Business

CAVA Group Set to Release Q3 2025 Earnings Amid Uncertainty

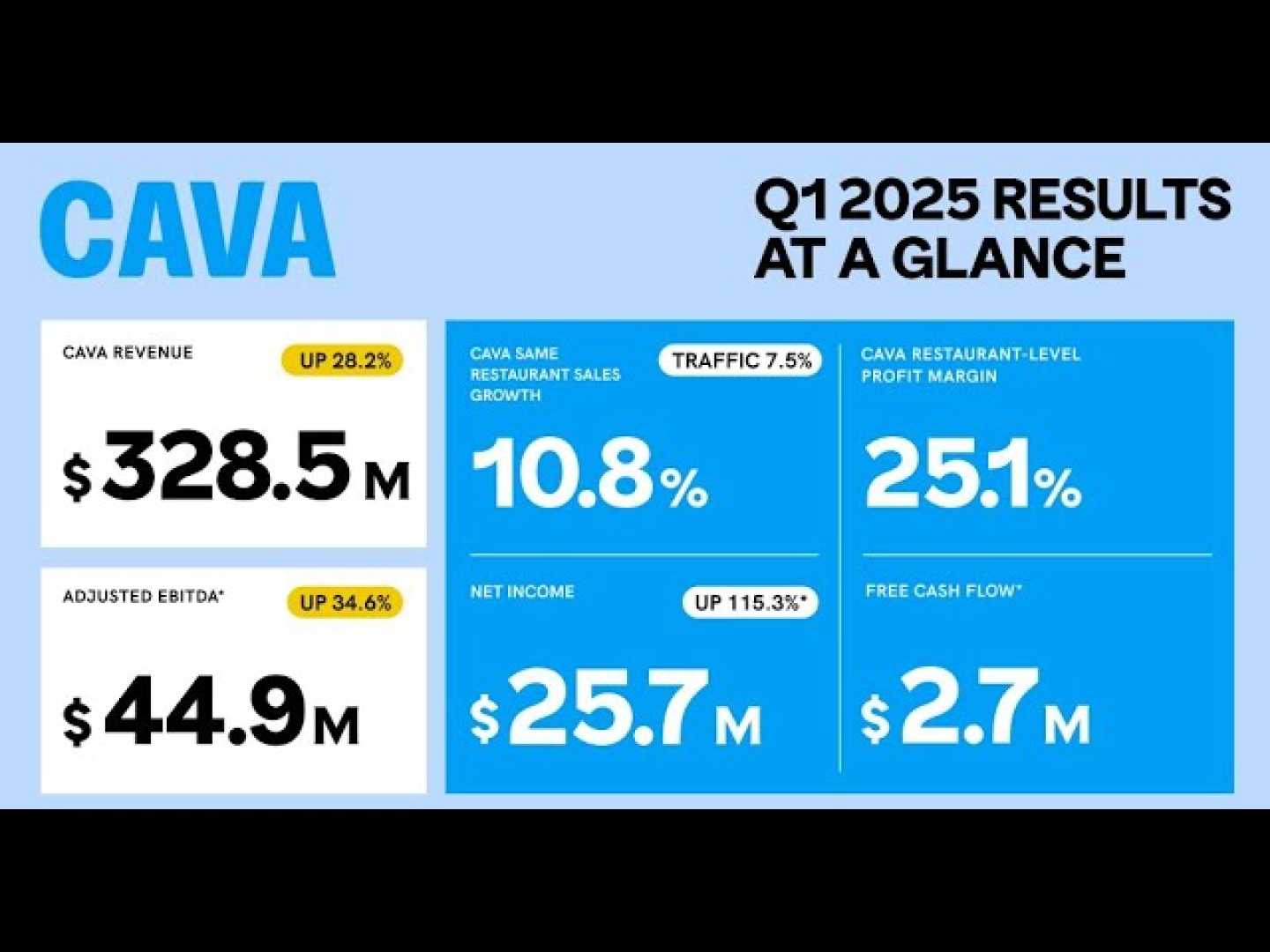

WASHINGTON, D.C. — CAVA Group, Inc. is scheduled to release its earnings for the third quarter of 2025 on November 4, after the market closes. The company’s previous quarter showed positive results, with earnings exceeding the Zacks Consensus Estimate by 23.1%. In fact, CAVA has surpassed earnings expectations in three out of the last four reporting periods.

The current consensus estimate for CAVA’s Q3 earnings per share (EPS) stands at 13 cents, showing a decline of 13.3% from the EPS of 15 cents reported a year ago. Analysts project revenue to reach $293.3 million, representing a year-over-year growth of 20.3%.

According to Zacks’ model, CAVA may not achieve an earnings beat this quarter. The company carries a Zacks Rank of 4 (Sell) and has an Earnings ESP of -5.77%, indicating a lack of favorable conditions for surpassing earnings expectations this time.

CAVA’s revenue growth has likely benefitted from an expansion program that has included new market entries in Michigan and Pittsburgh. This strategy is designed to enhance brand awareness and drive customer engagement. With Mediterranean cuisine gaining popularity, CAVA has increasingly positioned itself as a leader in this market segment.

Additionally, CAVA’s recent menu innovations, such as the introduction of chicken shawarma and new pita chip flavors, are expected to encourage customer traffic and increase average spending. Enhanced loyalty programs and marketing campaigns like the “Peter Chip” initiative aim to foster deeper customer relationships.

CAVA has also invested in operational improvements via its Connected Kitchen initiative, which utilizes technology to enhance order accuracy and service efficiency. These innovations are anticipated to support revenue growth by improving customer experiences and increasing sales capacity.

Despite the anticipated revenue growth, several challenges could pressure CAVA’s earnings. Rising costs associated with key ingredients, increased labor expenses, and ongoing investments in technology and personnel may affect profitability. The push for premium menu items like chicken shawarma may lead to higher food costs as well.

CAVA’s stock price has seen a decline of 59.2% over the past year, underperforming compared to its industry peers. Analysts have expressed concerns about the company’s current valuation, as it trades at a premium relative to its industry on a price-to-sales basis.

In light of these developments, analysts suggest caution for investors considering CAVA stock before the earnings announcement. While the restaurant chain shows solid revenue potential, concerns about profitability and stock valuation could lead to market volatility following the upcoming earnings report.