Business

Investors Eye WeBull’s Growth Potential Amid Stock Dip

New York, NY — WeBull Corp. (NASDAQ:BULL), a leading online brokerage, has experienced a recent dip in its stock price, drawing attention from investors looking for opportunities to buy the dip. Analysts cite several factors indicating that WeBull has strong potential for growth despite this setback.

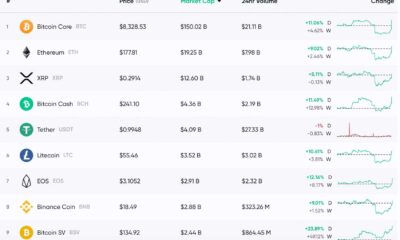

One of the main reasons for optimism is WeBull’s recent acquisition of $357 million in Bitcoin using common stock. This strategic move highlights the company’s commitment to cryptocurrency and its ability to adapt to emerging trends in the financial market. The integration of cryptocurrency trading into its main investment app could significantly drive future revenue growth.

The broader stock market has faced volatility, presenting both challenges and opportunities for WeBull. With strong fundamentals and diversified revenue streams, the company is well-positioned to benefit from a potential market rebound. Innovative features and competitive pricing have helped WeBull attract and maintain a solid client base, which could fuel growth as the market stabilizes.

The rise of online trading is another factor benefiting WeBull. As more investors turn to digital platforms, WeBull’s user-friendly interface and robust trading tools have positioned it for success. This trend suggests that WeBull’s market share and revenue could continue to rise as demand for online brokerage services grows.

A previous analysis had predicted a 60% downside for WeBull’s stock. However, that scenario has not manifested. Instead, the current dip presents a buying opportunity for investors. Many believe that WeBull’s solid fundamentals and the potential recovery of the market could turn this dip into a profitable investment.

While WeBull’s recent stock price drop does present challenges, the combination of strong fundamentals, the possibility of a stock market rebound, and the growing trend of online trading provide compelling reasons for investors to consider purchasing shares. The company’s ongoing innovation and ability to leverage emerging trends indicate a promising future for WeBull.