Business

Wyndham Hotels Surpasses Earnings Expectations in Second Quarter 2025

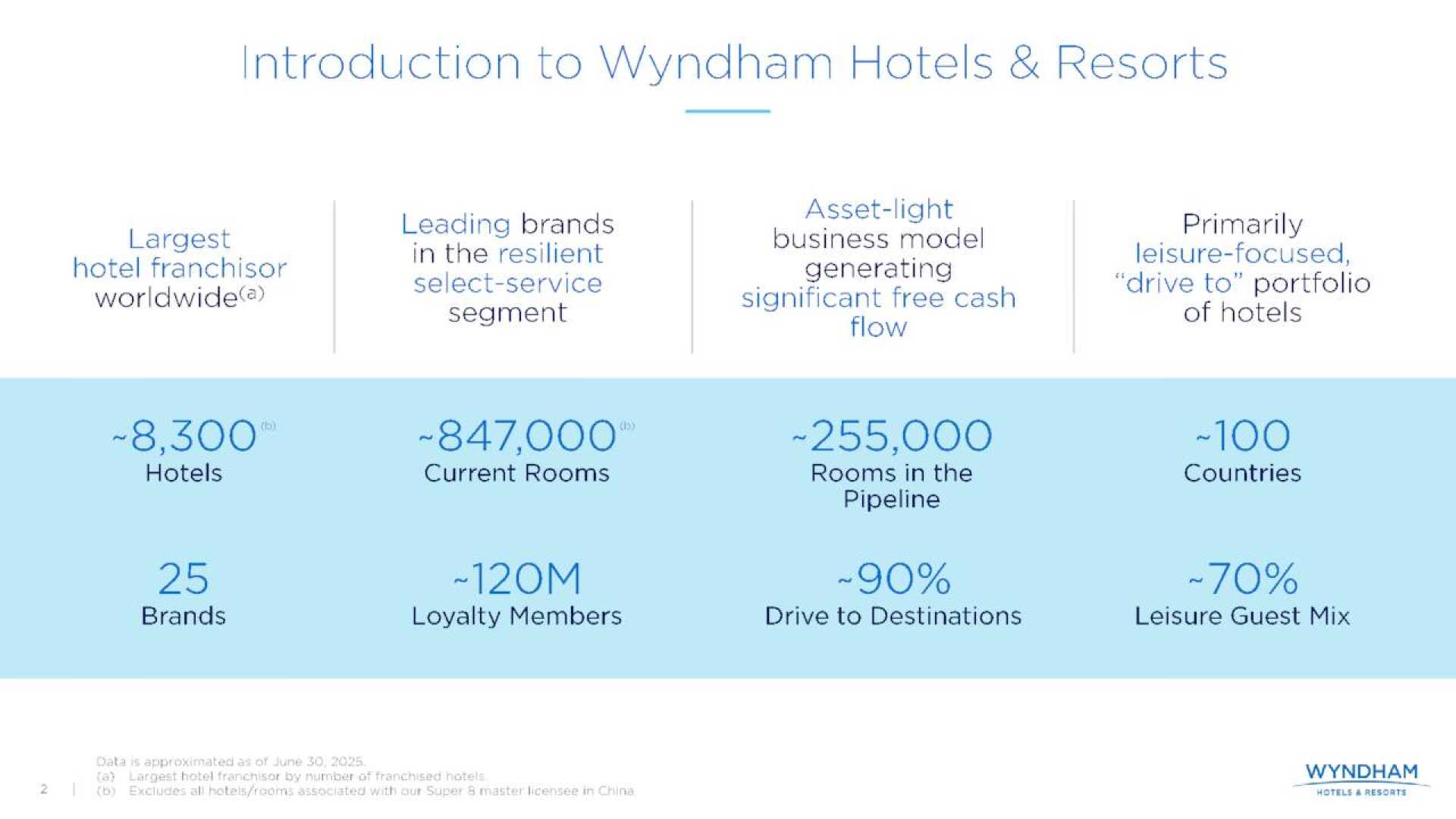

Parsippany, New Jersey – Wyndham Hotels & Resorts, a leader in hotel franchising with approximately 8,300 hotels globally, announced its second quarter 2025 results on July 23, 2025. The company reported adjusted diluted earnings per share (EPS) of $1.33, exceeding analyst expectations of $1.16, while revenue reached $397 million, surpassing the $386.64 million estimate.

Wyndham’s impressive results reflect its growing global system size and a robust development pipeline. However, U.S. revenue per available room (RevPAR) showed signs of softness compared to the previous year. This performance demonstrates the resilience of Wyndham’s asset-light model, emphasizing strategic engagement with higher-value market segments.

In terms of financial metrics, adjusted EBITDA increased by 10% to $195 million, and adjusted net income rose by 13% to $103 million. The company’s free cash flow also surged by 27.5% to $88 million. These improvements were attributed to a 19% growth in ancillary revenues, bolstered by higher royalties and franchise fees.

Wyndham’s global system size expanded by 4% year-over-year, totaling 846,700 rooms as of June 30, 2025. The number of pipeline rooms reached a record 255,000, with 58% located outside the U.S. RevPAR fell 3% globally, driven by a 4% decrease in the U.S. market, though international markets posted a 1% increase.

Management noted that various factors, including the timing of holidays and a solar eclipse, impacted U.S. RevPAR. When adjusted for these events, the decline was approximately 2.3%. Internationally, the EMEA region saw RevPAR growth of 7%, while Latin America experienced an 18% increase.

Wyndham is also in the process of expanding its ancillary revenue streams, which include its branded credit card partnerships. With membership in its Wyndham Rewards program at about 114 million, the loyalty initiative continues to support customer retention and franchise profitability.

On the development front, about 76% of the pipeline comprises new construction, and extended stay hotels make up 17% of this pipeline. The company has raised its full-year 2025 growth outlook for net room openings to between 4.0% and 4.6%, indicating a shift towards higher-value segments.

Despite these advancements, management remains cautious regarding the global outlook, reaffirming expectations for modest changes in RevPAR for the remainder of 2025. The company continues to believe that a one-point shift in RevPAR can significantly affect its annual fee revenue by around $10 million.

As Wyndham continues to navigate these evolving market conditions, it remains focused on leveraging its strong brand portfolio and franchise structure to maintain its competitive advantage.