Business

Trump’s 50-Year Mortgage Proposal Sparks Controversy and Debate

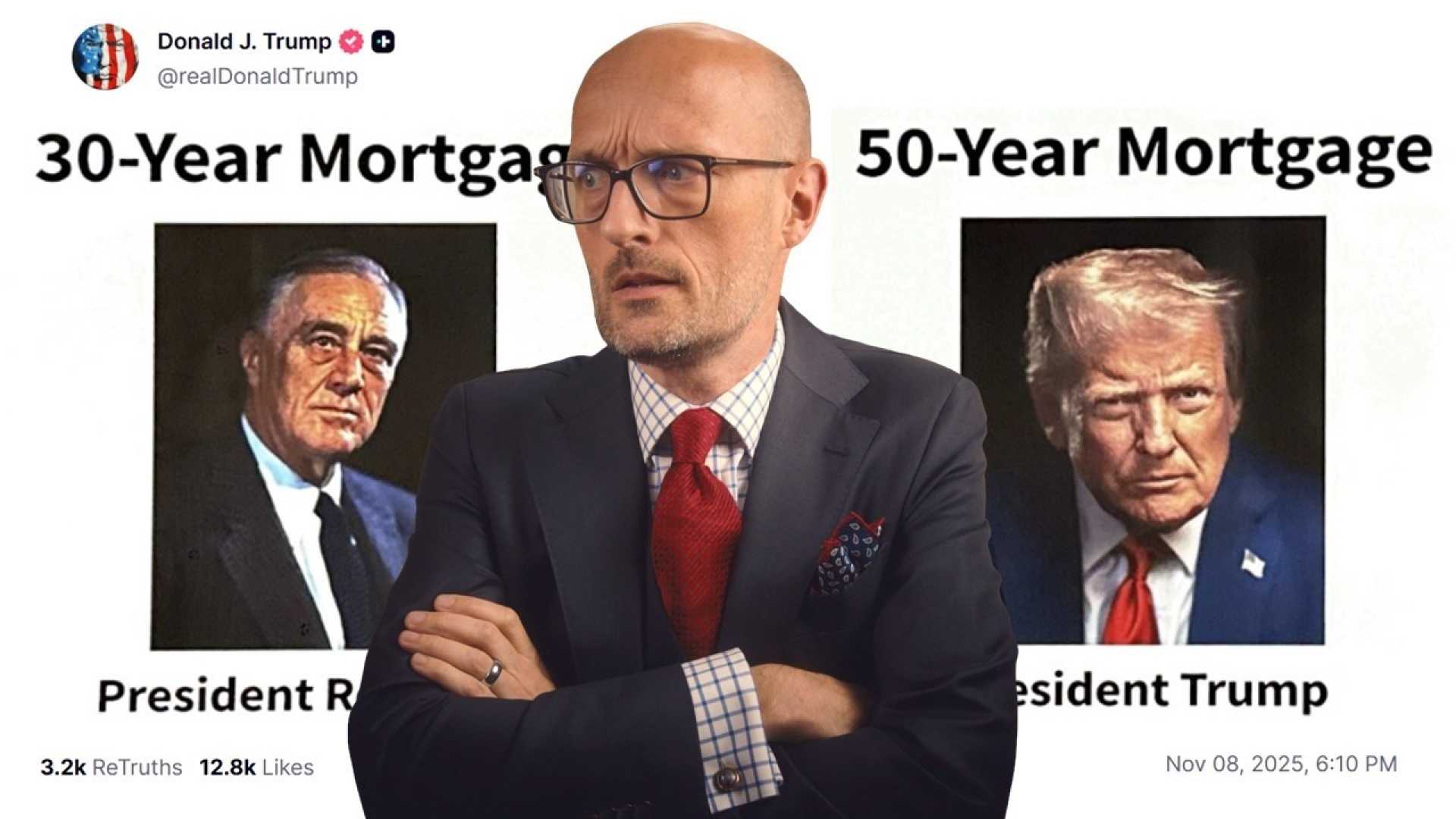

WASHINGTON, D.C. — Last week, President Donald Trump proposed a government-backed 50-year fixed mortgage, igniting debate over its implications.

The proposal led to fierce criticisms from various quarters, even from some of Trump’s supporters. Many argue that it would trap Americans in lifelong debt. Critics claim that it could significantly increase the total interest paid by homeowners, causing them to make interest-only payments for extended periods.

“It will ultimately reward the banks, mortgage lenders, and home builders while people pay far more in interest over time and die before they ever pay off their home,” said Rep. Marjorie Taylor Greene (R-Ga.). Comic Josh Johnson mentioned on The Daily Show, “President Trump is creating generational debt.”

Amid the backlash, some economists suggest that the idea may not be as impractical as critics claim. “It’s not quite as outlandish as it sounds,” said John Campbell, an economist from Harvard University.

Statistics show that most American homeowners sell their property long before fully paying off their mortgage. The average homeowner stays in a residence for about 13 years, making the 50-year mortgage less likely to be a long-term commitment. “Most people will not have that 50-year mortgage product for that length of time,” said Daryl Fairweather, Redfin’s chief economist.

Supporters of the mortgage type argue that it could offer lower monthly payments, making homeownership more accessible. Eric Zwick, an economist from The University of Chicago Booth School of Business, endorsed the idea, noting, “A longer duration mortgage is gonna lower the monthly payment.”

However, significant drawbacks include a higher interest bill and longer periods with little principal equity accumulation. Critics point out that these concerns also apply to the widely accepted 30-year fixed mortgage, which many Americans favor. “ It’s key to note that U.S. homebuyers often have extensive refinancing options, which distinguishes the U.S. mortgage market from others,” Zwick remarked.

The government plays a crucial role in making 30-year mortgages available through entities like Fannie Mae and Freddie Mac. Without such backing, alternatives like the 50-year mortgage may not be feasible for lenders.

Experts underscore that while a 50-year mortgage could help some individuals, it does not solve the existing housing affordability crisis. Many believe a greater housing supply is necessary for genuine relief. Some economists warn that creating options like the 50-year mortgage could actually raise prices without increasing supply.

“The main beneficiaries of such proposals are the people selling houses,” Campbell concluded. “Ultimately, we need to focus on building more homes.”