Business

Wall Street’s Fear Gauge Drops as Treasury Yields Retreat

NEW YORK — Wall Street’s so-called fear gauge, the Cboe Volatility Index (VIX), dropped significantly this week as Treasury yields retreated from recent highs, providing relief to the U.S. stock market.

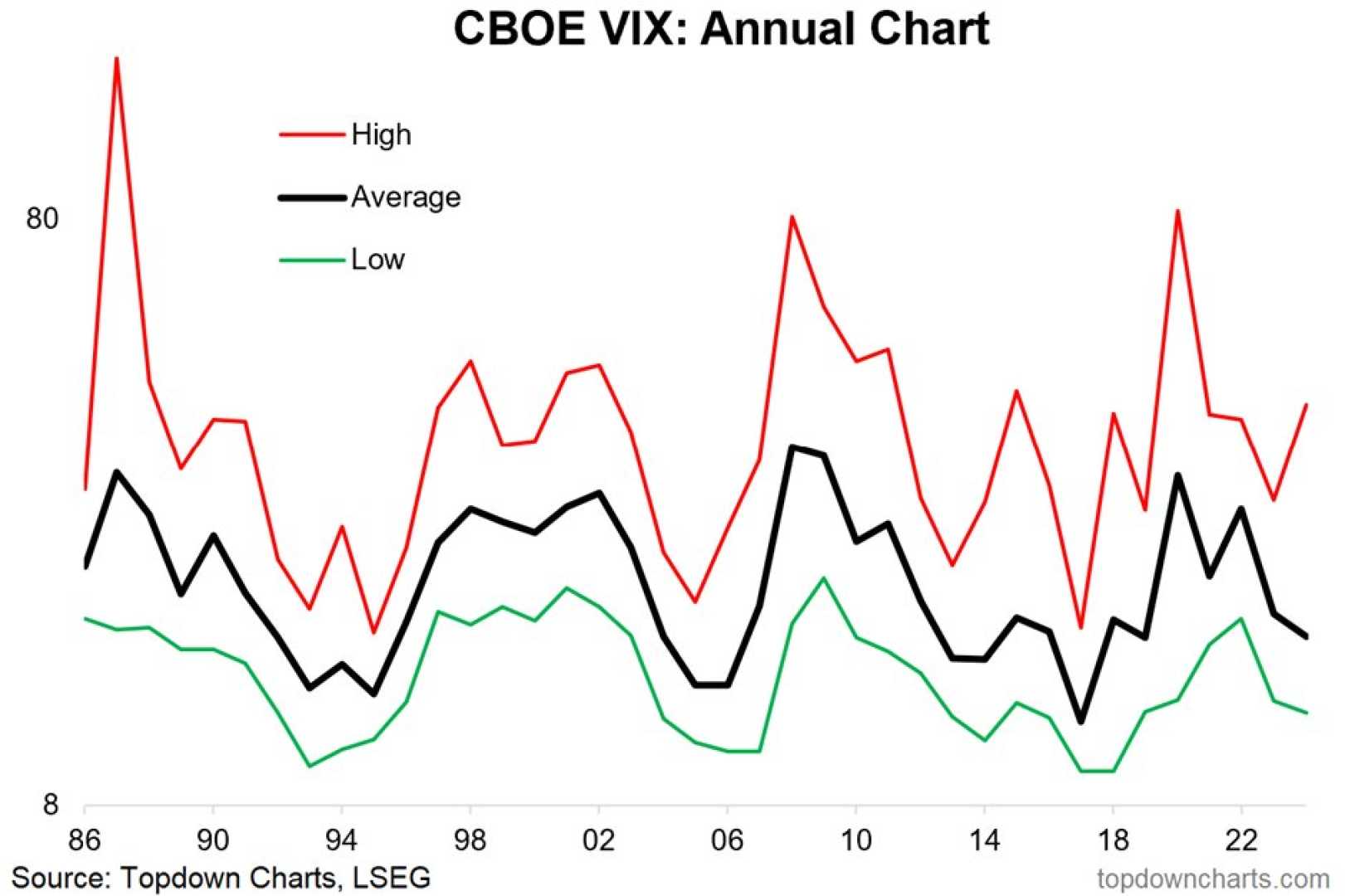

The VIX, which measures market volatility expectations, fell 3.5% to 16 on Friday afternoon, marking an 18% decline for the week, according to FactSet data. The index traded below its longer-term average of around 20, signaling reduced investor anxiety.

Stocks rallied in response, with the S&P 500 gaining 3.1% for the week as of Friday afternoon. The yield on the 10-year Treasury note, a key benchmark for borrowing costs, also declined, settling at around 4.61% in Friday trading.

“The pullback in Treasury yields has been a major driver of the market’s positive sentiment this week,” said a market analyst at FactSet. “Investors are breathing a sigh of relief as inflationary pressures appear to ease.”

The VIX, often referred to as the “fear gauge,” tends to rise when investors expect increased market volatility. Its decline this week reflects growing confidence in the stability of the financial markets.

Market participants are now closely watching upcoming economic data and Federal Reserve policy decisions for further clues on the direction of interest rates and inflation.