Business

Zoom Earnings Countdown: Analysts Split Ahead of Q4 Announcement

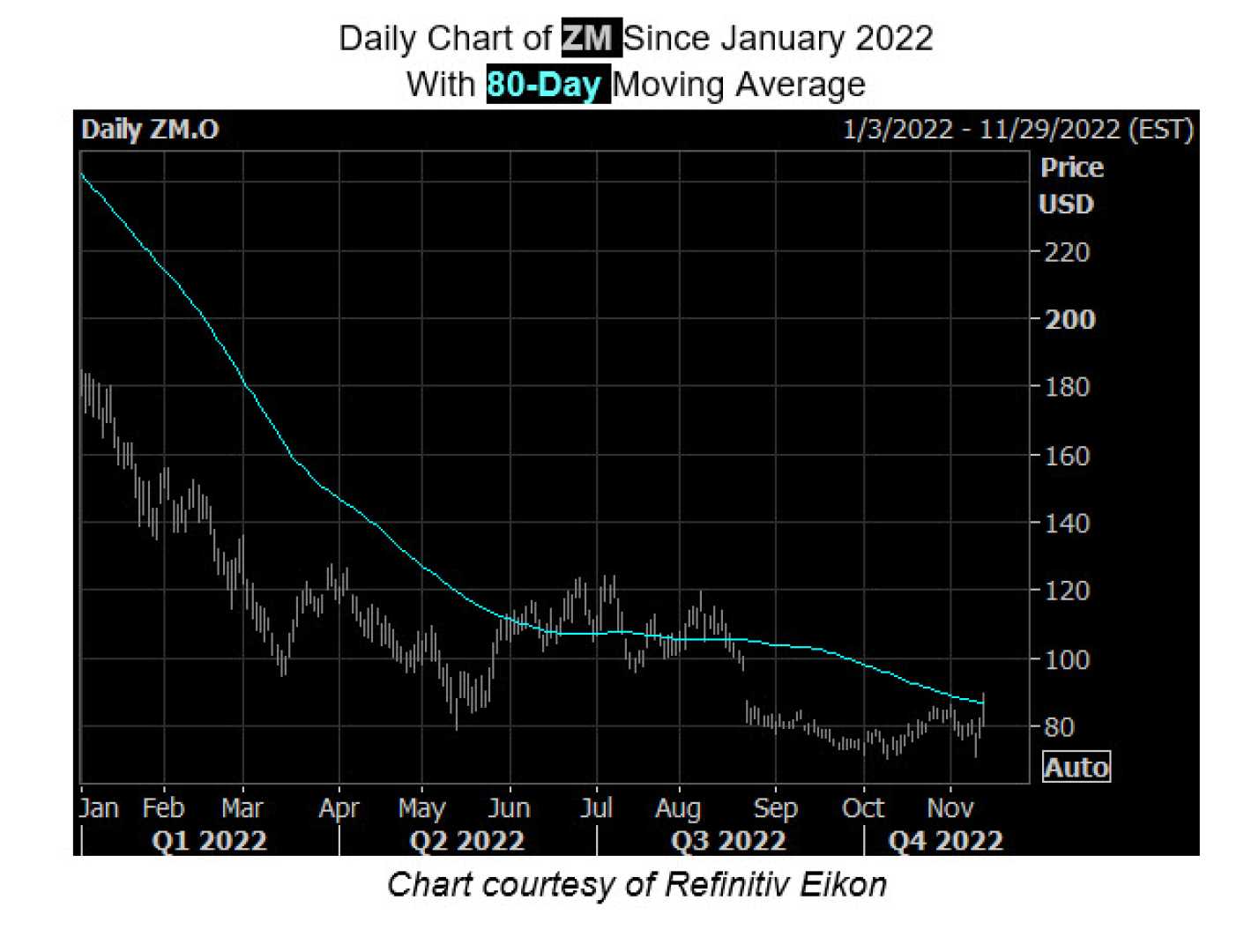

San Jose, California — Zoom Video Communications is poised to release its fiscal Q4 FY25 results on February 24, with analysts divided over the company’s prospects. The stock has surged more than 38% over the past year, buoyed by technological advancements and solid financial reports.

Wall Street estimates a modest revenue increase of 2.6%, projecting earnings of $1.18 billion. Notably, Zoom has consistently exceeded market expectations, surpassing earnings estimates for nine consecutive quarters.

As anticipation builds, one analyst maintained a Hold rating on ZM stock with a price target set at $96. The analyst pointed out that while Zoom’s Enterprise segment is predicted to contribute to revenue growth, it might fall short of prompting a stock re-evaluation. “The current valuation and market conditions lead to cautious optimism about Zoom’s long-term potential,” the analyst stated.

In contrast, another firm revised Zoom’s price target from $86 down to $85, while keeping a Neutral rating. This cut in forecast reflects concerns regarding weak partner feedback and declining web traffic. The analyst noted, “There appears to be no clear catalyst for Zoom’s stock to regain momentum in the near term,” emphasizing the importance of tracking website visits in gauging consumer interest in Zoom’s subscription services.

Website traffic analysis showed a decrease in visits in Q4, both sequentially and year-over-year, further raising concerns among analysts. Moreover, the firm employed TipRanks’ Options tool to investigate market expectations for Zoom’s stock following the earnings announcement. The tool projects a significant price movement in either direction post-earnings.

Currently, consensus among analysts reflects a Hold rating for Zoom stock, with five Buys, 15 Holds, and one Sell recorded in the past three months. The average price target of $92.45 indicates an upside potential of approximately 8.55%, highlighting a cautious outlook as the company prepares to unveil its latest financial results.