Business

CrowdStrike Faces Major Stock Decline Amid Global IT Outage

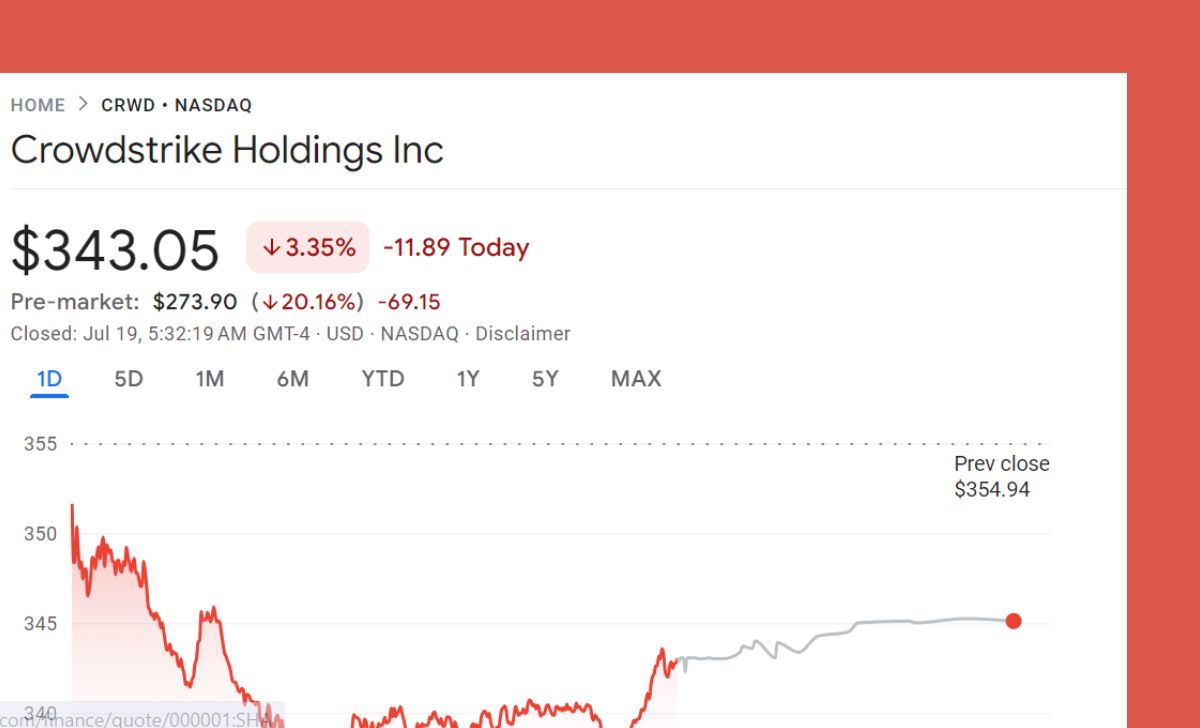

Shares of CrowdStrike Holdings, a prominent cybersecurity firm, took a significant hit on Friday, suffering from a wave of negativity following a widespread global IT outage that disrupted various technologies. This unfortunate event has pushed CrowdStrike’s stock down considerably, marking one of its most challenging days on the market.

At the inception of trading, shares plummeted by nearly 15%, setting the stage for what could become the company’s steepest daily loss since November 2022. The stock price dipped to a disconcerting $290, indicating its lowest intraday trading price since late April.

As the day progressed, it became apparent that CrowdStrike was on track to experience the third-worst stock performance since it went public five years ago. The turbulence in CrowdStrike’s shares coincided with a similar slump in shares of Microsoft, a firm affected by the same outage that paralyzed systems using CrowdStrike’s applications alongside Microsoft’s own Windows software. During this chaotic morning, Microsoft shares fell by 1%, reflecting the lowest valuation level witnessed since June 11.

In a contrasting twist, shares of CrowdStrike’s rival, Palo Alto Networks, saw a 4% increase on the same day, while the tech-heavy Nasdaq Composite managed a slight gain of 0.2%. This uptick was fueled by gains from major tech players such as Apple, which rose by 1%, and Alphabet, which increased by 1% as well while eyeing a $23 billion acquisition of the cybersecurity company Wiz.

The recent downturn in CrowdStrike’s stock has drawn scrutiny from market analysts, with some claiming it is an overreaction to what they classify as a temporary glitch. Catharine Trebnick, a noted analyst at Rosenblatt, indicated in her correspondence to clients that this situation presents a worthwhile opportunity for investors looking to capitalize on a momentary setback. Her analysis points toward a decreased valuation for CrowdStrike, suggesting that this is an ideal time to invest in a company that exhibits high growth potential in the cybersecurity sector.

Trebnick highlighted that the company’s price-to-earnings ratio (P/E), a critical metric used to gauge a stock’s relative valuation against its anticipated profits, fell to its lowest point since April. While she acknowledged that CrowdStrike’s P/E ratio is currently around 70, which is elevated for a company of its scale, she advocates for the firm’s long-term growth potential amidst ongoing market fluctuations.

Industry expert Troy Hunt commented on the scale of the outage, indicating it may potentially be the largest IT breakdown in history. He further explained that the disruption affected a myriad of sectors, including airline operations, emergency services, and financial market trading. Over 1,200 flights within the United States faced cancellations due to this incident, and various 911 call centers also reported outages, severely impacting public safety and services.

In light of the situation, CrowdStrike’s CEO, George Kurtz, addressed the public through social media platform X, informing stakeholders that the issue affecting their systems had been identified and isolated, with solutions actively being deployed. He reassured that the complications were specifically impacting customers utilizing Microsoft’s products alongside the CrowdStrike software.

Despite the tumultuous events surrounding CrowdStrike, it’s worth noting that the New York Stock Exchange maintained normal operations. A representative from the exchange confirmed that all markets were fully functional, ensuring that trading proceeded without interruption.

The IT failure created noteworthy disruptions not only for CrowdStrike and Microsoft but reverberated across major transportation networks and healthcare systems. Medical facilities in states like Massachusetts, Kentucky, and Ohio reported difficulties due to the outage, which further heightened public concern about the incident.

While investors initially reacted with panic, increasing volatility on the stock market, some analysts caution against a rushed exit from CrowdStrike’s stock. With an appreciation of over 200% since the end of 2022, driven by a broader sentiment surrounding generative artificial intelligence technologies, there is considerable debate regarding the potential for recovery as the company continues to expand its foothold in the cybersecurity industry.

As observations about the impact of this global IT outage unfold, it will be critical for CrowdStrike to demonstrate resilience and effective management of client relationships following this incident, particularly as competitors potentially seize upon market uncertainties to attract new business.