Business

Meta Platforms Stock Drops 2.3% After Insider Sales

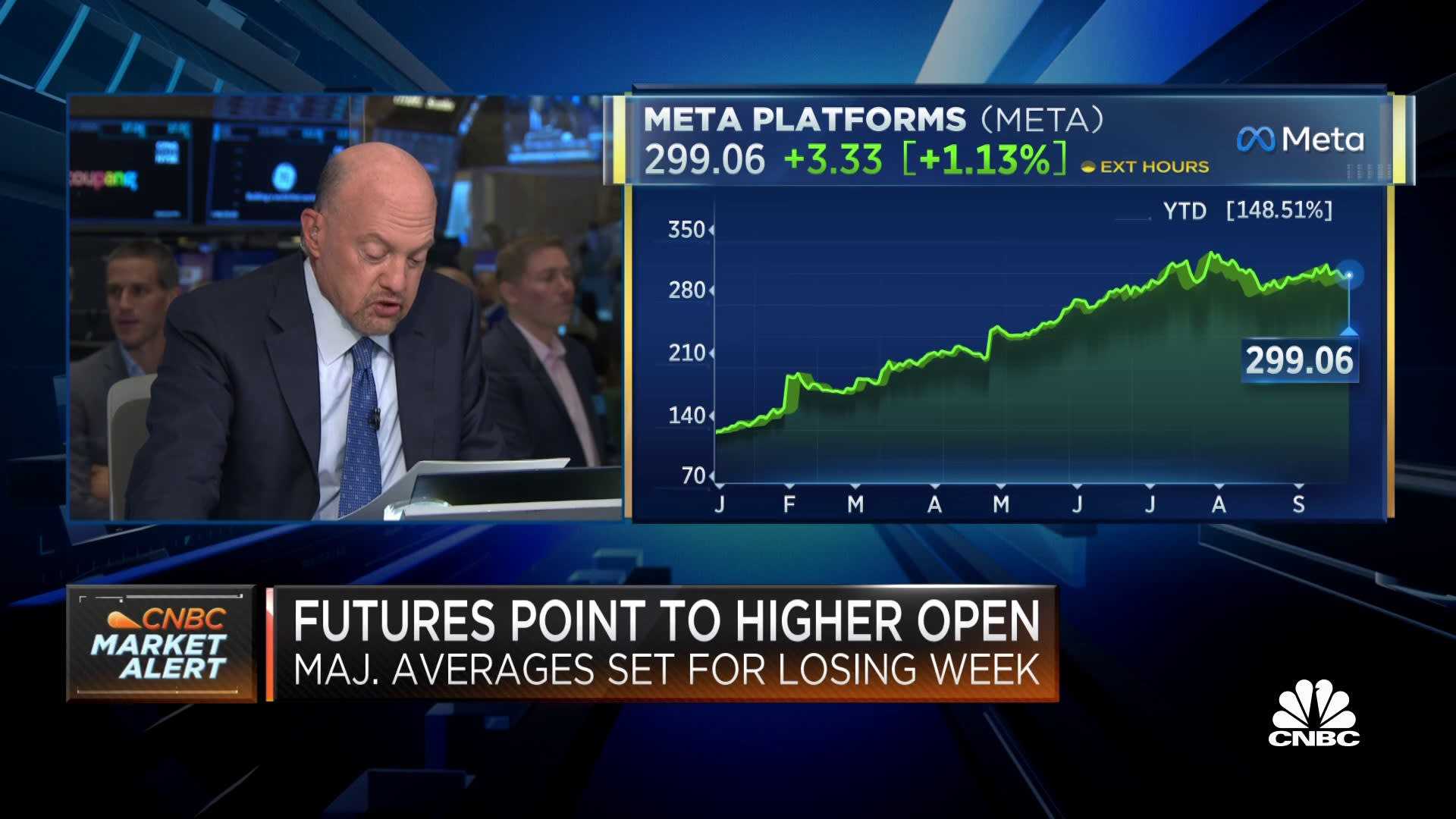

Menlo Park, California — Meta Platforms, Inc. saw its share price drop 2.3% during mid-day trading on Friday after an insider sold shares in the company. The stock traded as low as $710.18 before closing at $710.56. A total of 16,050,705 shares changed hands, up 10% from the average daily volume of 14,594,915 shares.

The insider sold 519 shares on September 30 at an average price of $741.50, amounting to $384,838.50. Following this sale, the insider retained 29,832 shares, valued at approximately $22.12 million, marking a 1.71% decrease in their holdings. This transaction was officially disclosed in a filing with the Securities and Exchange Commission.

In addition, the company’s Chief Operating Officer sold 517 shares on September 29 for $748.72 each, totaling $387,088.24. After this transaction, the COO held 10,026 shares worth about $7.51 million, representing a 4.90% decrease in their ownership.

Amid the fluctuations, several research firms issued ratings on Meta Platforms. Cantor Fitzgerald reiterated an “overweight” rating with a price target of $920.00. HSBC upgraded the stock from “hold” to “buy” with a new price target of $900.00. Other firms like UBS and Wedbush also raised their price targets, showing confidence in Meta’s future performance.

Currently, 79.91% of Meta’s stock is owned by institutional investors and hedge funds. The company boasts a market capitalization of $1.79 trillion and has reported solid earnings, with a recent quarterly EPS of $7.14, beating estimates and showing significant revenue growth year-over-year.

Meta’s next quarter guidance suggests strong potential as analysts expect the company to post an average of 26.7 earnings per share for the fiscal year. The firm also recently paid a quarterly dividend of $0.525, amounting to an annual yield of 0.3%.