News

IRS to Automatically Send Stimulus Payments to Eligible Taxpayers

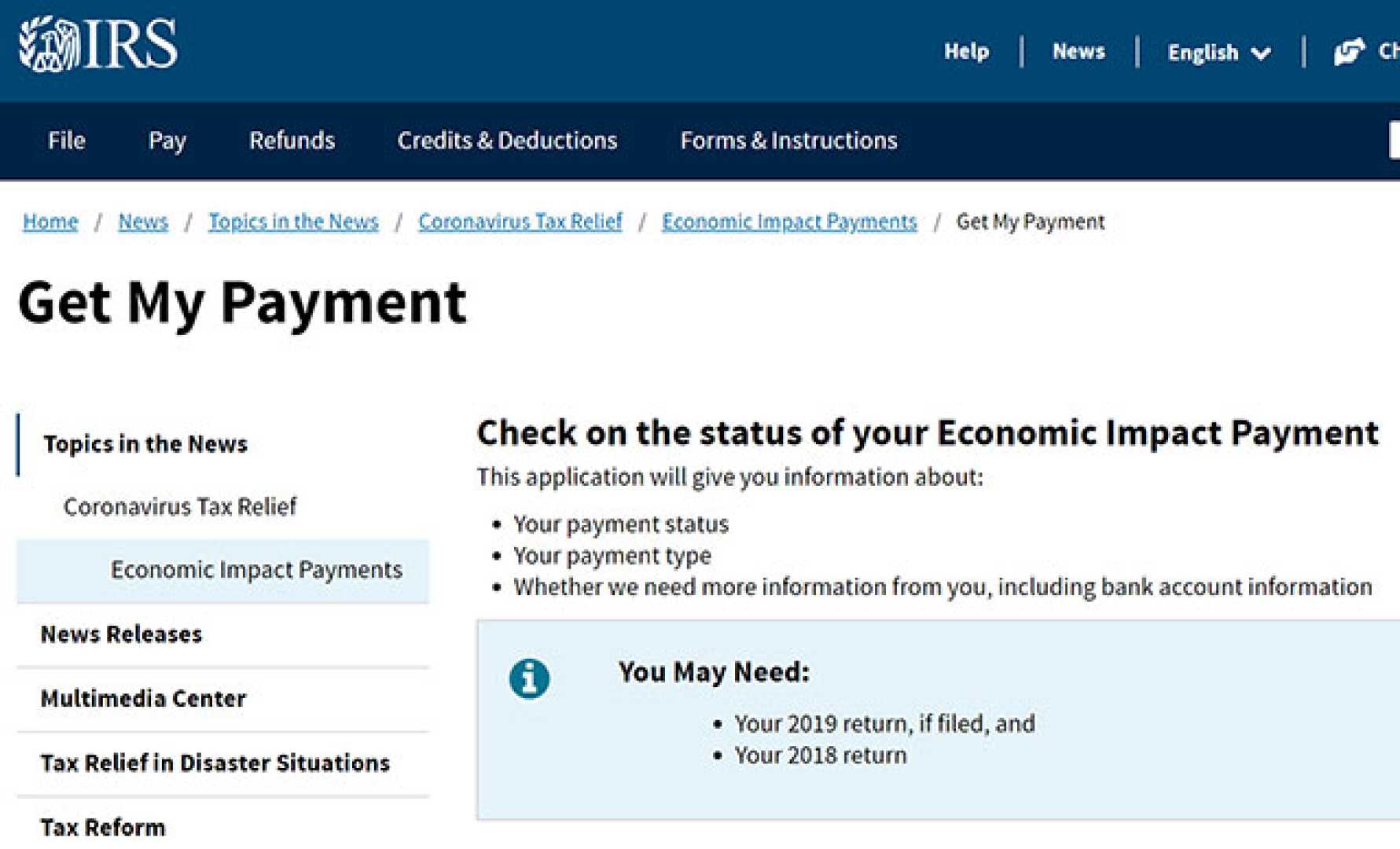

The Internal Revenue Service (IRS) announced that eligible U.S. taxpayers who did not claim the Recovery Rebate Credit on their 2021 tax returns will automatically receive stimulus payments by late January. The decision follows an internal review revealing that approximately one million taxpayers overlooked the credit despite being eligible.

The Recovery Rebate Credit is a refundable credit for individuals who did not receive one or more Economic Impact Payments (EIP), commonly known as stimulus payments. IRS Commissioner Danny Werfel stated, “Looking at our internal data, we realized that one million taxpayers overlooked claiming this complex credit when they were actually eligible. To minimize headaches and get this money to eligible taxpayers, we’re making these payments automatic.”

Eligible taxpayers do not need to take any action to receive the payments, which will be distributed via direct deposit or paper check. The IRS will also send notification letters to inform recipients of the incoming payments. Taxpayers can review their 2021 tax returns to check if they left the Recovery Rebate Credit field blank or entered $0.

The maximum amount an eligible taxpayer could receive is $1,400, with an estimated $2.4 billion being dispersed nationwide. Those who did not file a 2021 tax return can still claim the Recovery Rebate Credit by filing their 2021 return by April 15, 2025. The IRS emphasized that even individuals with minimal or no income must file a return to claim the credit.

This initiative aims to provide financial relief to taxpayers who missed out on previous stimulus payments. The IRS has already distributed multiple rounds of stimulus checks and tax refunds to ensure equitable distribution among residents.