Business

IRS Sends Unclaimed Payments Amid State Direct Relief Initiatives

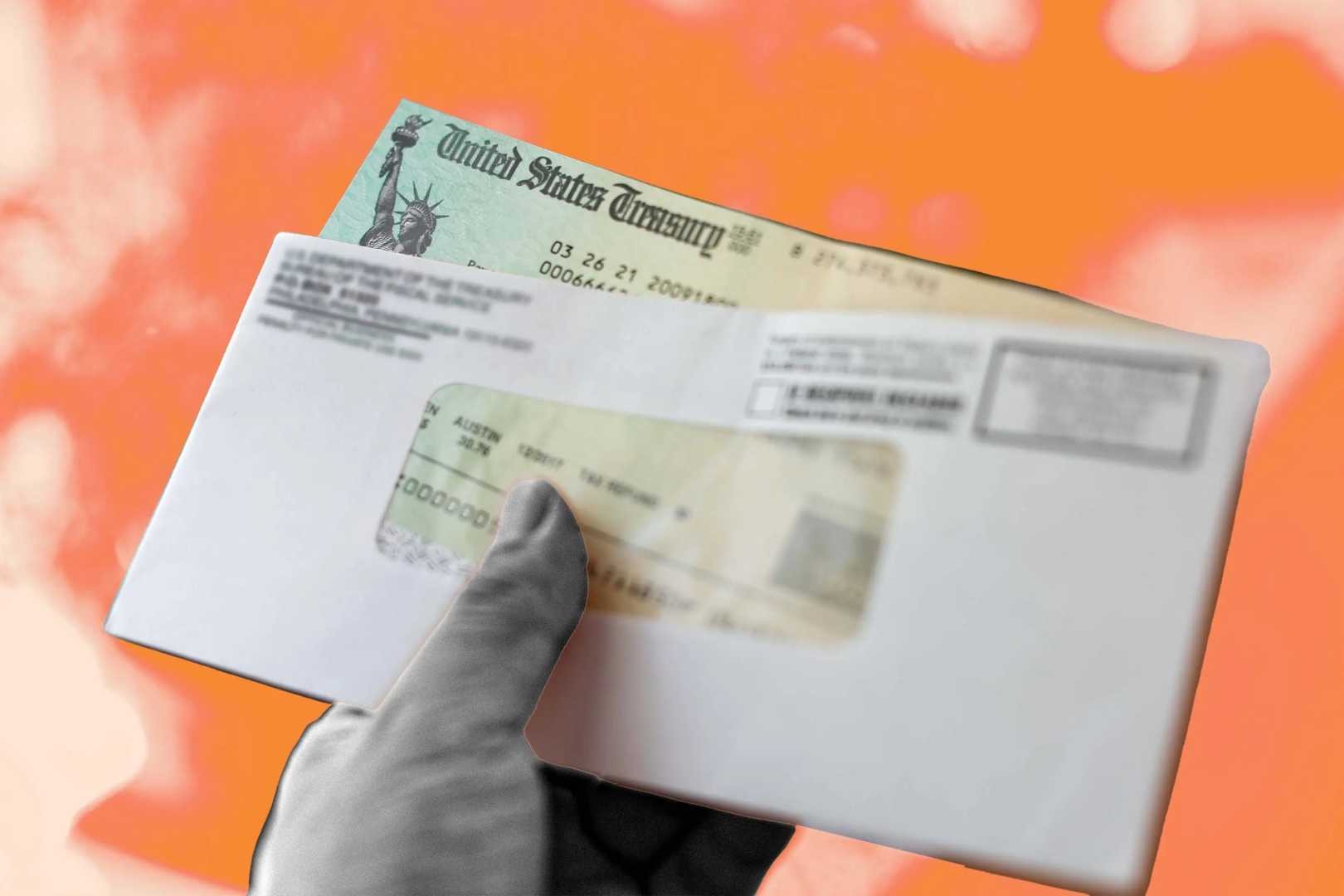

WASHINGTON, D.C. — The IRS is concluding the distribution of unclaimed 2021 stimulus payments, automatically sending up to $1,400 to approximately 1 million taxpayers who did not claim their payments on their tax returns.

The initiative is part of the American Rescue Plan that provided direct payments to individuals earning under $75,000, or up to $150,000 for joint filers. Eligible recipients must have a valid Social Security number and cannot be claimed as dependents. The IRS has begun notifying recipients through letters regarding these payments.

This marks the end of pandemic-era direct relief efforts, with no further federal stimulus checks expected. However, several states are providing financial relief through their tax rebate programs. California, for instance, is piloting a program that offers $725 monthly payments to 200 low-income families until November 2025.

Additionally, in 2025, Georgia taxpayers will receive tax rebates ranging from $250 to $500, thanks to legislative measures addressing a substantial state surplus. Similarly, Colorado is providing TABOR refunds, with payments expected to range from around $177 to $1,130, depending on income and filing status.

The potential for additional federal ‘stimulus checks’ has also been proposed on Capitol Hill but remains a distant reality, as any such measures would require congressional approval and careful consideration of increasing national debt.

As the IRS continues its distribution efforts, states also plan various aid initiatives aimed at relieving residents amid inflation and rising living costs.