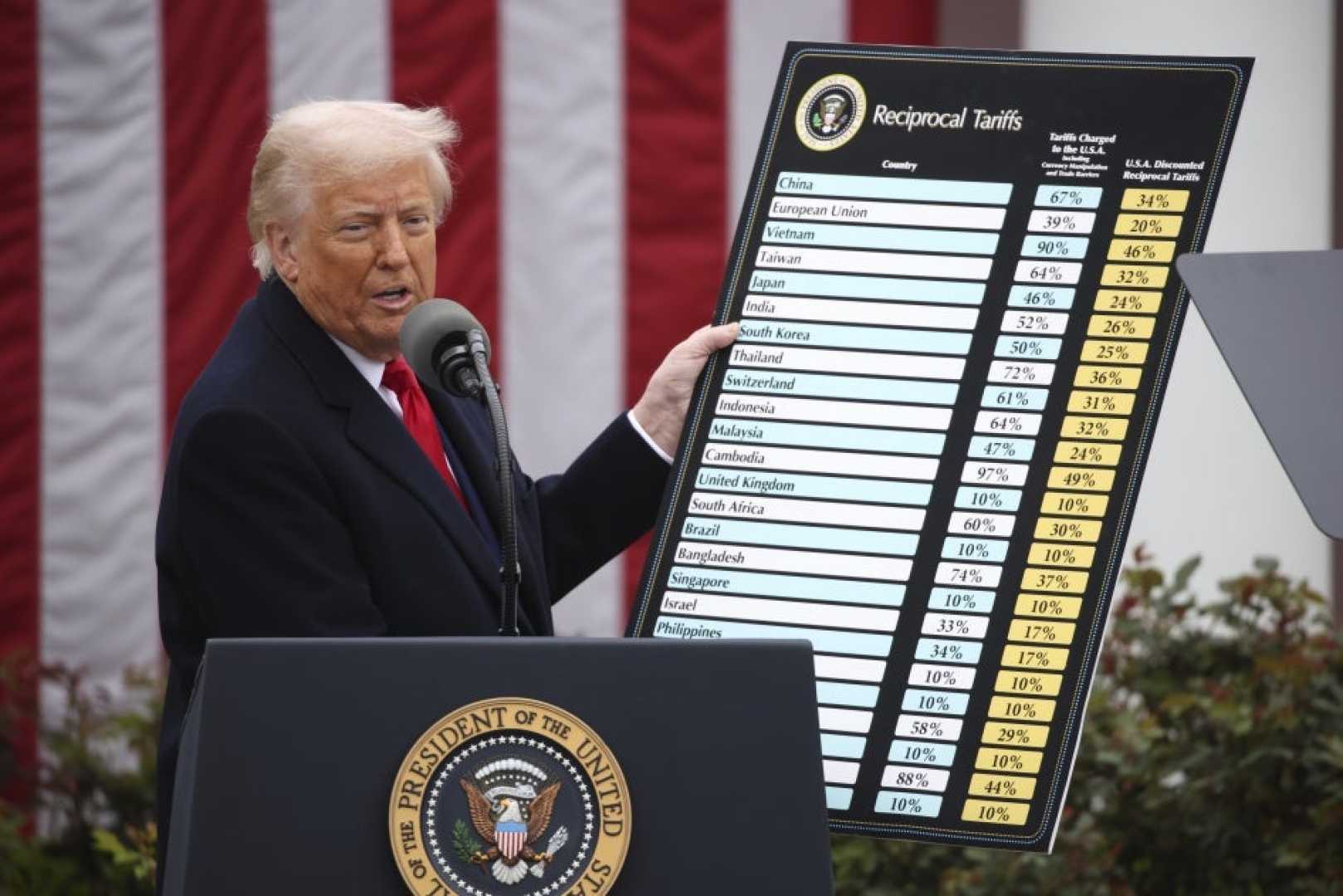

During the same press briefing, Trump commented on the current 145% tariff on Chinese imports, suggesting it is “very high” and should decrease significantly. He assured investors that while tariffs would not reach zero, they would drop “substantially.”

The prospect of lower tariffs contributed to a notable premarket rally. Major stock indices followed suit: the Dow Jones Industrial Average rose by about 761 points, or 1.9%; the S&P 500 increased by 2.5%; and the Nasdaq Composite gained 2.9%. Notably, businesses benefitting from strong ties to China experienced increased stock prices, including key technology companies.

Elon Musk‘s Tesla also saw a boost, with shares climbing 7% post-earnings release, as Musk announced reduced time commitments with the Trump administration’s Department of Government Efficiency. The bullish sentiment in the stock market stems from investor optimism over a potential de-escalation of US-China trade tensions.

These remarks also encouraged Treasury Secretary Scott Bessent, who hinted at possible negotiations in the ongoing trade war, stating that the current status quo cannot continue. Adjustments in sentiments toward trade have increased demand for riskier assets, yet many investors still seek safe-haven investments like gold.

Investors remain cautious, worried about future trade uncertainties despite the recent market rally. “There is a ton of money hiding out in gold at the moment, so there’s plenty of unproductive money that will find its way back into the market at some point,” remarked Jamie Cox, managing partner at Harris Financial Group. The market is in a state of flux, with much depending on upcoming negotiations.

As this situation unfolds, analysts remain watchful for both profitability and market stability amid the evolving landscape between the US and China.